We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

World’s most expensive credit card

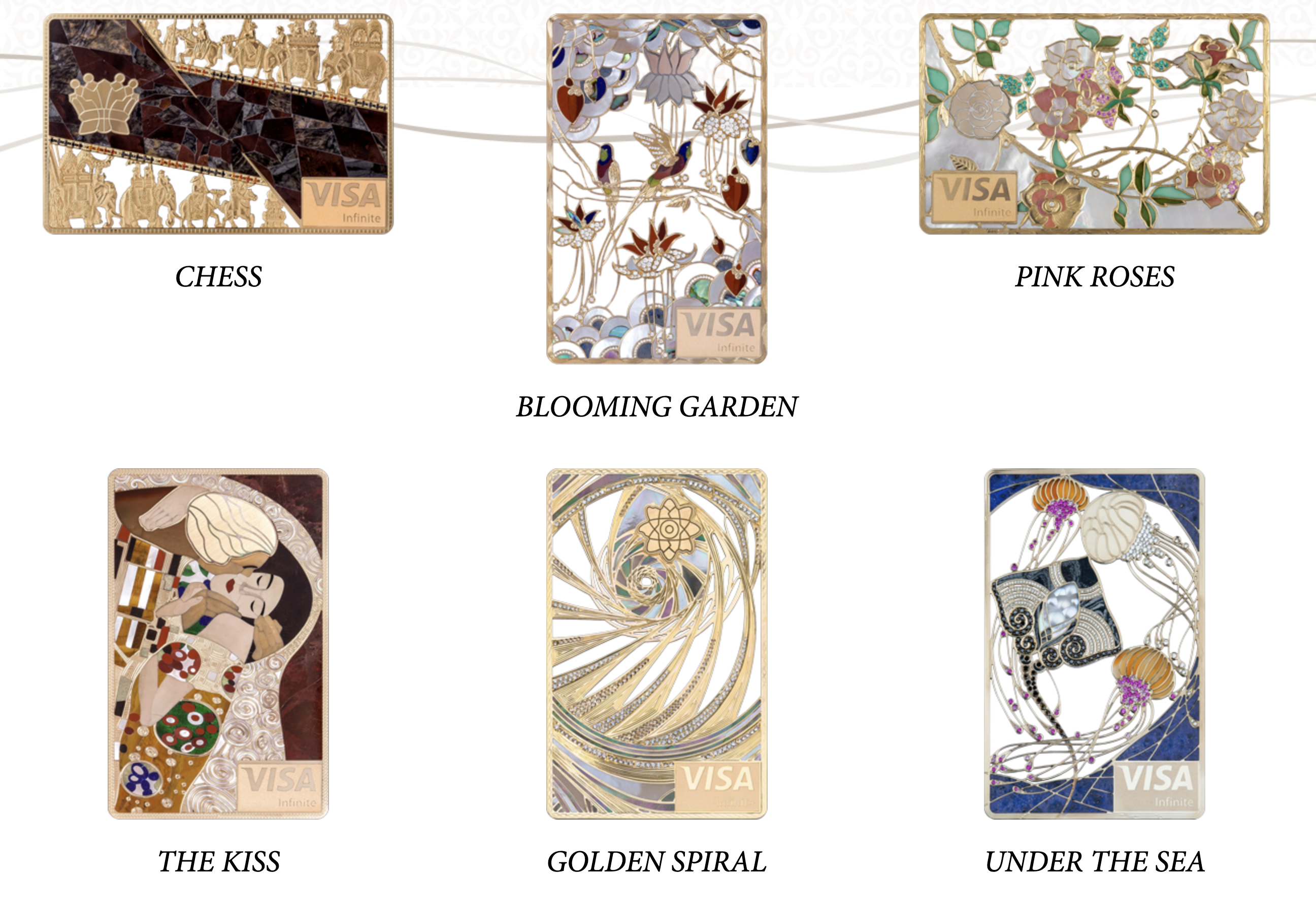

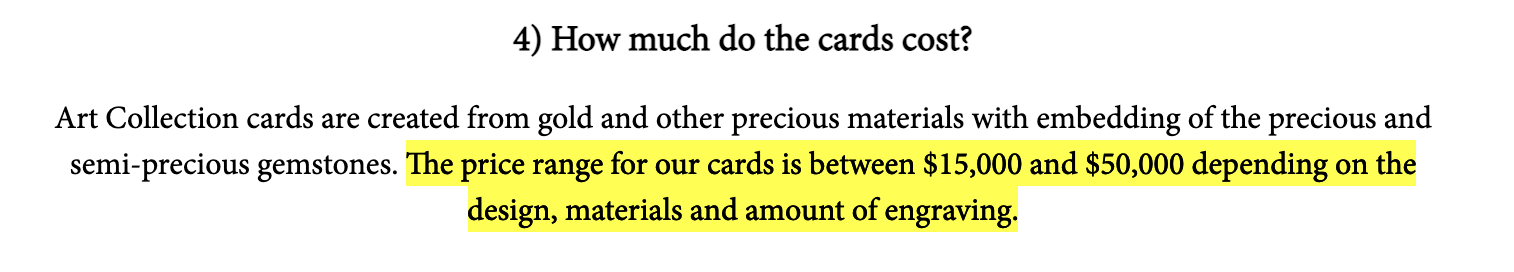

Think an Amex Black Card was fancy? Or the JP Morgan Reserve card? Think again. Meet Rosan Diamond – the maker of the most expensive credit cards in existence. Look at these bedazzled beauties! We’re talking rare gemstones, gold, platinum, and probably kryptonite. Rosan Diamond designed Visa Infinite/Signature cards are totally unique and actually work. They have chips and can be inserted or swiped like a normal credit card, but not used in an ATM. I can’t imagine I’d ever SEE one of these let alone Hold one, but they’re pretty incredible pieces of art. If you’re like me, you’re wondering how much these cards would set you back…$15k to $50k a pop. Let’s take a look at the world’s most expensive credit cards.

CNBC did an entire piece on them a few years back

Here’s a link to Rosan’s Instagram feed. The cards are just unreal. A few of the images from their feed:

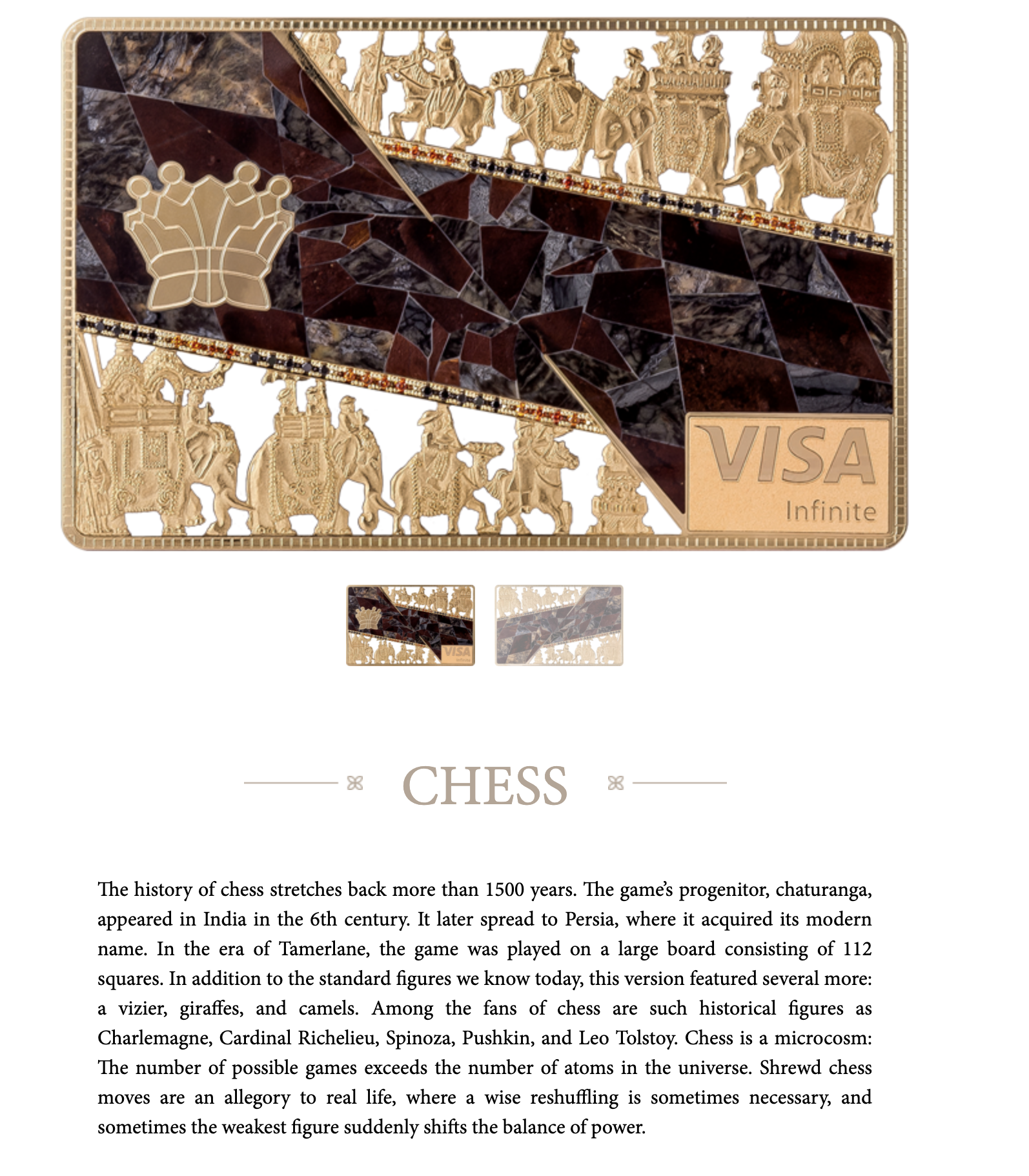

Here are the details from, ” Chess” from Rosandiamond.com

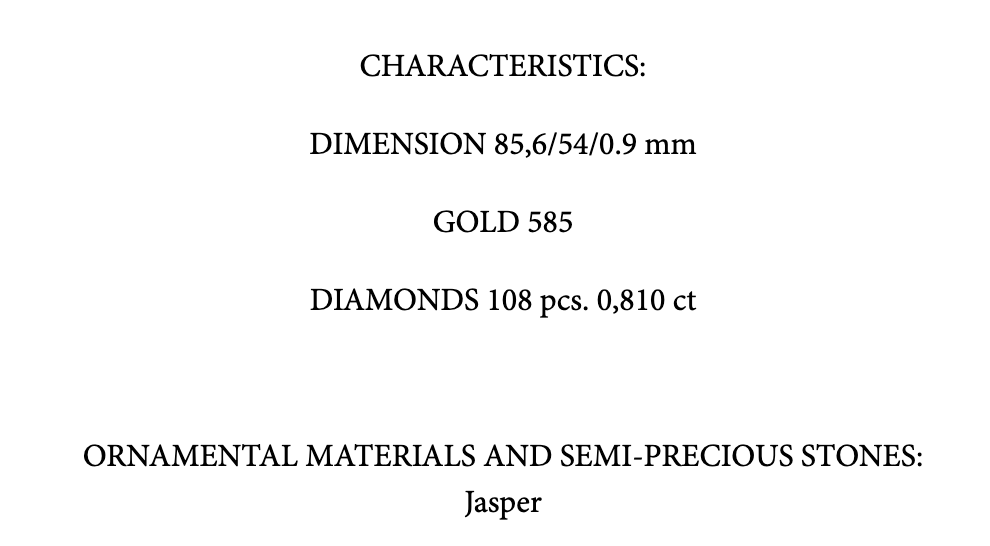

How many stones and precious metals you ask?

The Cost to acquire a Rosan Diamond credit card:

The Cost to acquire a Rosan Diamond credit card:

Which banks issue the Rosan Diamond “Art Collection” Cards?

All of the Rosan Diamond “Art Collection” cards are Visa Infinite or Visa Signature cards; however, only a select number banks are partnered to issue them – they are almost all in Russia with a family office issuing in both Switzerland and Panama.

Have you ever seen one?

These are clearly targeting a very specific subset of the world’s population. I don’t run in circles with many Billionaires…er rather any Billionaires lol. The biggest thing I can’t imagine doing is using these. Buying it as a piece of art is one thing…I could see some big name credit card bloggers owning one as a piece of art since it is how they made their millions. But, the fact that they are functional is pretty extraordinary and mind boggling to think that someone would throw this down to pay at Ruby Tuesday’s for Happy Hour Friday 🙂

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.