We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

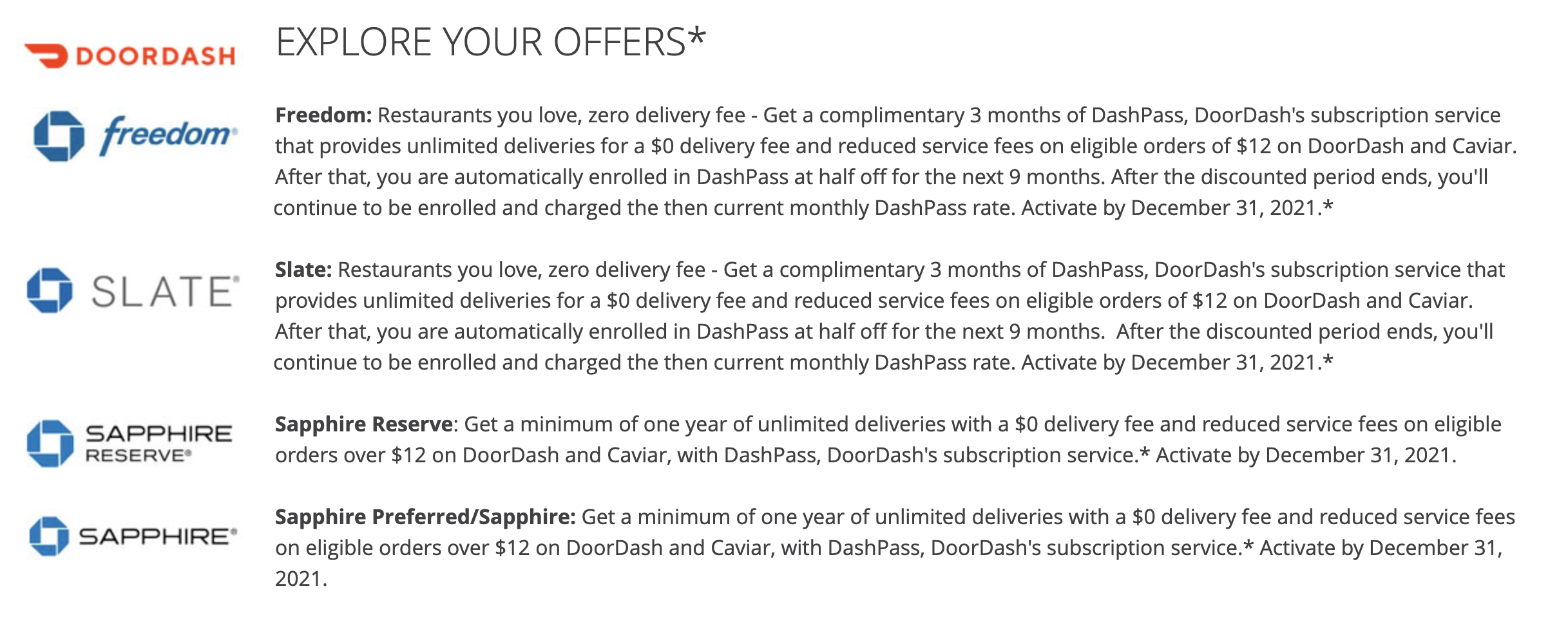

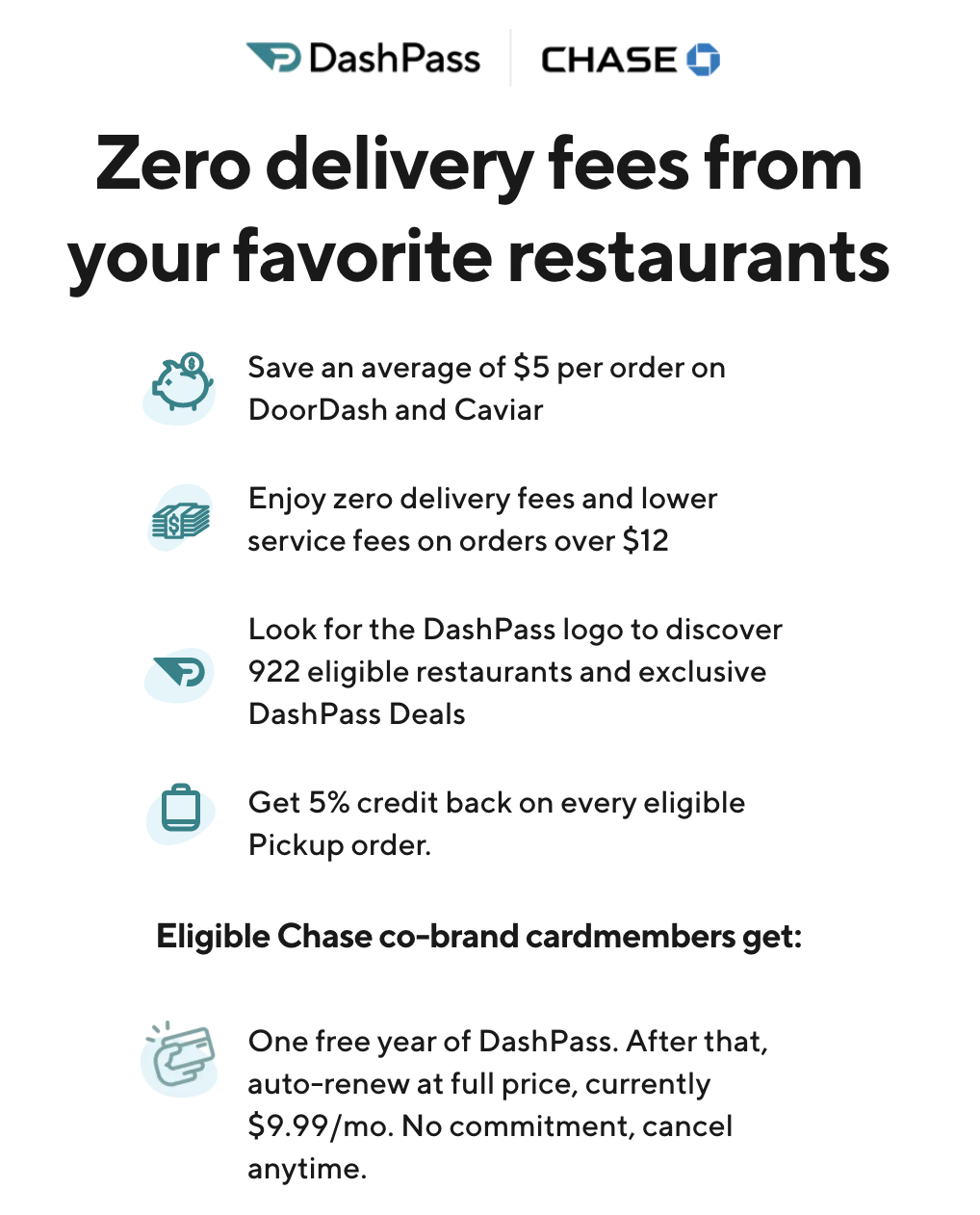

Chase has been integrating its partnership with DoorDash for quite some time, most notably with the following DashPass complimentary memberships. DashPass gives you $0 delivery fees on orders of $12 or more when you use DoorDash or Caviar. If you use this feature very often, it adds up quickly.

- Chase Freedom:

- Get a complimentary 3 months of DashPass, DoorDash’s subscription service that provides unlimited deliveries for a $0 delivery fee and reduced service fees on eligible orders of $12 on DoorDash and Caviar. After that, you are automatically enrolled in DashPass at half off for the next 9 months. After the discounted period ends, you’ll continue to be enrolled and charged the then current monthly DashPass rate. Activate by December 31, 2021.*

- Chase Slate:

- Get a complimentary 3 months of DashPass, DoorDash’s subscription service that provides unlimited deliveries for a $0 delivery fee and reduced service fees on eligible orders of $12 on DoorDash and Caviar. After that, you are automatically enrolled in DashPass at half off for the next 9 months. After the discounted period ends, you’ll continue to be enrolled and charged the then current monthly DashPass rate. Activate by December 31, 2021.*

- Chase Sapphire Reserve

- Get a minimum of one year of unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 on DoorDash and Caviar, with DashPass, DoorDash’s subscription service.* Activate by December 31, 2021.

- Chase Sapphire Preferred

- Get a minimum of one year of unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 on DoorDash and Caviar, with DashPass, DoorDash’s subscription service.* Activate by December 31, 2021.

Now…they have extended DashPass to include the following co-branded cards with a complimentary 1 year of DoorDash Dash Pass

- Eligible Chase co-brand cards include: Southwest® Rapid Rewards® Credit Cards; United Credit Cards; IHG® Rewards Cards; Aer Lingus, British Airways, and Iberia Plus Visa Signature® Cards; Marriott Bonvoy Bold™ and Boundless™ Cards; World of Hyatt Card; Disney® Visa® Cards; and Starbucks® Rewards cards, with an auto-renew feature at the then current rate.

You can read the full release here

You can go here to sign up

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.