This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: Use Transitive benefits to your advantage

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo shows how to use transitive benefits to your advantage.

What are transitive benefits?

To put it simply: If A=B and B=C then A=C

We all learned this at some point in school, perhaps in Geometry, but I find it far more useful in my everyday life to apply this property to points. In fact, I usually refer to them as the ‘transitive property of ballerness’ because understanding how you can maximize your conversions equates to high levels of baller feelings.

Typically I look at “C” and reverse engineer how to convert into it

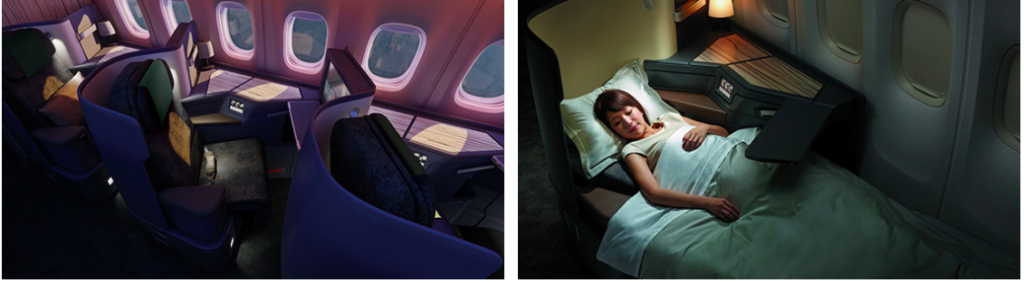

Let’s say you want to fly on China Airlines business class. We know that it is a member of SkyTeam and thus partners with all of those airlines. So you could transfer points into one of those airlines in order to to fly on China Airlines. The ones that pop up in my mind are: Delta, Air France, and Korean Air because their points can be easily used to redeem on China Air. There are others, but these are easiest to use as an example.

A ===> B ===> C

Chase Ultimate Rewards ===> Air France & Korean Air ===> China Airlines

American Express MR ===> Air France & Delta ===> China Airlines

Citi Thank You ===> Air France ===> China Airlines

SPG ===> Delta, Air France, & Korean Air ===> China Airlines

OMG my baller feelings are already percolating just LOOKING at China Air Biz =)

The Marriott/Starwood Merger has create lots of Transitive Bennies

What I’ve written already:

- Amex Platinum to Marriott Gold

- SPG Platinum to United Silver

- Marriott status challenge to get SPG Platinum in 9 stays

There are more that I will touch on, but let’s look at more examples of using the transitive property of ballerness:

Use American Express MR to fly Virgin Atlantic by transferring into Delta

If you transfer your points to Virgin you’ll pay huge fees, but transferring to Delta you’ll only pay $5.60 from the states to london

AMEX MR ===> DELTA ===> FLY VIRGIN

I can attest… I felt BALLER paying $5.60 for this flight

You could use SPG to transfer into American to book Etihad Business Studio

SPG are some of the best points to use for airline redemptions. Every 20k SPG you transfer yields 25k in the destination program. There are a few exceptions to his rule, but generally speaking, this is the case. From the US to Middle East is 70k AA one way.

60k SPG ===> 75k American Airlines AAadvantage ===> Etihad Business Studio

Etihad is one of my favorite business class products in the sky.

The list goes on and on but you get the idea. Use transitive benefits to your advantage

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.