This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedom is offering a quarterly 5x bonus with Apple Pay, Chase Pay, Samsung Pay, etc. What’s great is that Apple has made it super simple to pay your friends money that you owe them. I wrote about how this was an easy way to earn 5x points, but you’d have to pay a 3% fee to do so. I got some questions: will I get hit with a cash advance? will the payment actually net 5x points? why would i do this when I could buy gift card? So and so forth.

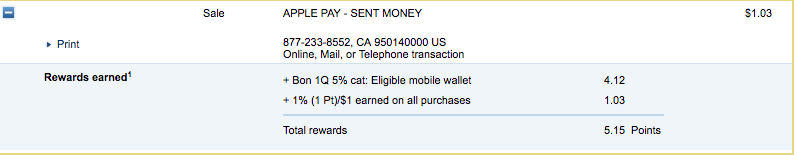

Here’s a screencap from my Chase statement where I used Apple Pay to send a buck.

So to answer those questions:

- Yes I earned the 5x points

- No there wasn’t a cash advance fee

- You could buy gift cards and avoid the fee, but this is a quick and easy way to pay friends, rent, etc without the hassle of having gift cards, liquidating them ,etc.

Hope this helps!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.