We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

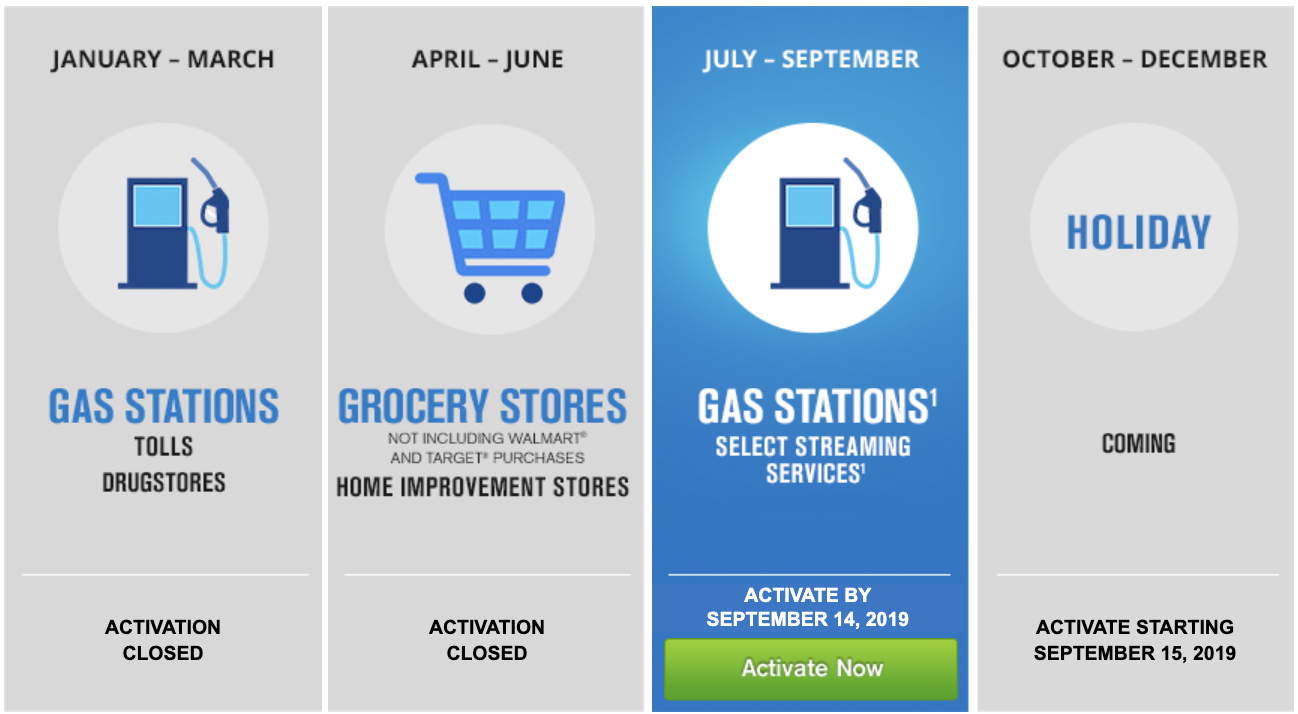

A friendly reminder that Chase has released their new category bonuses for the 3rd quarter of 2019. If you’re unfamiliar with this is benefit, each quarter cardmembers of the Chase Freedom card enjoy 5% back on rotating categories. For the next quarter, you’ll be able to earn the 5x bonus on Gas Stations and select streaming services. Note the 5x bonus is capped at $1500 per category, per quarter, or $75/7500points. The new quarter will start on July 1st, 2019.

If you’re like me and carry a Chase Premium credit card like the Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred then you can combine your Freedom points into those accounts in order to transfer them into valuable partners. This is by far the most advantageous usage of Ultimate Rewards, but also increases the value when redeemed in the Chase Travel center. For instance, if you move them into a Chase Sapphire Reserve account, your points will instantly be redeemable for 1.5cents per point, a 50% increase over redeeming them in the Freedom Chase Travel Center.

You can help us out by using our Chase Refer a Friend bonus

We get points when you sign up which aids us in taking more and more trips and providing helpful reviews.

*feature image is of Lufthansa Business Class, upstairs on the 747-8 – a redemption made by using Chase Ultimate Rewards transferred to United

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.