This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Round of applause everyone. Southwest has decided to do something you seldom see…add value to their program rather than devalue it, and make status a bit easier to attain. This is accomplished via 5 steps and it’s in stark contrast to the hideous Delta announcement we saw earlier in the month.

Personally, I don’t chase Southwest status, so the reduced A-List requirements don’t have a lot of meaning to me, but I know some people who are absolutely obsessed with Southwest and this makes status a lot more attainable.

I find the Cash + Points update the most enticing. Currently you need to have the full amount of SWA Rapid Rewards in your account for a redemption, this will make using the points much easier – keep in mind the cash used in conjunction with Cash + Points won’t count toward status.

- Cash and Points

- Begins Spring 2024

- Credit Card Spending is enriched

- Get 1,500 tier towards A-List and A-List Preferred with every $5000 spent (previously $10,000) on your Rapid Rewards Premier, Premier Business, Priority, or Performance Business Credit Card.

- Starts 1/1/24

- Fewer Flights to A-List

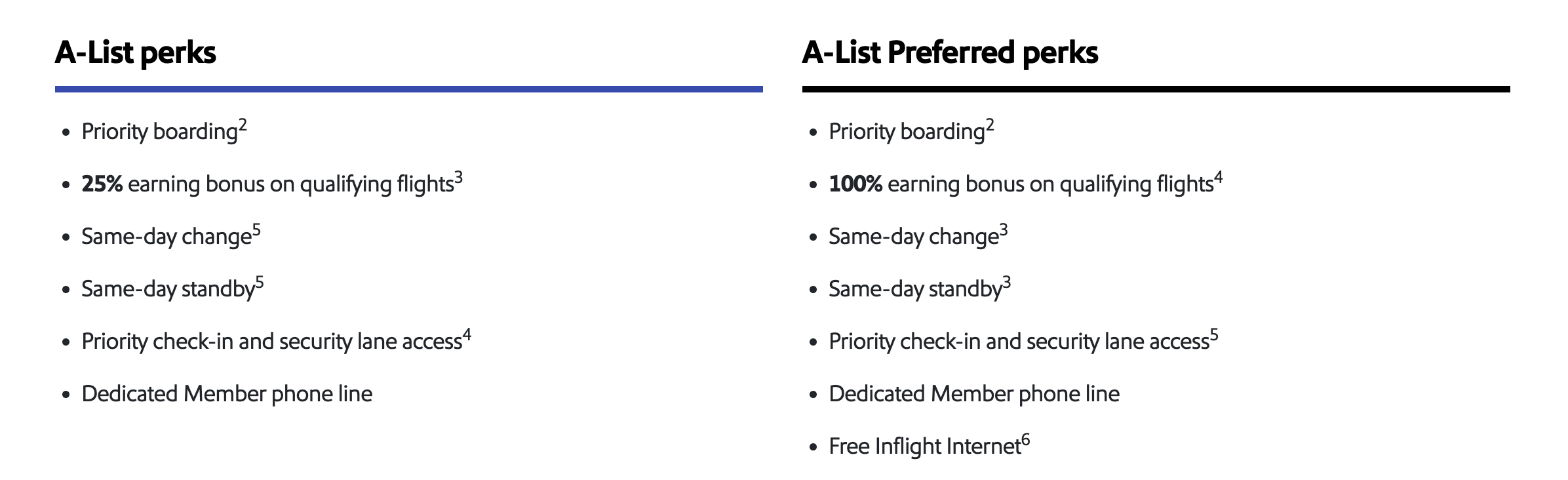

- Fly only 20 one-way qualifying flights or earn 35,000 tier qualifying points in a calendar year to earn A-List status-and all the perks that come with it

- Starts 1/1/24

- Fewer Flights to A-List Preferred

- 40 one-way qualifying flights (down from 50 flights) or 70,000 tier qualifying points to earn A-List Preferred status.

- Starts 1/1/24

Overall

If Southwest is any indication of reduced travel demand, I wonder if we won’t see more targeted offers for status, etc from other airlines; however, it’s worth noting that Southwest had a lot of bad press last Christmas when they had a severe meltdown. I’d say SWA has won back a lot of customer goodwill over the past year, and creating more value, more ways to use points, and an easier path to status only highlights their willingness to lure customers back over.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.