This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This was a question I received from a reader, Jason. He has a stash of SPG with no immediate trip planned, and taking into consideration the rumor that SPG may remove airline transfers, he wanted to know where should he move them? This is based on a comment someone made on a OMAAT post that speculated the transfers were ending on April 16th. I can’t imagine they would do this without a whisper of warning, but alas, we’ve seen such things done in the past. Can we say, “Alaska and Emirates award pricing?” So, for speculation sake, and a helpful reminder of great SPG redemption options, let’s take a look at the best ways you could transfer your SPG points.

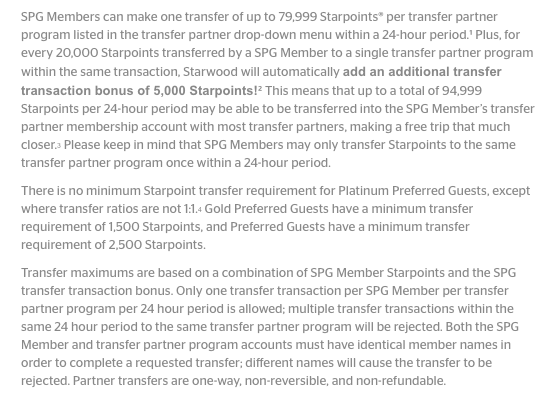

First let’s look at the terms and conditions of SPG

It’s worth nothing that:

- The most you can transfer in a 24 period is 79,999 SPG points

- If you have more than that…strategize

- Platinum has no minimum number of points

- Gold must transfer 1500

- Preferred must transfer 2500

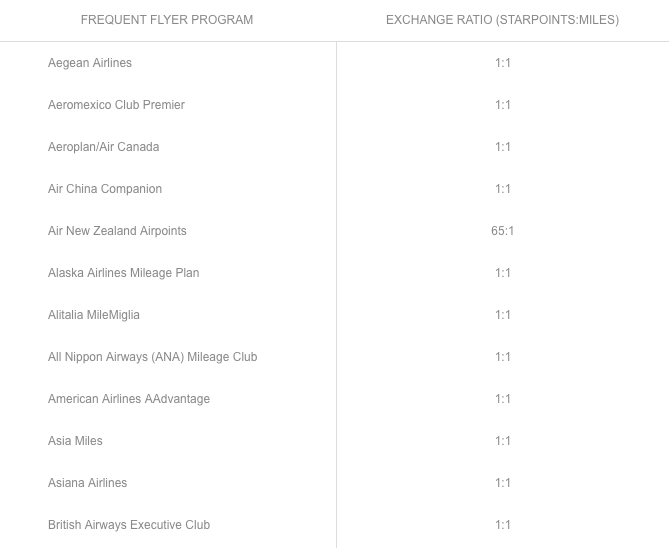

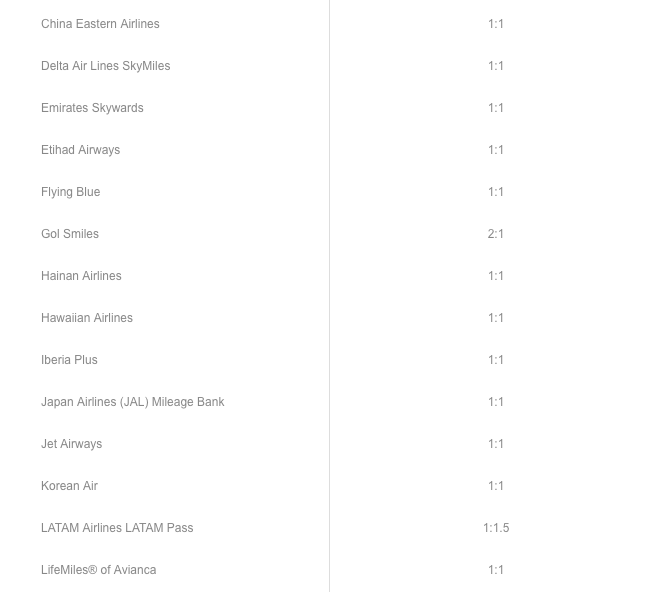

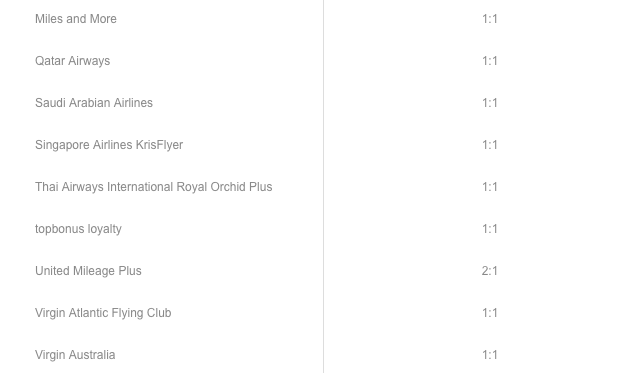

And here is a list of all the airline partners.

Most of these partners transfer at a rate of 20k:25k. Meaning for every 20k SPG you transfer you will get 25k airline miles. There are exceptions, but by in large, this is the transfer ratio.

In order to hedge, and extract the best value of your SPG points there are a few things I would take into consideration.

The three main things I would take into consideration are: Loyalty/Status, Redemption Value, and the Ability to shore up with other programs. If you have a ton of United miles, carry top tier status, and are looking to take a trip with your family, it may not make sense to you to transfer your SPG into Korean. Sure Korean has sweet spots in their chart that make it a winner for redemption value, and you can shore it up with Ultimate Rewards, but it may make your life a lot more difficult than just putting them into your United account. Where you keep loyalty/status is an important factor in extending the life of the SPG points that may outweigh other value factors. After all, value is subjective, and depending on your priorities.

-

Do you have loyalty status with any specific airline?

- Clearly you prefer the experience on this airline, are earning their status, and many miles by putting your butt in their seats. When it comes time to redeem, you may want to plan your trip utilizing those miles. Having more of them may make more sense, even if the redemption options aren’t as great, the ease outweighs it.

- More access to award availability

- Familiarity with booking and product

- Your local airport is regularly serviced by that airline

- Elite phone lines with better agents

- Lounge access Internationally

- Clearly you prefer the experience on this airline, are earning their status, and many miles by putting your butt in their seats. When it comes time to redeem, you may want to plan your trip utilizing those miles. Having more of them may make more sense, even if the redemption options aren’t as great, the ease outweighs it.

-

Redemption Value

- If you don’t carry any loyalty then you want to pinpoint programs that offer the best ways to fly in premium cabins for the least amount of points. Other things to consider are whether the programs offer access to the premium cabins that you want to fly, and whether they pass on surcharges.

-

Ability to Shore up your Account

- You want to be able to contribute to that loyalty account by as many ways as possible. The SPG points that you transfer may not be enough for the redemption you seek in the future, so you want to consider programs that other flexible currencies partner with as well.

Here are the programs that I think are worth considering.

Alaska Airlines

Alaska has some of the very best award charts in the game, and they also offer mileage sales quite often so if you really need to shore up your account, you can do so regularly for about 2 cents. I put together a PRO TIPS guide on the best ways/uses of Alaska miles that I’d highly recommend you reading if you’re considering transferring. I’m heading out soon to Australia in Qantas First Class, booked with 70k Alaska Miles, and last year flew on Cathay Business (50k) , Japan First (70k) , and Cathay First (70k) all with Alaska Miles. Alaska has recently merged with Virgin and expanded their route network across the US.

Asiana

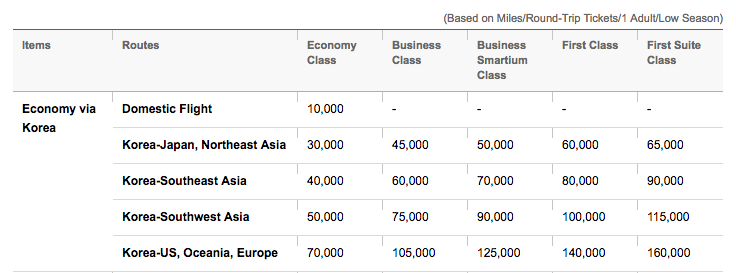

Asiana, a Star Alliance airline, offers a program that is under utilized featuring incredible redemption values, especially for Lufthansa First Class. In fact, Asiana prices roundtrip North America-Europe business at 80k, and first at just 100k. With the SPG transfer bonus, that means just 80k SPG would fly you roundtrip in Lufthansa First Class. Epic deal. Here’s a peek at their award chart, and their partner award chart. Asiana doesn’t have an option for booking online, so you’ll need to phone in. Another great sweet spot is their own metal: Roundtrip First Class = 140k.

One downside of Asiana is that it doesn’t partner with any of the other three flexible currencies ( Citi, Chase, Amex). I’d take this into consideration before transferring as it’ll be harder to shore up your account if don’t have enough miles.

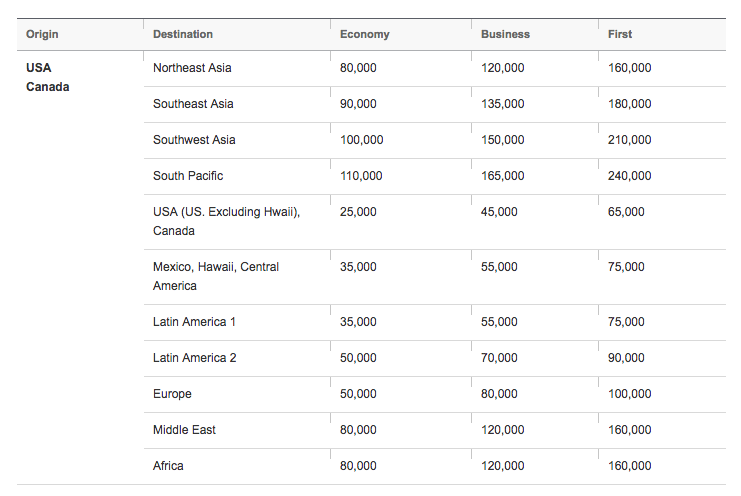

Korean Airlines:

Korean Airlines, a SkyTeam member, has some incredible sweet spots in their chart. 88K Roundtrip to Europe in business class, and just 80k to fly from the States to Korea in their own First Class. The biggest downside of Korean is booking for multiple people, which requires providing them proof of a relationship ( mother, father, sibling, spouse). Korean is also a transfer partner of Chase which makes shoring up your account much easier. Traditionally, Korean Airlines has been very reliable when it comes to releasing award space, but recently they’ve pulled inventory. Time will tell if this is a temporary adjustment, or a longer arching trend. Korean Miles also stay valid for 10 years without activity.

Singapore Airlines

Singapore Airlines offers a great option when it comes to transferring SPG points. Not only does it have some great sweet spots, but it is a transfer partner of every flexible currency. Meaning, you can easily shore up your account if need be. The biggest downside to Singapore Airlines Krisflyer is their 3 year point expiration policy. There are ways to extend that time, but not indefinitely, meaning you need to use them or you lose them. Other than airlines that I’ve aligned my loyalty with ( AA and Alaska), Singapore has been my go to transfer partner for a lot of redemptions. They also have very attractive change fees ( $50 ) compared to many airlines.

Some Singapore Airlines sweet spots:

- US to Europe Business

- partners for 70k

- own metal 65k

- US to Europe in Suites for 76k

- US to Hong Kong for 92k in First

Cathay Pacific Asia Miles

Asia Miles, One World, is another transfer partner that is often overlooked. I’ve written a few posts recently about how you can take advantage of their multi partner award, but one aspect of their program that is especially attractive is access to Cathay Premium cabins. Cathay prioritizes Asia Miles members over partners, releasing space to their own members before it does so to partners. This can be very advantageous when you’re planning trips on their metal. Asia Miles is also a transfer partner of both Citi and Amex, making it quite easy to shore up an account. You can read this post where I explain how you can fly roundtrip to South America for just 85k miles

ANA

ANA has some downright attractive redemption options, and not just on their own metal. ANA is a transfer partner of Amex as well, which makes shoring up easy to do. The biggest downside of ANA is that they pass on fuel surcharges. I almost left ANA off this list for that very reason, but the award prices are so compelling that I thought it warranted mentioning them. Here are a few of the great redemptions you could make using ANA.

- US to JAPAN Roundtrip in Biz

- 75k to 90k on their planes

- 95k on partners

- US to Europe roundtrip in Biz for just 88k

Honorable Mentions:

In terms of loyalty, if you’re aligned with AA it may be worth just transferring your miles into it. It has its own unique situations whereby you can get great value (AA Reduced Mileage Awards and there are good redemptions like 57.5k to Europe) I’d avoid Delta – who knows what they’re doing with their program. They devalue without notice, recently re-valued, but all in all, they’ve set a precedent that they can’t be trusted, and I certainly wouldn’t transfer my points there.

The Virgin Atlantic program is quite attractive as well. With outstanding sweet spots like r/t from LHR to Beijing on Air China for just 75k miles, and flying ANA First Class for 110k, it certainly warrants a discussion.

Japan Airlines has a very attractive award chart, especially when it comes to Emirates. However, with surcharges being added to US originating flights, and the difficulty in accumulating miles I left it off.

Aeroplan has a lot of positive attributes, but it’s partnership with Air Canada is going away in 2020. We have no idea what will happen with the program, and if you’re looking for a place to stick miles, that’s a big time time red mark. If you have redemptions to make in the next 18 months, it’s worth checking that program out as there are very attractive redemptions, and it’s a transfer partner of Amex.

What I would do:

I would probably prioritize Alaska, Singapore and Korean. That would give you access to Star Alliance, Sky Team, and great premium cabin prices on Alaska. Alaska also partners with quite a few One World Airlines so you’d gain that alliance as well. They all have online search engines that are fairly proficient, meaning booking would be fairly straight forward and easy. You can shore all of them up with transfer partners, or purchasing in the case of Alaska. It all comes down to how many points you have, where you’re thinking of going, and the cabin of service you seek, but I like these 3 programs quite a bit, and would feel comfortable holding miles in them…for the foreseeable future. Don’t forget Singapore Miles expire in 3 years tho…so take that into consideration.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.