This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I have a dedicated page discussing the various sweet spots of Marriott Vacation Club Ownership and how to extract luxurious redemptions from the program which you can read here. It’s evolved quite a bit over time, and if you’re an owner, and not taking advantage of these sweet spots you’re leaving some pretty cool options on the table. My family picked up Marriott timeshares in the 80s and have gotten immense value out of them over time. Lately, however, the biggest value has been in either utilizing the new point structure towards hotel redemptions, like the Ritz Reserve Mandapa ( Bali ) which isn’t available with Bonvoy, or converting them into Bonvoy and staying at places like the St Regis NYC.

Earning a 90k Bonvoy Bonus

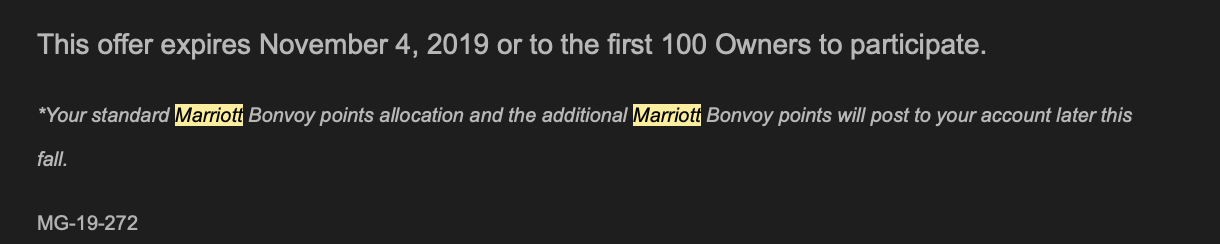

The conversion into Bonvoy is what we had decided to do for our 2020 year, but before we made the call, we got an amazing email. Receive an additional 90k Bonvoy points if we converted one of our owned units, Marriott OceanWatch at Grande Dunes, into Marriott Bonvoy points.

One thing to note is that the offer expires on November 4, 2019 OR after the first 100 owners have taken advantage of it. We called MVC within hours of receiving the email and traded the week for Marriott points so we’d receive the bonus 90k.

Targeted at other properties?

I have to imagine that this isn’t solely at the Marriott OceanWatch at Grande Dunes and other owners would be targeted for similar offers if they own during peak weeks. This IS the first time I can remember ever being targeted for a transfer bonus in addition to the contractual amount.

It’s worth noting that not all Marriott Vacation Club owners can transfer their weeks, and not all of them would be eligible for such bonuses even when owning during Platinum weeks. Marriott has done a really effective job at making the entire program quite complex when you start digging into it. It just so happened that when we changed from weeks to Vacation Club Points our deed, and negotiation, ultimately ended with us getting full points every other year vs the contractual 65% that most would earn at our ownership level. Usually the ratio is 32 Marriott points for every 1 Vacation Club Point you own. Take note of what your contract states, and keep an eye on your email as you may be targeted for a great offer.

Have you been targeted?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.