We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Always. Be. Charging.

Do you have Champagne taste and a beer budget? I feel ya. I’d much prefer the subtle complexities of Krug than Miller Lite most any day, but I can’t afford that lifestyle. But still…The heart wants what the heart wants. Mine…loves to fly in baller cabins where they give you warm nuts and crisp champagne before you’ve had the chance to take your first selfie. You will NEVER forget the first time you fly business. Full Stop. Period. You won’t. The biggest reason? The trip starts the moment you arrive at the airport. No long lines, you have expedited security, and if that wasn’t enough, you’ll luxuriate in a pimped out lounge until you’re allowed to board the plane before everyone else so you can sip champagne and start a movie. So how can you afford to do it? Let’s take a look at 3 savvy things you could be doing to fly business class on your next long haul adventure.

Number 1: Maximize your expenses with the right credit cards.

Ever see Glenngary Glen Ross. Always Be Closing.

Well, you need to Always Be Charging.

Earn something back on every single dime you spend. You don’t need to have a deck of credit cards, but you do need to be using the right cards. Which are those? The ones that can be transferred into partner programs for redemptions. The best ones earn bonuses for dining, travel, or gas. I think every wallet should have a Chase Ultimate Rewards card, and an Amex that earns Membership Rewards. Do that…and you’re on track.

- Chase Sapphire Preferred/Reserve and a Ink Business Preferred are amazing and I highly recommend

- Any Amex that earns Membership Rewards

- Citi Thank You cards ( Premier and Prestige )

- Amex SPG

You can transfer your miles from any of the above programs into Singapore Airlines and fly like this for 65k miles.

Number 2: Sign up for Credit Cards, pay them off. Earn better credit and more points.

Once your everyday purchases are put on cards that earn you great points, start calculating when you have BIG expenses. Enough in three months that could hit a minimum spend for a new credit card. Usually between $3k and $5k in 90 days. And then sign up.

As long as you don’t rack up a balance and pay these bad boys off in full each and every month, your score will go up and not down. The best part? You’ll earn tons and tons of airline miles, credit card points, free hotel nights, gain access to lounges, more award space, and even have concierges on stand by willing to fulfill your every request.

Just to make sure you have the absolute best chance of getting approved – we put together a guide. Check it out here. You don’t have to go crazy, but use sign ups to achieve the goals you’ve set. After you’ve held the card for a year, determine if the fee is worth it, if not, transfer the line of credit to an existing card and close it.

Number 3: Position to cheaper cities and ones with availability

Buying flights:

Did you know that it’s often much cheaper to position yourself to cities different from where you may want to leave from or go to? For Instance…if you live in Europe and you want to visit the U.S. or Asia, it’s often far cheaper to fly from Scandinavia, Ireland, or Eastern Europe. I’ve flown business class cheaper out of Dublin than I would have paid for coach out of London. Sure it added a few hours to my journey, but I flew in comfort, earned more miles, and arrived fresh.

Using points:

Be willing to book a separate ticket to fly out of a city that has availability, or drive there to start. Chicago is going to have a lot more options than St Louis when it comes to finding International business class award availability. Don’t just search from where you live, find where the avail is, and position yourself.

Bonus Tip: Buy Points when it makes sense.

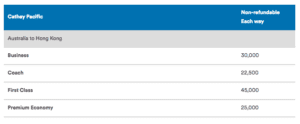

Often times it is far cheaper to buy the points for a flight than to pay for it. Airlines and hotels are continually putting their currency on sale. Right now, Alaska is offering a 40% bonus on purchased miles, which means you can buy them for just 2.1 cents. I just wrote an article about how buying points could fly you from Australia to Asia for just $600. That’s nearly 10 hours of flying, and because Alaska prices those awards at just 30k miles, you can make it happen for the price of buying an econ ticket.

Hope this helps – feel free to ask any questions.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.