This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Here’s how you can earn United Elite status starting in 2020

Spend a ton of money on flights, but don’t actually fly often? United just made you their most important and valuable customer. Late last night, United released the following video on their website along with some substantial news pertaining to 2020 United MileagePlus Elite Status requirements. Namely…going forward, there will not only be an emphasis on spend, but you’ll conceivably be able to earn every single elite status without flying much at all. How? Just spend a lot.

How much? If you spend $24k on United, or its partners, you will be 1k without having to schlep around on 54 flights.

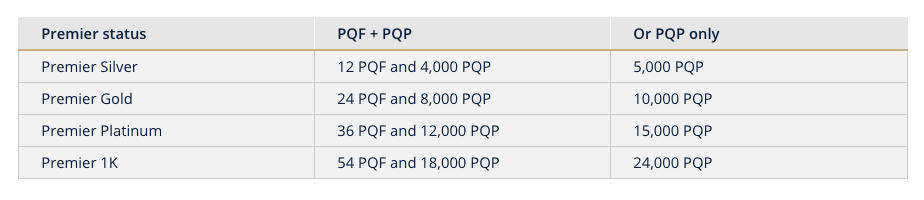

Here’s the 2020 United Mileage Plus Elite Status Requirements going forward

The right hand column tells you how much money you need to spend with United in order to avoid having to hit a certain minimum segment requirement, or PQFs. This is the first time an airline has waived minimum flying requirements in lieu of spending.

What the heck are PQFs and PQPs?

Seriously, in an apparent attempt to make things easier, they invented new terms that are as ambiguous as the old ones.

- PQF – otherwise known as a segment

- This is every flight, take and landing that you take.

- PQP – otherwise known as dollars spent

- This is only the base fare exclusive of taxes and fees

- Includes

- Base fare + Surcharge

- Economy Plus seating or subscriptions

- Preferred seat purchases

- Mileage Plus Upgrade Award Co-pays

- Paid upgrades

- Flights ticketed and operated by Star Alliance Partners

How are PQFs and PQPs calculated? I.E. How are United flights and dollars earned on partners?

PQPS

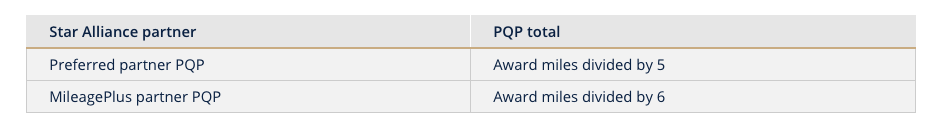

We have another chart that explains how PQPs are earned. Pretty straight forward and you can calculate how many miles you’d earn by going here: This way of earning PQP is only on tickets that don’t start with 016. If you purchased a Lufthansa flight via United, and it’s ticketed by United, you’d earn based off the fare you paid because would start 016. However, if you purchased that same flight via Expedia or Lufthansa and it didn’t start with 016 you’d earn based on the following:

Preferred vs Mileage Plus?

- Air Canada

- Air China

- Air New Zealand

- All Nippon Airways

- Austrian Airlines

- Avianca

- Azul Brazilian Airlines

- Brussels Airlines

- Copa Airlines

- Eurowings

- Lufthansa

- SWISS International Airlines

MileagePlus partners:

- Aegean Airlines

- Air Dolomiti

- Air India

- Asiana Airlines

- Croatia Airlines

- Edelweiss

- EgyptAir

- Ethiopian Airlines

- EVA Air

- Juneyao Air

- LOT Polish Airlines

- Olympic Air

- SAS

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- TAP Air Portugal

- Thai Airways International

- Turkish Airlines

For instance if you were on a non discount Lufthansa business class between LAX and FRA you’d earn the following

- Roundtrip miles flown – 11612

- Bonus at 200% – 23224

- Total miles earned = 34836

- Preferred partner / 5 = 6967.2 PQP

PQFs

You’ll earn a PQF, or up your flight count on partner segments, excluding light fares, basic fares, and award tickets

Credit benefits have been gutted

The biggest and most important – Spend waiver for certain Chase United cards. Gone

Starting on January 1, 2020, United Cardmembers who are eligible for a PQD waiver, PQM, or Flexible PQM (FPQM)2 based on annual card spend will be offered ways to earn Premier qualifying points (PQP) based on annual card spend3. The ability to earn a PQD waiver, PQM, or FPQM on these cards will end on December 31, 2019.

Segment minimum waiver…gone

We’ll no longer waive the 4-segment minimum for members with eligible MileagePlus Chase Cards. Each member must take a minimum of 4 flights on United or United Express to be eligible for Premier status. Removing these waivers aligns qualification requirements for all of our members.

Various cards will earn 500 PQP for every $12k they spend on that card.

-

The UnitedSM Explorer Card, United ClubSM Card, UnitedSM Explorer Business Card, United ClubSM Business Card, United MileagePlus® Awards Card, United MileagePlus® Card, and United MileagePlus® Business Card earn 500 PQP for every $12,000 in card spend, up to 1,000 PQP in a calendar year, that can be applied up to Platinum.

-

The United MileagePlus® Select Card and United MileagePlus® Platinum Class Visa Card earn 500 PQP for every $12,000 in card spend, up to 3,000 PQP in a calendar year, that can be applied up to 1K.

-

The UnitedSM Presidential PlusSM Card and UnitedSM Presidential PlusSM Business Card earn 500 PQP for every $12,000 in card spend, up to 10,000 PQP in a calendar year, that can be applied up to 1K.

What does this mean?

It means a couple of things to me. Elite status is devalued because a lot of corporate travelers are going to absolutely blow these numbers out of the water, so upgrades will be harder to land. If you’re a traveler who flies to the banker’s route between NYC and Lon quite a bit, and not on BA, this could be great for you – you’ll hit status super fast. I know a of entertainment vips that fly between NY and LA a couple of times a month, in business. Suddenly, you’re 1k in no time and didn’t have to hit mileage requirements, and certainly not these segment requirements. You hit it on lie flat, transcon comfort.

For the rest of us? The best bet is going to be traveling a bunch on discount business class internationally, with a combination of short domestic flights.

Or…

If it’s at all possible, switch to another airline like I did with Alaska. I still earn tons of miles for every mile flown, and on top of that, redemptions aren’t based on revenue, but rather a fixed award chart.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.