This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The numbers are inching up and up and up and up.

Hyatt is small in comparison to Hilton, Marriott/SPG, and IHG. Instead of leveraging their nimbleness with a superior Gold Passport program and attract and retain high spending mega loyal diamonds, they devalued and created World of Hyatt. Top tier members left in droves as the program made it very difficult to attain Globalist let alone Explorist, and albeit unreported, I’m quite sure . Things needed to change.

Last year Hyatt made the decision to pivot. The luxury leisure market would be a great place to strike some partnerships and they put the car in drive, hit the gas, and struck an incredible partnership with Small Luxury Hotels. The first drove of hotels was announced and the overall reception was great…aside from a new 40k, category 8 level of redemption that I’m still quite dubious about its purpose.

They’ve released more. GSTP must be happy – the Viceroy Bali is on the list.

I hung out with him a bit in Singapore prior to his stay there. He loved it.

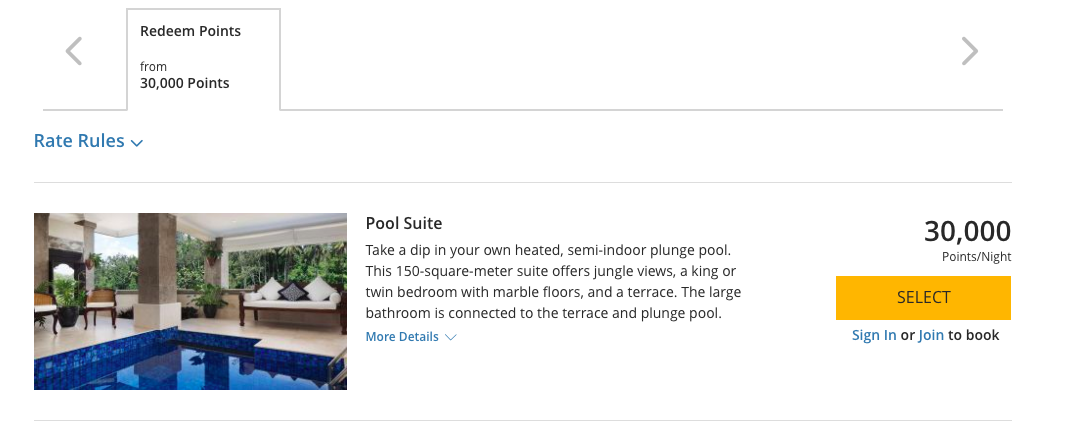

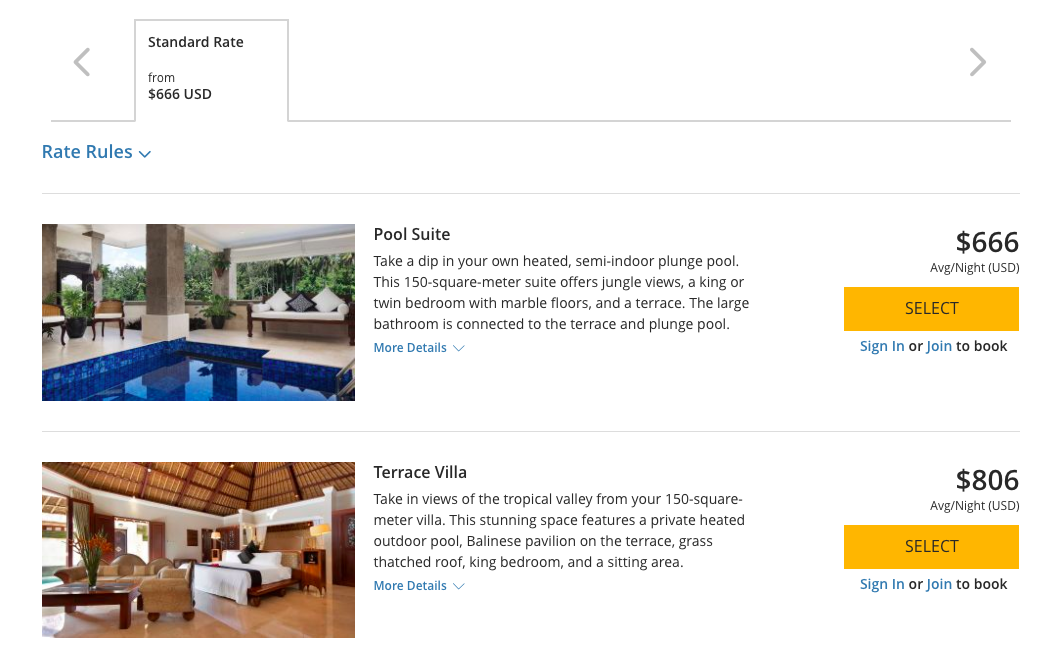

And now…so can you. For 30k a night. Much better than the $660+ rates

Don’t forget these dope Hyatt benefits. Including breakfast and an upgrade. Hello Villa!

- Complimentary continental breakfast for two

- Complimentary Wi-Fi

- Early check-in 12:00pm (based on availability at check-in)

- Late check-out 2:00pm (based on availability at check-in)

- One category room upgrade (based on availability at check-in)

Wanna see the full list? Go here to check them out

*feature image of the Aleenta Hua Hin Resort is courtesy of SLH

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.