We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Our New Years trip through Europe had taken some twists and turns and looked to be winding down after an incredible stay at the Park Hyatt Vienna. What a gorgeous hotel. As luck would have it, our trip continued on through London, the North of England, and Paris – what is this life?? – but Vienna was intended as our last stop before visiting some family in England. Because we’d booked so last minute, we were at the mercy of availability and the only seats that opened up from Vienna to London were in British Airways Club Europe.

Personally, I’m not a fan of using points to experience “premium” flights intra-europe as there isn’t much distinction between flying in Business Class vs Economy. Yes, you get some free food and drink, lounge access, but for a couple hour flight that rewards premium passengers with a blocked middle seat, I’d rather stretch my points further and fly economy twice.

The Deets:

- When: January 2019

- Where: Vienna to London

- Aircraft: A320

- Cabin: Club Europe ( Business Class )

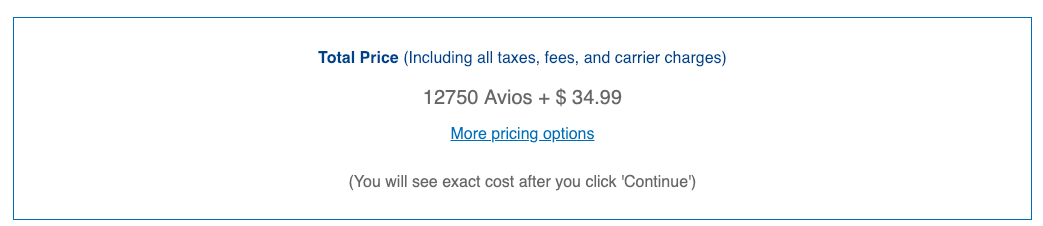

- Currency: 15k Avios per ticket + $35

Acquiring the points for booking

I used American Express Membership Rewards which instantly transferred to BA. While I booked for 15k, had I flown just a bit later in the month I’d have been able to book at a Saver rate of just 12,750 Avios. If you recall, Amex often offers transfer bonuses to BA and late last year they were offering a 40% bonus on transferred points – at 9k Amex points…it may be worth the extra points to fly biz over economy.

Currently I hold the following cards:

- American Express Business Platinum

- American Express Rose Gold

- American Express Platinum

- American Express Blue Business

Lounge:

You will gain access to the Air Lounge. However, if you’re a Priority Pass member…you’d have access anyways so the added value is nil for those in business who also carry a Priority Pass card.

Boarding:

Funny thing…we “boarded” the bus first. Then road the bus out to the plane where I ended up being 3rd to last to get on the plane from that bus. Another one shortly followed that carried maybe another 20 people. Not exactly the intention of priority boarding I don’t think, but it gave me the opportunity to snap a cool pic of the plane from the tarmac. Just another reason why I don’t think it’s worth the premium

The Cabin

As you can see…it looks like economy

with a blocked center seat.

Food:

It’s a short flight and we had a nice, tasty snack. But…is it worth paying the premium? I could have had a decent meal at the airport – I would suggest doing this prior to security and not relying on the lounge to provide great quality or filling food. It was quite sparse.

Arrival fast track – go here to read how you can get it at Heathrow

Fast track is incredible, but if you have status with BA or One World for that matter, you have access to fast track anywho…a nice benefit nonetheless

Overall:

We booked this flight 2 days before departure and cash rates to get us to London direct and at a good time were outrageous. While I wouldn’t spend the extra points under ordinary circumstances, the cash rate was $1k for this flight. We’d never pay that, but it just goes to show how incredible transferrable points like Amex, Chase, Citi, and Capital One really can be when cash rates skyrocket.

We had a pleasant flight, but if you’re considering this as a luxurious option…I would mull it over and as I recommend to award clients…spend fewer points, reserve a emergency exit row, and rest easy that you aren’t really missing out on much by flying economy.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.