We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Recently we learned that American Express would be increasing the annual fee on their Business Platinum credit card from $450 to $595. I wrote an article explaining that I thought even at the higher rate I’d be willing to keep the card because of the value I extract exceeds $595. I also noted that I’d have several months to weigh this decision. Actually…I’ll have an entire year.

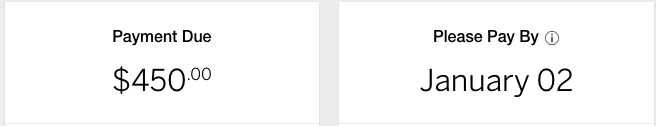

When doing my analysis I’d made a clerical error referencing that I’d already paid the existing $450 when, in fact, my billing cycle was coming in January. This is pretty much the best case scenario when it comes to keeping or cancelling this card. The new $595 fee will be effective in February, so this gives me the absolute maximum amount of time to weigh my options.

If you’re at all considering an Amex Business Platinum I’d heavily consider doing it now vs doing it in February when the fee is higher. One, you’ll pay $145 less for your first year, and second you’ll get the airline credit for this year and next year. That’s $400 of the $450 right there ( Note: you’ll need to be approved quickly and also either request expedited delivery or your instant credit card number. This way you can use your card quickly/immediately and your credit will have a better chance of applying by year end.)

Currently the welcome offer is tiered:

- 50k Membership Rewards after $10k spend

- 25k Membership Rewards after another $10k spend

This isn’t the highest public offer we’ve ever seen ( I believe that was 100k ), and if you’re targeted for the higher offer and can meet the minimum spend requirement, I’d seriously weigh doing that sooner than later. Otherwise…the ability to sign up for this card with the lower annual fee is ending soon.

The Existing Benefits:

- $200 annual airline fee reimbursement –

- The airline reimbursement is per calendar year vs the cardmember year of which the annual fee is based.

- This means you’d get $400 in reimbursement for the first cardmember year.

- A lot of airline gift cards often register as incidental. Alaska even refunds flights under $50.

- The airline reimbursement is per calendar year vs the cardmember year of which the annual fee is based.

- 35% refund on points when redeemed via AmexTravel ( on your select airline or premium cabins )

- 1.5x points on qualifying purchases over $5000

- Global Entry fee reimbursement – worth $100

- Priority Pass Select membership – worth ~ $400

- Delta Sky Club lounge access – when flying on Delta

- Centurion Lounge access – network expanding and very worthwhile

- Access to Fine Hotels and Resorts

- Amazing benefits such as free breakfast, resort credits, room upgrades, early check in, late check out, etc

- Using Amex FHR has earned me $100s per stay each time I use it.

- Amazing benefits such as free breakfast, resort credits, room upgrades, early check in, late check out, etc

- Over 20 transfer partners: like Singapore Air, Aeroplan, Air France, British Airways, and Avianca

- I love the transfers to Singapore and Aeroplan.

- SPG Gold status – which you can use to get Marriott Gold

- Hilton Honors Gold status

- Boingo free wi-fi at more than 1,000,000 hotspots around the globe

- The Hotel selection

- slightly different that Fine Hotels and Resorts, but provides great benefits, credits, and upgrades

- Return protection on goods a store won’t take back, you get reimbursement up to $1000/year $300/item

- 10 Free GOGO in flight WIFI passes. Per Year

- Valued at just $10/piece this is another $200

- 5x points on flights booked through Amex Travel

At $450 – this card is a no brainer for me to keep.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.