This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Business Platinum comes with a litany of benefits, but carries a hefty fee of $595 a year. In order to to help during the pandemic, Amex proactively offered cardholders $200 appreciation credits as well as monthly $20 shipping, $20 mobile phone credits, and added another $200 in Dell credit. I ended up renewing my card at the end because frankly it offset most of the fee. A couple of days ago Amex announced that their personal Amex Platinum cardholders would receive $30 monthly PayPal credits that would last through June of 2021. We’ve been eagerly awaiting the news on whether we would see further incentives for Amex Business Platinum, and it appears we have the news: new 5x categories. Is this the everything we’ll see? Who knows, but it’s a good opportunity to earn a hefty amount of bonus points.

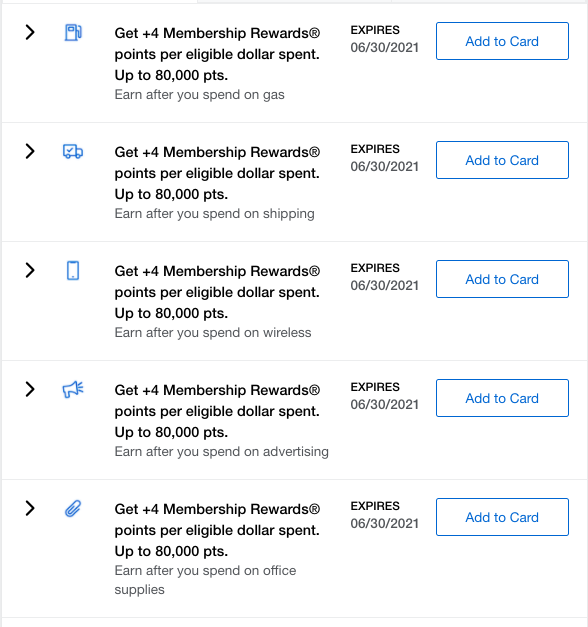

These incentives hit my Amex Offers:

All offers are for 4 bonus points, expire 6/30/21 and are capped at 80k. Additionally, you must have had your Amex Platinum since 11/1/2020.

- Gas

- Shipping

- Wireless

- Advertising

- Office Supplies

While I’m sure I will rotate purchases on to my Amex Business Platinum…there is no way I’ll max these categories out. That’s a $20k cap per category. Definitely more than I’d spend in any single category.

Why we love Amex Business Platinum

It comes down to the benefits, but most specifically the increased point valuation in Amex Travel. While we prefer to use our points most often on transfer partners, knowing I get 1.55c on redemptions on premium cabins in Amex Travel, or my selected airline, make for great incentive.

- $200 Incidental Airline Credit with your specified airline

- $200 Annual Dell credit ( split $100 each 6 months of the year )

- Centurion Club Lounge Access

- 50% bonus on purchases over $5k

- 35% back on points redeemed on your airline of choice/premium cabin tickets

- 5x points on flights purchased in Amex Travel

- $595 annual fee

Of course the transfer partners are amazing

Overall

If you’re thinking of getting an Amex Business Platinum you should know you won’t have access to these increased category bonuses. Still interested? I’d highly check out our referral page where you can not only leave your link, but try your luck at multiple referral offers. At the time of writing, 95k referral welcome offers are populating.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.