We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express has been on an absolute roll. We’re seeing Amex Platinum new member offers up to 150k, Gold up to 90k, and another round of bonuses given to those who add authorized users just hit. I received the following offer on both my Amex Platinum and my Amex Gold – the biggest thing to pay attention to is the fact that even if you add 5 AUs, you’ll only receive the bonus on the first AU that meets the spend.

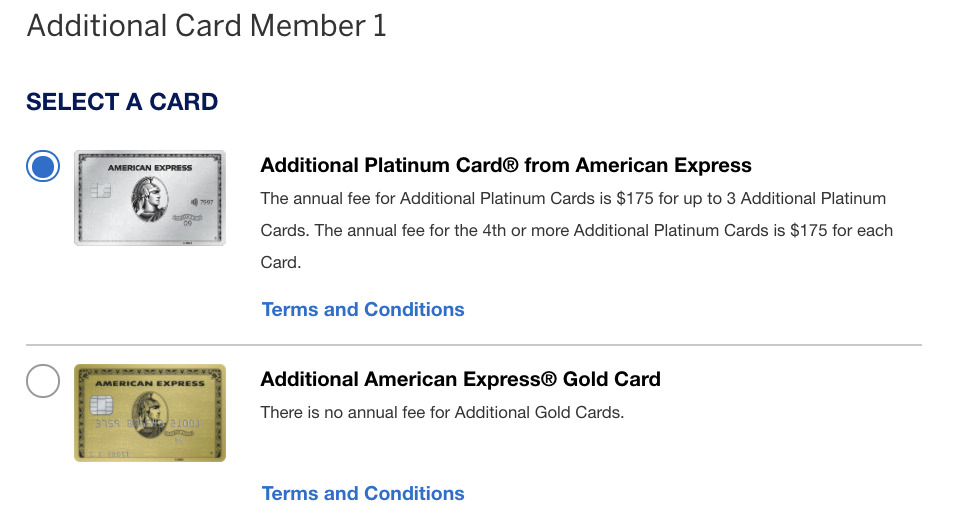

Couple things that will save you money

- Add Authorized User Gold cards to Amex Plat without a fee

- Add Authorized User Basic Card to the Amex Gold without a fee

Add an authorized user to your Platinum card and receive 20k Membership Rewards after they spend $2k in 6 months.

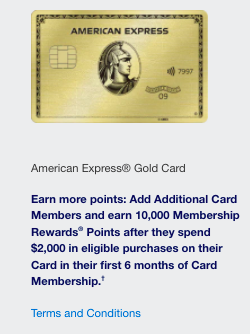

Add an authorized user to your Gold card and earn 10k Membership Rewards after they spend $2k in 6 months:

That’s an easy 30k points for just $4k spend over the next 6 months by adding my wife! Again note…you only earn the 20k bonus on the first authorized user.

Direct link to my authorized user offer:

As I mentioned up above, I was given the option of which kind of card I’d like to add: you can see Gold cards are fee free.

Overall:

Overall:

I don’t see why I wouldn’t take advantage of this offer… 6 months is a generous target to hit $4k spend and 30k Membership Rewards is over 7x return on spend.

Amex Platinum Additional Card Member Terms:

Add one or more new Additional Card Members to your account and you can earn 20,000 Membership Rewards points for the first Additional Card Member that spends $2,000 or more in eligible purchases on their Card within their first 6 months of Card Membership starting from the date on which the Additional Card Member is added. The maximum you can earn as part of this offer is 20,000 Membership Rewards points. Purchases made by other Additional Card Members on your Account will not count toward the $2,000 purchase requirement. Purchases made by eligible Additional Card Members will not be combined to satisfy the $2,000 purchase requirement. Your purchases as the Basic Card Member will not count toward the $2,000 purchase requirement. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchase of gift cards, person-to-person payments, or purchases of other cash equivalents. Additional terms and restrictions apply.

You can earn 20,000 Membership Rewards points after the Additional Card Member spends $2,000 or more on eligible purchases on their Card within their first 6 months of Card Membership starting from the date on which the Additional Card Member is added. In rare instances, the Additional Card Member’s period to spend $2,000 may be shorter than 6 months if there is a delay in receiving their Card. Also, purchases may fall outside of the 6 month period in some cases, such as a delay in merchants submitting transactions to us or if the purchase date differs from the date they made the transaction. (For example, if they buy goods online, the purchase date may be the date the goods are shipped). The 20,000 Membership Rewards® points will be applied 8-12 weeks after the Threshold Amount is met.

If we in our sole discretion determine that you or your Additional Card Members have engaged in abuse, misuse, or gaming in connection with this offer in any way or intend to do so (for example, if you added one or more Additional Cards to obtain an offer(s) that we did not intend for you; or if you or your Additional Card Members cancel or return purchases made to meet the Threshold Amount), we may not credit the Membership Rewards points to, we may freeze the Membership Rewards points credited to, or we may take away the Membership Rewards points from your account. We may also cancel this Card account and other Card accounts you and your Additional Card Members may have with us.

Your account must not be canceled or past due at the time of fulfillment of any offers.

Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards; person-to-person payments; or purchases of other cash equivalents. Additional terms and limitations apply.

The annual fee for the Platinum Card is $695. The annual fee for Additional Cards is $175 for up to 3 Additional Cards. The annual fee for the 4th or more Additional Cards is $175 for each Card.

There is no additional fee for Gold Cards.

American Express reserves the right to modify or revoke offer at any time.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

Amex Gold Additional Cardmember Terms

Add one or more new Additional Card Members to your account and you can earn 10,000 Membership Rewards points for the first Additional Card Member that spends $2,000 or more in eligible purchases on their Card within their first 6 months of Card Membership starting from the date on which the Additional Card Member is added. The maximum you can earn as part of this offer is 10,000 Membership Rewards points. Purchases made by other Additional Card Members on your Account will not count toward the $2,000 purchase requirement. Purchases made by eligible Additional Card Members will not be combined to satisfy the $2,000 purchase requirement. Your purchases as the Basic Card Member will not count toward the $2,000 purchase requirement. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchase of gift cards, person-to-person payments, or purchases of other cash equivalents. Additional terms and restrictions apply.

You can earn 10,000 Membership Rewards® points after the Additional Card Member spends $2,000 or more on eligible purchases on their Card within their first 6 months of Card Membership starting from the date on which the Additional Card Member is added. In rare instances, the Additional Card Member’s period to spend $2,000 may be shorter than 6 months if there is a delay in receiving their Card. Also, purchases may fall outside of the 6 month period in some cases, such as a delay in merchants submitting transactions to us or if the purchase date differs from the date they made the transaction. (For example, if they buy goods online, the purchase date may be the date the goods are shipped). The 10,000 Membership Rewards® points will be applied 8-12 weeks after the Threshold Amount is met.

If we in our sole discretion determine that you or your Additional Card Members have engaged in abuse, misuse, or gaming in connection with this offer in any way or intend to do so (for example, if you added one or more Additional Cards to obtain an offer(s) that we did not intend for you; or if you or your Additional Card Members cancel or return purchases made to meet the Threshold Amount), we may not credit the Membership Rewards® points to, we may freeze the Membership Rewards® points credited to, or we may take away the Membership Rewards® points from your account. We may also cancel this Card account and other Card accounts you and your Additional Card Members may have with us.

Your account must not be canceled or past due at the time of fulfillment of any offers.

Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards; person-to-person payments;or purchases of other cash equivalents. Additional terms and limitations apply.

American Express reserves the right to modify or revoke offer at any time.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.