This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How using an Amex Biz Plat to pay taxes is “profitable”

I was looking at the economics of using Plastiq to pay taxes with my American Express Business Platinum card. Right now Plastiq is offering a 2% processing charge. American Express announced last fall that they would be refunding 50% of the point redemptions through Amex travel if you maintain an Amex Biz Plat, effectively valuing every Membership Reward point at $0.02.(You must redeem on your specified airline or book a premium ticket). So for every dollar you’re spending in fees you’re earning back a commensurately valued Membership Reward point when redeemed through Amex travel for qualified fares. Amex also announced that every qualified purchase over $5k would earn a 50% bonus. If your tax bill was over $5000 and you used Plastiq ( which qualifies for the 50% bonus) you’d actually be net ahead 1/2 point on every dollar paid. Let me show you how using Plastiq + Amex Biz Plat to pay taxes is “profitable.”

I say “profitable” because the net gain is trapped in membership rewards. This isn’t a liquidating strategy, but rather a way to create value off of your tax bill.

Plastiq has a promotion going until 2/28/17 for a reduced processing fee of 2% when using Amex

Let’s take a look at two examples.

The first example is if you have an Amex Biz Plat already:

- Tax Bill: $20,000

- Plastiq fee: $400 ( $20,000 *0.02)

- Membership Rewards earned: 30,000 ( 20,000 on spend + 50% bonus of 10,000)

- Value of 30,000 MR = $600

- Net gain = $200

The second example is if you don’t have an Amex Biz Plat

You sign up with the current offer:

- Tax Bill: $20,000

- Plastiq fee: $400 ( $20,000 *0.02)

- Membership Rewards earned: 105,000

- 50,000 from the first $10k spent

- 25,000 from the 2nd $10k spent

- 20,000 from the tax bill

- 10,000 from 50% bonus

- Value of 105,000 = $2100

- Net Gain = $1700

*the 50% bonus is capped at 1,000,000 points.

The worst case scenario you are pre-paying for discounted fare market valued flights purchased through Amex Travel. Best case, you redeem the points by transferring them to partners for premium flights that equate to a far higher valuation than $0.02. This is how I flew on a $10k Lufthansa First Class flight, road across the tarmac in a Porsche, and took a nap in a private bedroom before my flight. I transferred Amex to Singapore to fly Lufthansa.

Additionally, retention bonuses are largely assessed from spend. The more spend you put on a card, the higher the odds of a better retention bonus. It’s not unheard of for Personal Amex Platinum retention offers to be 50k points. I know a few people who have received that offer who have put 5 to 6k per month on the card for a couple years. Obviously this is a Business so it is a different paradigm, but the premise is the same: more spend, higher potential retention bonus.

I used taxes as an example, but Plastiq can be used for car payments, rent, mortgages, etc. Any of those situations provides the potential for a net gain.

A couple thoughts of caution

- Amex Biz Plat is a charge card, meaning you have to pay the bill in full

- if you don’t have the means to pay your business tax bill do not think of this as a way to finance it. It’s a terrible idea in that situation. I’m not an financial advisor, etc but am just to make it clear – this is only an alternative to writing a check

- This is profitable for those who travel a lot. This isn’t a cash out opportunity, but rather a way to earn valuable Membership Rewards to be transferred or redeemed for a value greater than the processing fee.

- The bonus points take a little while to populate the account, so know that going into the transaction. If you’re counting on them for a redemption, you may be in a holding pattern until the credit.

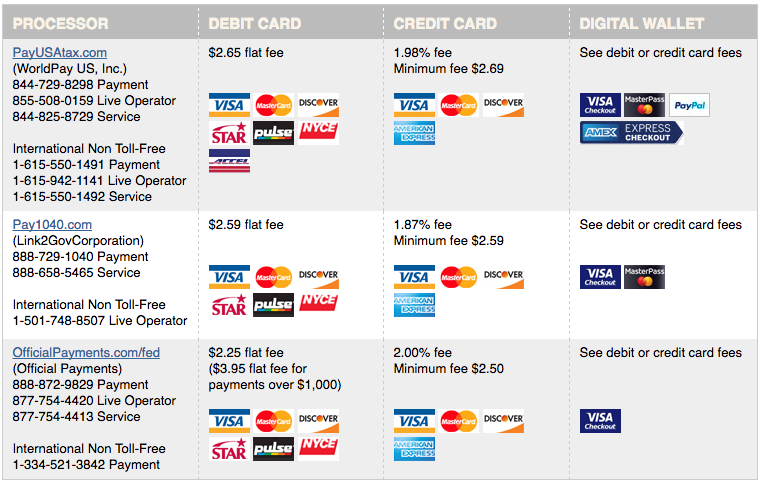

Other resources to pay your taxes: From irs.gov

Pay1040.com has the lowest fee at 1.87% – I’m assuming this would qualify to earn the 50% bonus on payments larger than $5k.

Less than 50k American Express Membership Rewards will put you in Singapore Business

Less than 30k will put you in EVA Royal Laurel

55,000 transferred to Aeroplan will put you in Ethiopian

Or Virgin Upper for 70k transferred to Delta:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.