This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

If you’re like me, odds are, when you hear the name Choice hotels, the likes of Quality Inn, Comfort Suites, etc come to mind. Great budget minded hotels, but the thought of getting pampered silly isn’t synonymous with the brand. That’s where we are both a bit wrong. While the overall hotel chain isn’t taking the luxury hotel market head on, their points program actually does an excellent job of opening up high end redemption options through their partnership with Preferred hotels. Let me walk you through how you can use 6k Amex points and a trick to gain huge discounts at luxury properties within the Preferred hotel umbrella.

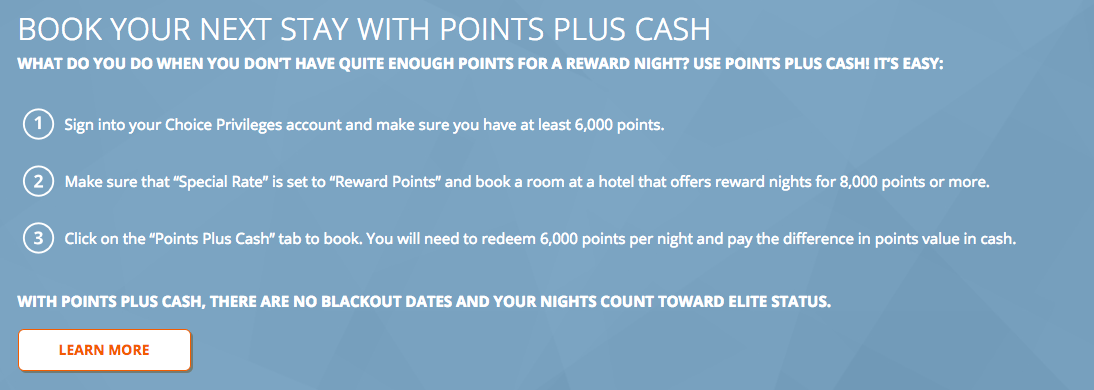

Choice hotels runs a cash + points redemption program

If you’re familiar with the IHG cash + points trick this one is very similar. Essentially, as long as you have a minimum of 6k points in your account, you can buy the remaining points needed for a redemption at just $7.50 per 1000 points.

You just need to make sure you follow these rules/steps set forth by Choice:

Miles – I don’t have an Choice hotel points. Hello Amex.

Other than just buying the 6k points when there is a juicy sale, you can just transfer the 6k points over 1:1 from your Amex account. The transfer is instant and you’ll be able to start booking Cash + Points awards. We wouldn’t advise using any more than 6k to boost your account solely because Amex points are worth far more than $0.0075 you’ll pay to buy what you need with Choice.

An example of HUGE savings. The Montage Laguna Beach.

Preferred hotels can’t be booked online, you need to phone in, but you can check avail and search redemption levels at Preferred hotels here. The Montage Laguna is a super lux 5 star hotel with nosebleed prices. Predictably, this property is priced at the top of Choice’s redemption level at 55k points.

You check avail and see that you can go over November 2-4

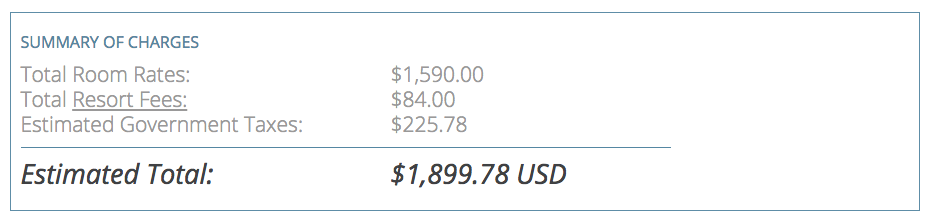

Let’s say you want to keep the 6k points in your account for future cash + points bookings and you buy 2 nights worth of points: 110k.

Two nights would set you back $825. No small amount. But how does this compare to paying outright at the resort?

Buying the points will save you over $1000

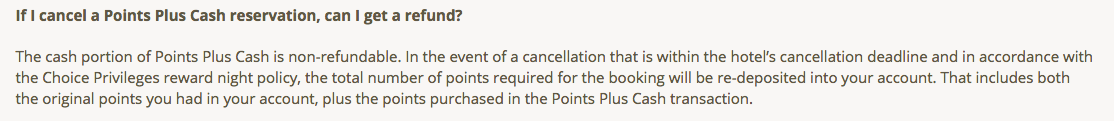

What if I need to cancel? This is actually a great workaround.

Much in the same vein as IHG’s program, the refund is solely in the form of points. So in the above scenarios, the 110k points would be refunded, not the money paid to buy the points.

If for some reason a phone rep gives you a hard time about buying points via the “points + cash” program for Preferred Hotels properties…don’t argue, simply hang up and find a hotel within the broader Choice umbrella that you can make a dummy booking with to buy the points needed. Cancel it and the points will be deposited in your account. Phone back in with the needed points in your account and book the property you want.

Is there a maximum amount of points you can buy.

Yes, 250k

Not just 5 star hotels

Properties like the Montage Laguna Beach are stupid expensive. Hell, even at $400ish a night they are really expensive, but for a special occasion, perhaps more within reach than the nearly $1k a night you’d pay direct to the hotel. We like to illustrate ways of accessing flights and hotels that are aspirational, but these tricks can be applied to most any price point. Hope this has helped!

Overall:

Amex and Choice are partners, often overlooked, but worthwhile for these specific purposes. This technique is ongoing, but there are many times throughout the year whereby Choice sells their points for even less than this deal. If you’re thinking you’d take advantage of these redemption options in the future, I’d highly recommend buying the 6k needed to initiate a “cash + points” redemption rather than move 6k Amex over, but the transfer option is always there if need be.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.