We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I recently had two Tik Tok videos go viral, and I’ve been able to reach a ton of people that aren’t familiar with the blog. While this content can be found in various places on the blog, I thought I’d customize a post that simply shows how I went about doing it using points and miles and how you can do it too.

Here they are…

@zacharyburrabelYou should see their apartments @elizabeth_henstridge ##raiseyourgame ##travelhacks ##pointsandmiles ##travelhacker ##etihad ##travelcoupledream

@zacharyburrabelMore info on my YouTube ft @elizabeth_henstridge ##etihad ##firstclass ##traveltips ##travelhacks ##pointsandmiles ##ttaveltricks ##travel ##bucketlist ##wish♬ Electric Love – BØRNS

First off… How did I book it?

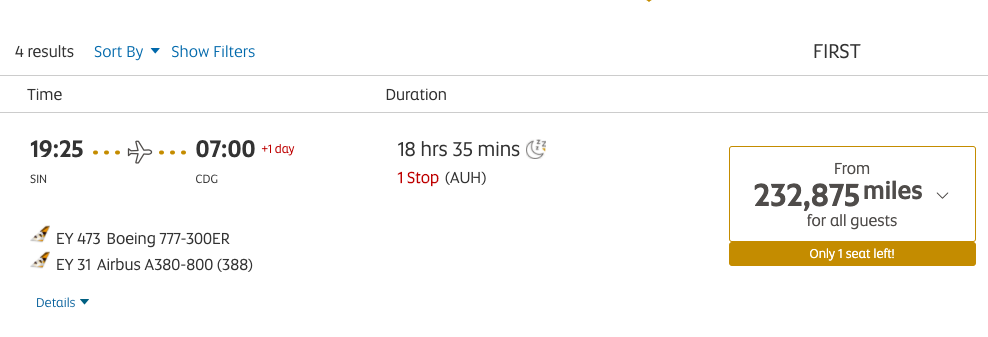

I used AA miles to book this ticket alongside roughly $30 in taxes and fees. Both of these flights were purchased on a single ticket, with an overnight layover in Abu Dhabi for 90k AA miles and just $30 per person. These are two of the best first class products in the sky, and I’ve attached two of the more popular award charts which you can access here

I flew from Singapore to Abu Dhabi on Etihad First Class on the 77W and then followed it up the next day from Abu Dhabi to Paris on Etihad Apartments on the A380. If you’re looking at the charts – that is Asia to Europe in First Class which is 90k AA miles. AA has mixed results when popuatling this award space ( sometimes it does, other it doesn’t – which is why you search using this trick and then calling AA to book and requesting the booking fee to be waived ). It populated for us and we were able to book online.

Alternatively, you could also redeem Etihad’s own miles or even redeem Aeroplan ( Air Canada’s award progrm). Both of these are viableoptions since they are American Express transfer partners; however, you may end up paying more in taxes and fees than I did. You can notice how much more it is to use Etihad miles. Some may also point out that I could have used Asiana miles as well, but those are far far harder to acquire so I won’t be detailing those.

Using Etihad Miles for the same itinerary

Using Aeroplan to book

How you can earn the miles

For those of us who are savvy with points and miles we already know that this amount of points and miles can be accrued pretty quickly, but many of those who are viewing the TikToks aren’t points and miles geeks like you and I.

I would highly recommend watching my beginner’s video where I detail 6 tips for beginner’s. This will answer a lot of quesitons you may have about your credit score, what impact it has, etc. Long/short – if you pay your bills on time and in full, your score will go up.

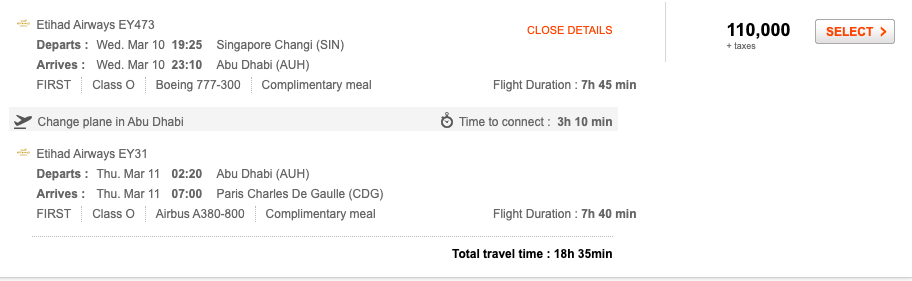

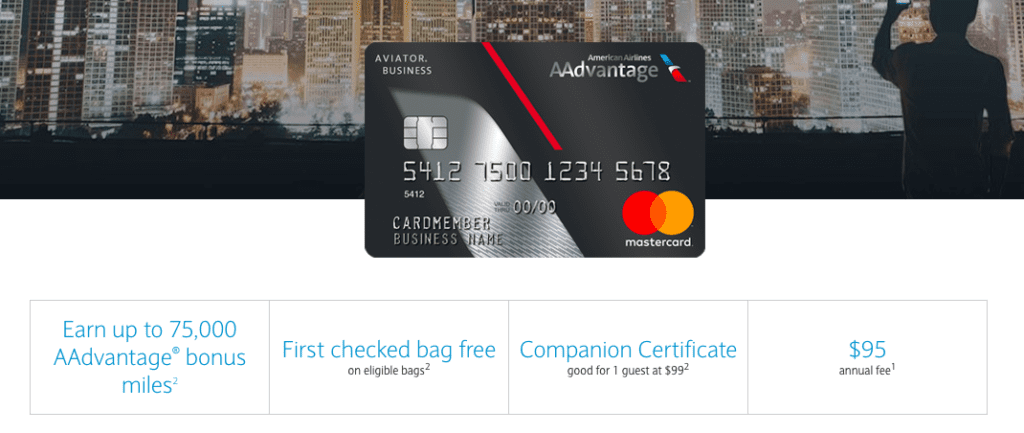

So…for the AA miles. The easiest is the Barclay Aviator Red + Business Red.

You could earn the miles needed in less than 5 weeks.

The current offers on these cards is a combined 135k points with only $1k in minimum spend. I don’t make any money off of these links, I wish I did because they are incredible offers, but just in case you’re wondering if I’m pushing them for commission, I’m not.

The Barclay Aviator Red personal will give you 60k points after a single purchase and paying the annual fee. The Business version ( which you can qualify for if you sell on ebay, tutor, drive uber or really make any kind of 1099 income ) is offering 65k after $1k spend in 3 months and 10k after issuing an authorized user card and spending once on it. Each card comes with other benefits like free checked bags, companion certs, etc that more than make up for the annual fees so I don’t factor them into the price of these tickets. If you want to expedite the miles, pay the fee before you get your statement, otherwise you’ll have to wait for another statement period to eclipse.

If two people each did this, you’d have 270k points – enough for 3 tickets on the routing I did…

Alternatively, you could always buy the miles when you see the space. AA is selling their miles for 1.7 cents right now which means this ticket could be purchased outright for roughly $1500 – not bad when you consider they retail for upwards of $10k. They’ve dipped as low as 1.5c during the pandemic -everyone has a different budget.

If you’re looking to book with Etihad or Aeroplan

Honestly, I would stay away from using Etihad miles since they are really overprice on this routing. There are certain instances and routes that makes sense, but for this example I’ll focus on Aeroplan. Either way, for those reading in the States, both programs are partners of Amex.

Amex is currently offering some of their highest offers on card referrals. I have dedicated posts to these cards, and if you aren’t using at least one of them, you should really consider examining what you’re using to make sure you’re earning points that align with your bucket lists. Also…these specific pages are for you guys – I don’t make any money off of them either, in fact, I lose money because I push traffic through them vs pages that have higher monetization, but I know these can be some of the best offers so I publish them. I also embed them with readers links so they make referral bonuses – if you don’t see Zachary referred you, you’re helping a reader out by giving them 5k – 30k bonus points off the referral. Readers earn millions of points off my site.

- Amex Green – 50k bonus points via Referral

- Amex Gold – 60k bonus points via Referral

- Amex Platinum – 75k Bonus points via Referral

You could also look into their business products, which I would highly recommend, and are linked in those posts above as well. A lot of people have Amex cards and don’t realize the wealth or opportunity already sitting in their point balance.

You can also watch this video for more ways to earn loads and loads of Amex points

You can also watch the full reviews of each of those flights here:

If you have questions please ask!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.