This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One Venture X Business

For most people, I think the Capital One Venture X is the best super premium credit card on the market. It’s easy to understand the benefits it yields and how you can recoup the $395 annually through them. Plus, it offers great travel portal bonus points + unlimited 2x earning and great priority pass lounge access. Simplicity is the path forward for Capital One and it makes a TON of sense to most people. So it’s natural that Capital One doubled down with the Capital One Venture X Business!

Here’s a rundown of the bennies which closely mimic the Capital One Venture X –

Capital One Venture X Business Details

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- Earn 10X miles on hotels and rental cars and 5X miles on flights and vacation rentals booked through Capital One Business Travel

- With no preset spending limit, enjoy big purchasing power that adapts so you can spend more and earn more rewards

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Every year, you’ll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings made through Capital One Business Travel

- Receive up to a $120 credit for Global Entry or TSA PreCheck®. Enjoy access to 1,300+ airport lounges worldwide, including Capital One Lounge and Landing locations and participating Priority Pass lounges, after enrollment

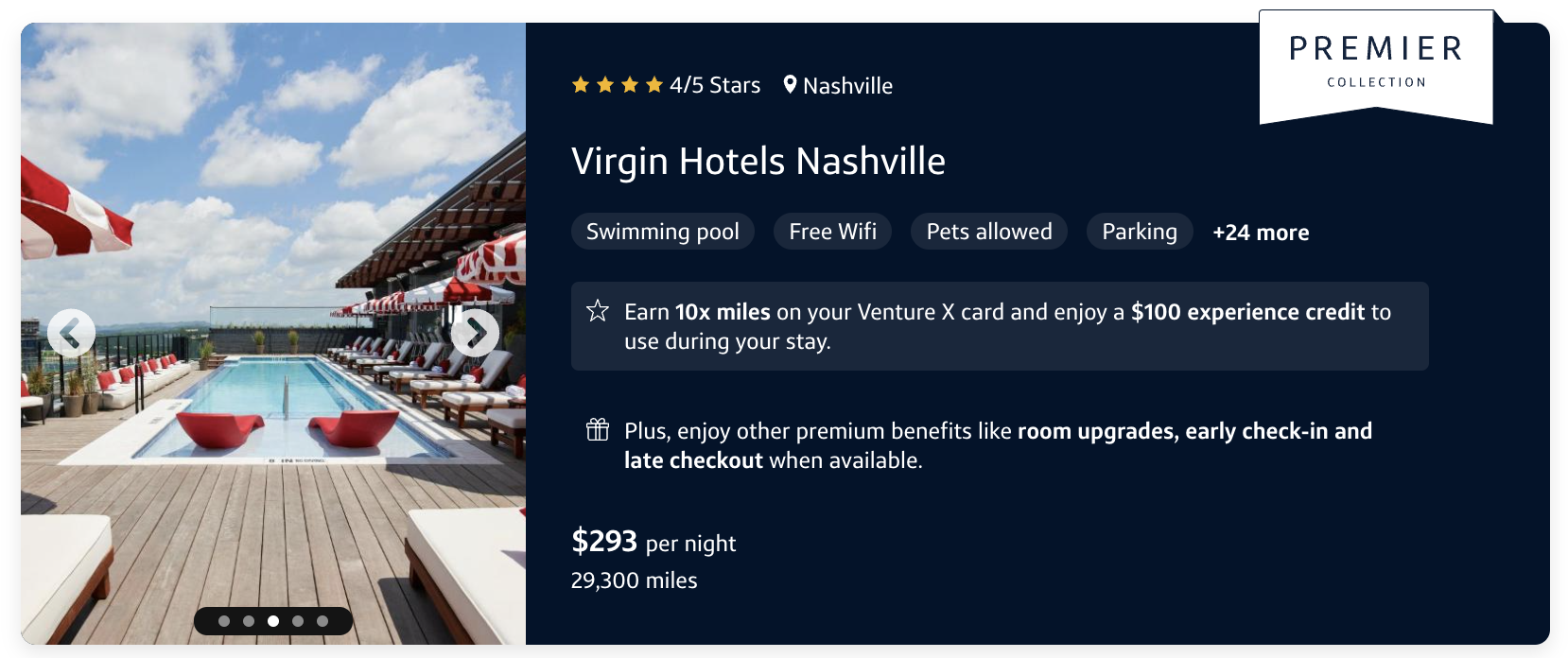

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- This is a pay-in-full card, so your balance is due in full every month

The grab n go section at the new Capital One Lounge in DC

Who is eligible?

If you currently hold the Capital One Spark Cash Plus then you’re ineligible; however, if you had it in the past this doesn’t apply. Other than that, you as long as you’re a small business owner, you should be good to go.

I don’t have a small business, Miles. You may, and not know it. Keep reading.

Chase is very friendly to entrepreneurs and small business owners. In fact, if you haven’t been in business for long, or you haven’t established yourself with an EIN, you can still apply as a Sole Proprietor ( fill in your SSN ).

Who qualifies?

- Online Coaches, tutors, etc

- Uber and Lyft drivers (assuming they still get 1099s whenever you’re reading this).

- DoorDash, GrubHub and Postmates

- Social Media income ( TikTok, Instagram, YouTube )

- Cater Waiters

- Personal Trainers

- Dog Walkers

- Freelance graphic designers and web designers

- Singers, artists, dancers, models, etc

- Virtual Assistants

- Ebay, Amazon and Facebook resellers

If you run a small side business and want a card to segregate your business income from your personal income at tax time…this is a great opportunity to earn a load of points and help yourself out. Personally, I have 3 businesses that I run, two have an EINs, and one doesn’t. I still need to keep all of their records separate, and so I have cards for each business.

If you want more information on this, read our full small business guide here

10k Capital One Miles every year you keep the card

Yep, you read that right. Upon your account anniversary, Capital One will credit your account with 10k miles which, at a minimum, is worth $100 in the Capital One Business travel portal, and potentially much more if you transfer them out to partners.

$300 Annual Credit on Capital One Business Travel bookings

This credit is applied to any travel that you book in the Capital One Business Travel portal. When you combine that with the 10k Capital One Mile Anniversary Bonus, you’re effectively getting $400 a year back in credits on a card that has a $395 annual fee.

Capital One Venture X Business has access to the Premier Collection Collection properties

How does this card compare to the personal Capital One Venture X?

The personal version is a the best super premium card on the market for most people and includes Hertz President’s Club status, and authorized users get access to lounges as well. With the business version, AUs don’t gain lounge access and there isn’t any Hertz status associated.

Both are very good cards and offer Capital One Business Travel portal credits that offset the annual fee starting in year two. However, on a head to head basis, the personal version offers more benefits than the business version; however, the business version has a higher welcome bonus, but also a higher minimum spend requirement.

Priority Pass(TM) Membership

A notable difference compared to the personal Venture X

- The business version DOES NOT include Priority Pass for free authorized users.

15+ Capital One Transfer Partners

Here’s a pretty chart regarding Capital One transfer partners. I’m really impressed with how far Capital One has come in just a few years regarding their push to establish themselves in the travel rewards ecosystem. This is an impressive list of 15+ partners and all but two are 1:1

- The following partners are now 1:1

- Aeromexico Club Premier

- Air Canada Aeroplan

- Avianca LifeMiles

- Air France Flying Blue

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Choice Privileges

- Etihad Guest

- Finnair Plus

- Qantas Frequent Flyer

- Qatar Airways

- Singapore Airlines

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles and Smiles

- Virgin Red

- Wyndham Rewards

- Accor transfer 2:1

- EVA transfers 2:1.5

- IPrefer transfers at 1:2

- JAL transfers at 4:3

- Emirates Skywards 4:3

Read this article to see the 50 best ways to use Capital One Miles

Would you/will you get it?

It’s a very high minimum spend requirement, and I’m actually kind of tempted to go for it. I do love my Capital One Venture X, and would love to have this business iteration. .

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.