This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedom Flex® vs Chase Freedom Unlimited®

Honestly, you can’t go wrong when choosing between these two stellar cash back cards, but there are some important differences. Our goal is to help you earn the most possible points on your purchases. Adding either, or both, of these cards to your wallet can help you earn a ton of additional points. In order to do that, let me describe the strategy I employ in achieving my own travel goals and recommend you consider. This strategy will ultimately help you choose between the Chase Freedom Flex® and Chase Freedom Unlimited®.

The Strategy of carrying these cards in tandem with a premium Chase credit card

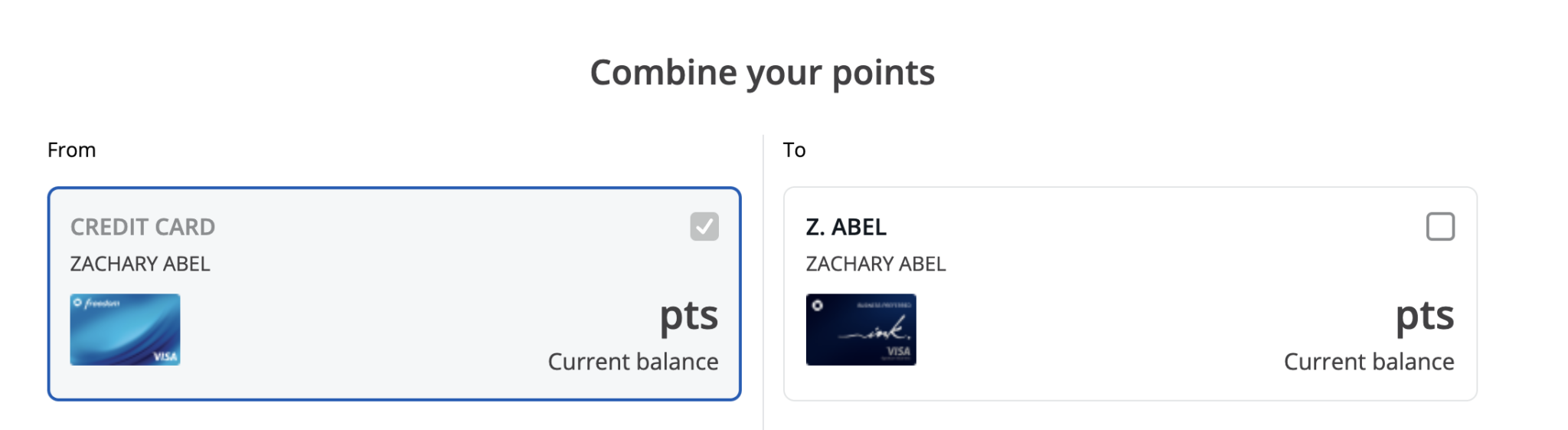

First, both of these are technically cash back credit cards, but their real potential is unlocked when you pair them with a Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Chase Ink Business Preferred®. How does this work? The 3 cards mentioned earn premium Chase Ultimate Rewards and Chase allows cardmembers to combine points – read this article to learn how this is done – which allows you to combine the points earned from these cards into those cards. Let me explain further.

The cash back you earn from a Chase Freedom Flex® and/or Chase Freedom Unlimited® is actually earned as Ultimate Rewards that can be redeemed for various things, but they can’t be transferred to travel partners. This is an exclusive benefit for cards that earn premium Ultimate Rewards. But, this is what I love, the points earned from a Chase Freedom Flex® and Chase Freedom Unlimited® can be combined with the points in premium card account. When you combine points they take on the traits of the account they’re merged into, and thus can instantly be transferrable.

Combining with a Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Chase Ink Business Preferred®

For instance, if you were to take the points earned from your Chase Freedom Flex® and merge them into your Chase Sapphire Preferred, they could then be transferred into Ultimate Rewards transfer partners or redeemed at 1.25c in Chase Travel ( SM ) . This action unlocks a bevy of redemption possibilities, but also increases the value of your points if you simply want to use them in Chase Travel (SM). Read this post to learn how

Adding a Chase Freedom Unlimited® or Chase Freedom Flex® to your wallet can help you earn a ton of Ultimate Rewards by leveraging high category bonuses, but then combining them into premium accounts for higher valuation and transfer options.

How the Chase Freedom Flex® and Chase Freedom Unlimited® welcome offers

The Chase Chase Freedom Flex® Reader Referral

Information about this card has been collected independently by Monkey Miles. Card issuer is not responsible for the information or accuracy

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate.

- Enjoy new 5% categories each quarter!

- 5% cash back

- on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back

- on drugstore purchases

- dining at restaurants, including takeout and eligible delivery service,

- Unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back.

- You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- No annual fee

- Member FDIC

The Chase Freedom Unlimited® has two offers

The first is the Affiliate offer

- Intro Offer:

- Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more;

- 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service

- 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent,

- enjoy 5% cash back on travel purchased through Chase Travel℠,

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service,

- Unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

The second is the reader referral

- Earn $200 or 20k Ultimate Rewards after $500 spend in 3 months

- 5x on Travel purchased through Chase Travel(SM)

- 3x on Dining including take out/eligible delivery services.

- 3x on Drugstore

- 1.5% or 1.5x points on every purchase

- No annual fee

Chase Freedom Flex® is a Mastercard and Chase Freedom Unlimited is a Visa

There are different benefits associated with each and you should be aware of them. Perhaps you see more value in one vs the other.

The Chase Freedom Flex® is a Mastercard World Elite

That means the card comes with these additional perks just because it’s a Master World Elite

- Mobile Phone Insurance – Up to $800 per claim and $1,000 per year on mobile phone protection

- theft and damage on users listed on the phone bill paid by the cardholder

- Lyft – $10 in credit for every five rides taken in a calendar month

- This gets applied to the next ride

- 1x per month

- ShopRunner – free membership

- 2 day shipping at over 100 stores

- Fandango – 2x VIP+ points on movie tickets bought on the Fandango app or Fandango.com

The Chase Freedom Unlimited® is a Visa Signature

Visa Signature benefits include traditional Visa benefits and add on a few perks

- Extended Warranty – add on an additional year of the manufacturer’s warranty if that that warranty is less than 3 years

- no added benefits, whatever is included in that original manufacturer’s warranty

- Auto Rental Collision Damage Waiver – Car rentals are protected against damage and theft when you rent for less than 15 days in the USA and fewer than 31 days abroad ( certain countries are excluded ).

- This is secondary coverage to your own insurance

- Personal Injury isn’t covered

- Some vehicles, including minivans, SUVs, and luxury/exotics

- Read the full details here

- Zero Liability

- You won’t be held liable for unauthorized transactions

5x rotating categories or 1.5x everywhere?

This is the biggest distinguishing characteristic in my opinion – will you earn more points on rotating categories or 1.5x everywhere? Only you can make that decision and it’s the biggest difference between the Chase Freedom Flex® and Chase Freedom Unlimited®.

The Chase Freedom Flex® has rotating 5%/5x category bonuses

Every quarter Chase Freedom Flex® cardholders can activate their card to earn a category bonus of 5% or 5x points on their purchases up to $1500. These categories rotate every 3 months. If you max out all of your quarterly bonuses for the year, you can earn 7500 points every quarter, or 30k Ultimate Rewards. That’s an amazing haul for just $6k worth of purchases.

Take a good look at these categories and see if you already spend quite a bit on these purchases as this could be the deciding factor of whether you get a Chase Freedom Flex® or Chase Freedom Unlimited®

2024 calendar

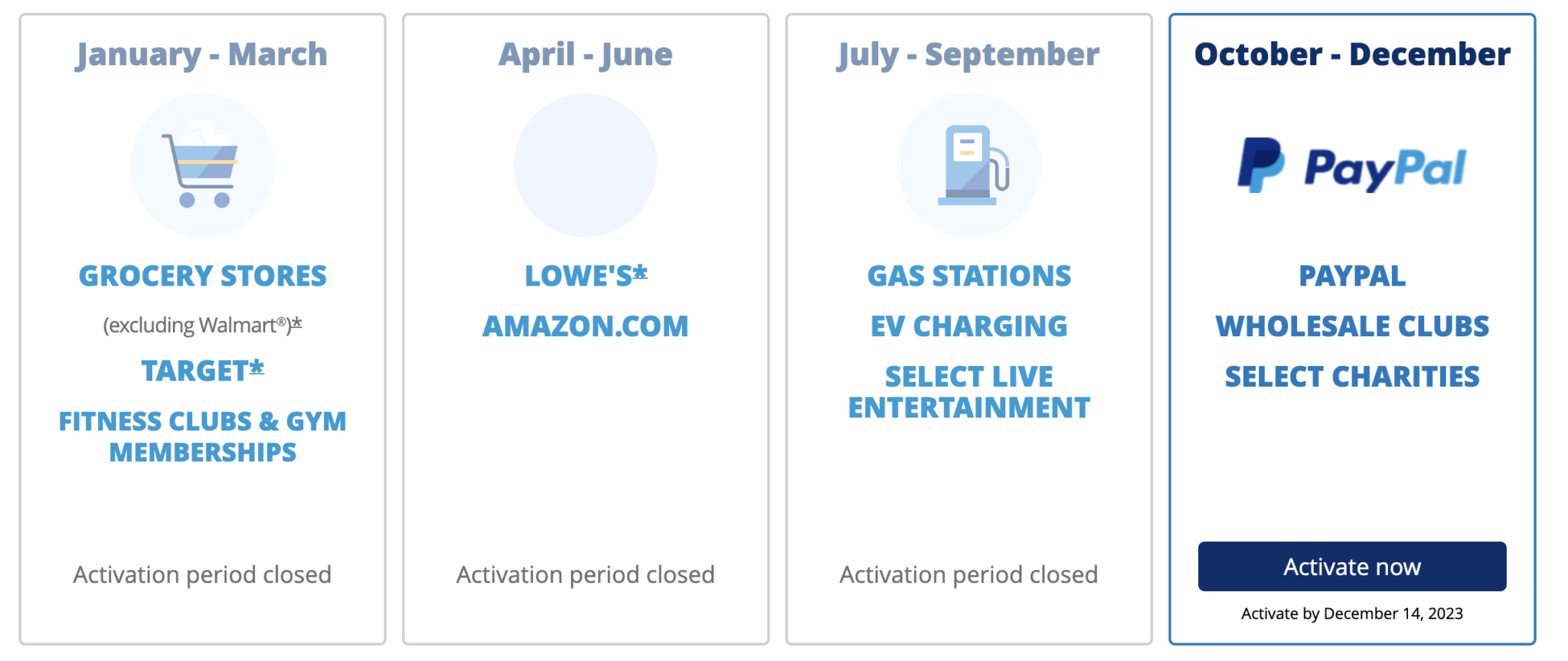

2023 Calendar:

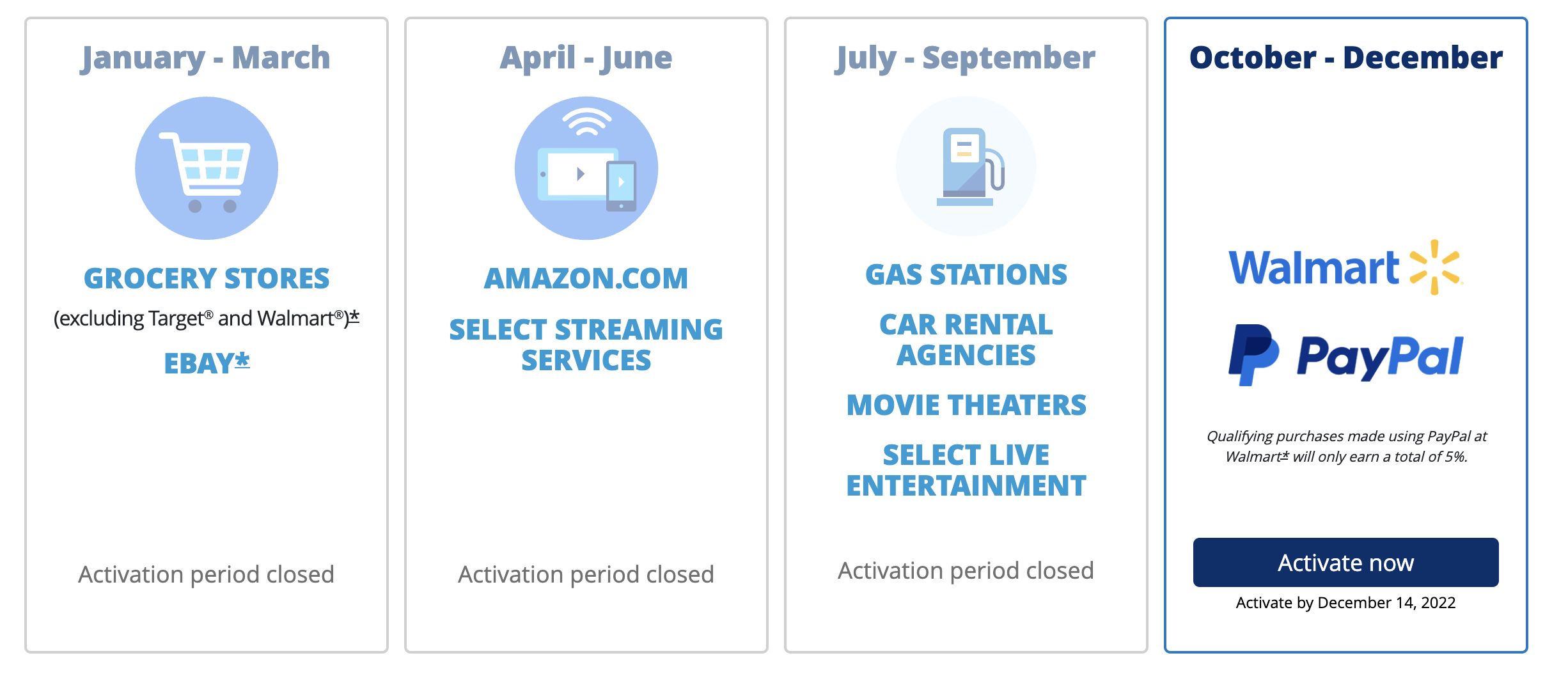

2022 Calendar:

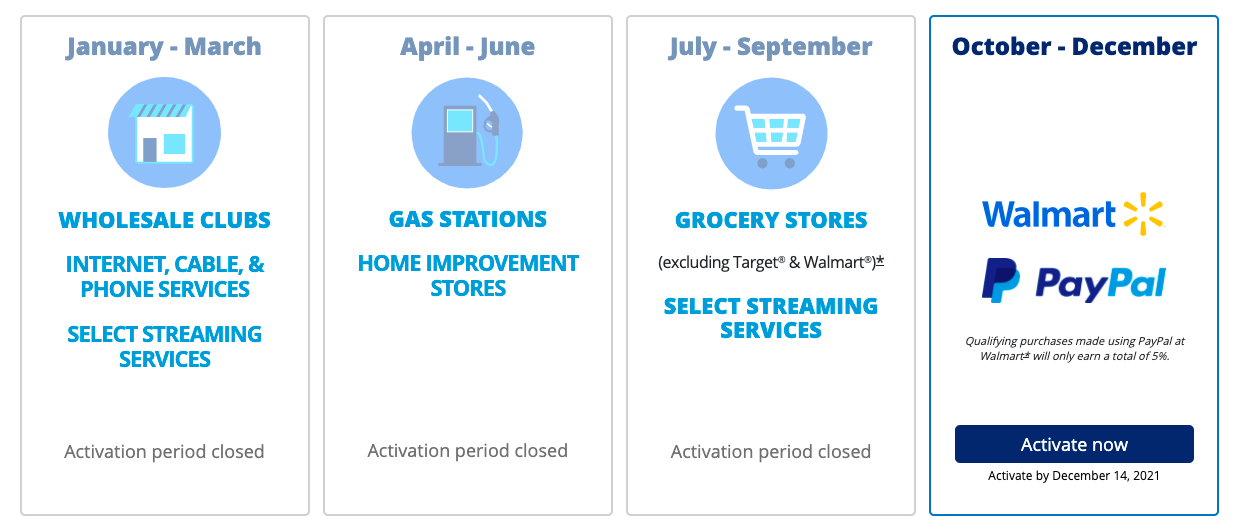

2021 Calendar

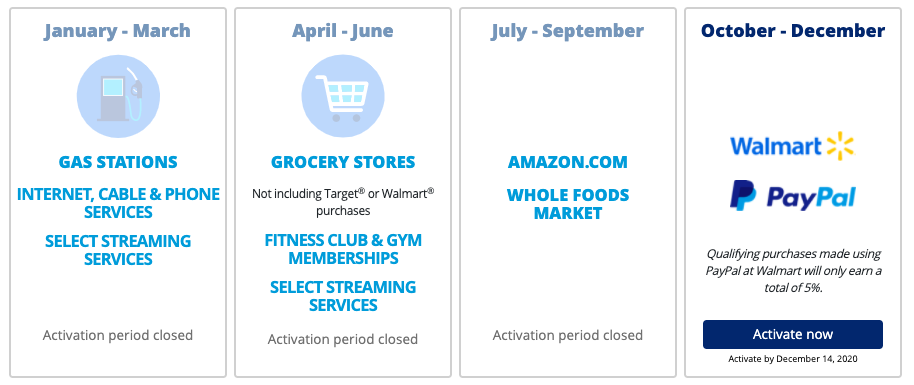

2020 Calendar

Can I hold both a Chase Freedom Flex® and Chase Freedom Unlimited® concurrently

Absolutely. Both cards carry no annual fee, and if you’re really looking to optimize the number of points you earn, carry them both. That way if you’re spending money at a place that hits one of those rotating category bonuses…you’ll earn 5x. If you’re not…you’re guaranteed to earn 1.5x. Carrying either, or both of these cards alongside a Chase premium card will increase the number of points you earn on every dollar you ordinarily spend.

If you were to hold both cards alongside a Chase Sapphire Preferred® perhaps you’d spend this way:

- 5x rotating category Bonuses – Chase Freedom Flex®

- 5x on Travel with Chase Travel(SM) – Any of the 3

- 3x on Dining – Any of the 3

- 3x on Pharmacies – Either Chase Freedom Flex® or Chase Freedom Unlimited

- Foreign Transactions – Chase Sapphire Preferred – no fx fees

- Rental Cars – Chase Sapphire Preferred gives primary rental car coverage

- 1.5x All other purchases – Chase Freedom Unlimited

That is a lot of category bonus points for $95 total annual fee spend.

Overall – you can’t go wrong

Both of these cards are stellar cards and I highly recommend them. Team them up with a Chase premium card and you’re well on your way to earning having a killer point balance come end of year.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.