We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

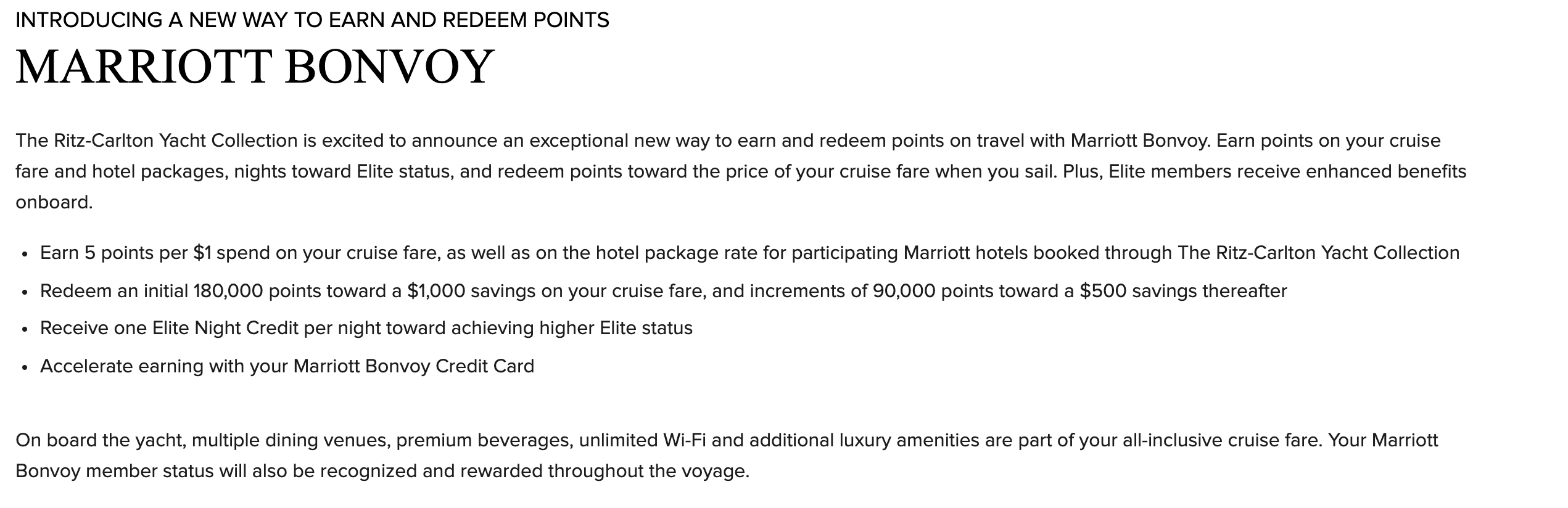

Marriott Bonvoy just announced the earn and burn rates for their Ritz Carlton cruise collection. I’ve never really been THAT interested in a cruise aside from one to Antarctica, but these have definitely piqued my interest. But…does it make sense to use Marriott Bonvoy points on these cruises? Members will be able to start earning and redeeming points on cruises scheduled to being on May 6th, 2022. All of the details can be found here, as well as booking information, but let’s take a quick look.

Marriott Bonvoy Earn and Burn rates for Ritz Carlton Cruises: I’ll probably never use Marriott points on cruises

As you can see below you’ll earn at this rate:

- 5 Marriott Bonvoy points per $1 on cruise fare + hotel package

- Each night you’re on the cruise you’ll receive an elite night

You’ll then be able to use Marriott Bonvoy Points as follows

- 180k points is the minimum redemption to offset $1k cruise fare

- Then you can redeem in 90k multiples to offset $500

Effectively you’ll be able to cash out your Marriott points at $0.0056 a piece. Terrible value IMO – I’d say Marriott points are fairly valued at 7/10 to 8/10 of a penny. Any redemption over 1 cent is great, but less than that and it’s pretty poor.

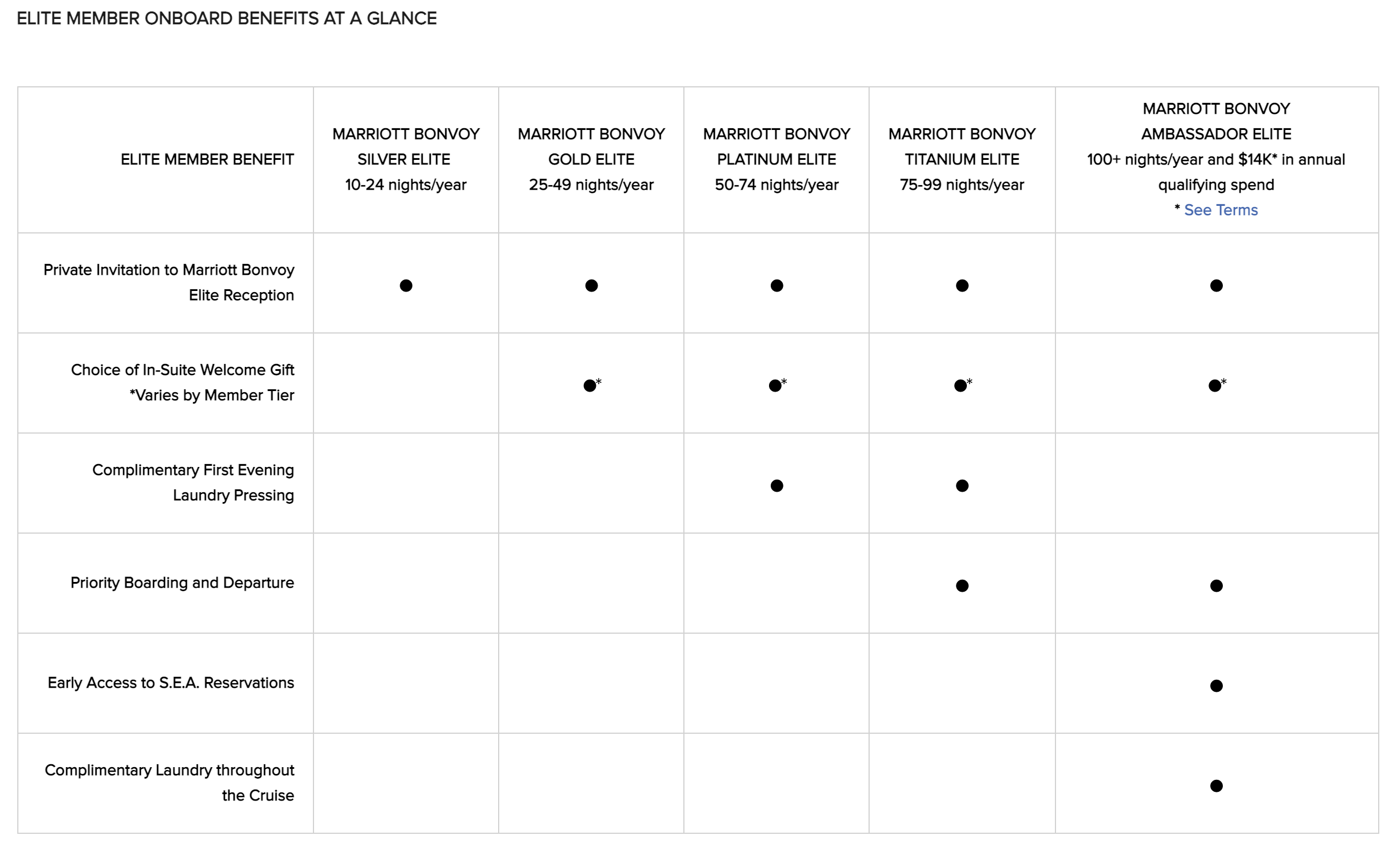

Elite Benefits while onboard Ritz Carlton Cruises

Aside from extra excursions, laundry, etc – the food and beverage is all inclusions while on board, similar to many other cruises. Aside from the unlimited laundry benefit of the Marriott Ambassador Elite, I’m not sure many of these benefits are that valuable. These ships are relatively small with 149 suites, all featuring private balconies, so I’d imagine you’re receiving an exclusive experience regardless. Note that elites aren’t receiving upgrades, etc but rather priority boarding and some onboard amenities like elite reception, pressings, and laundry.

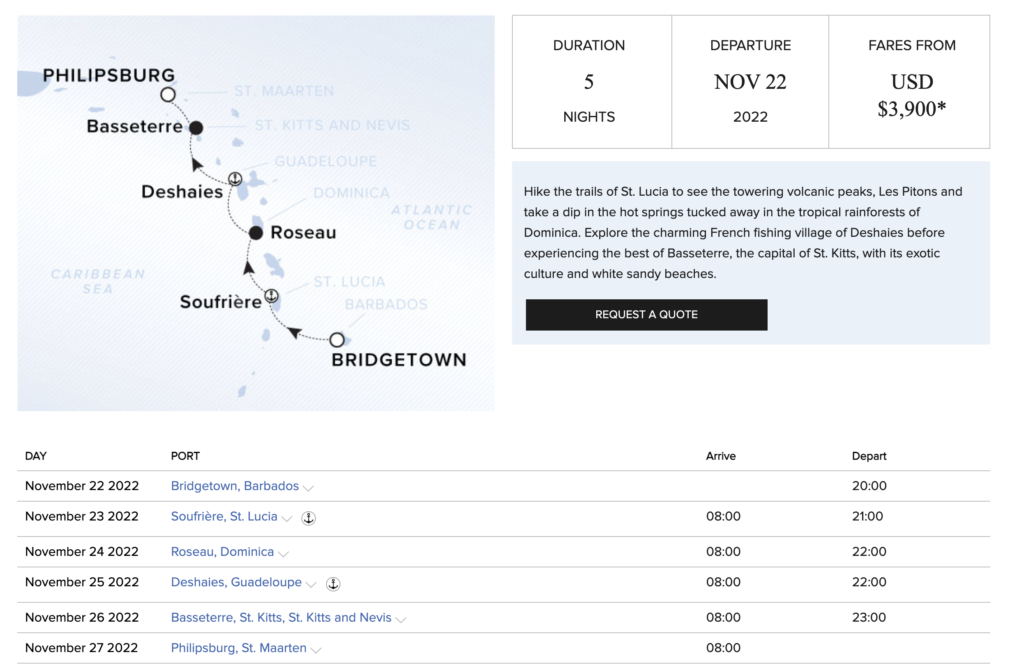

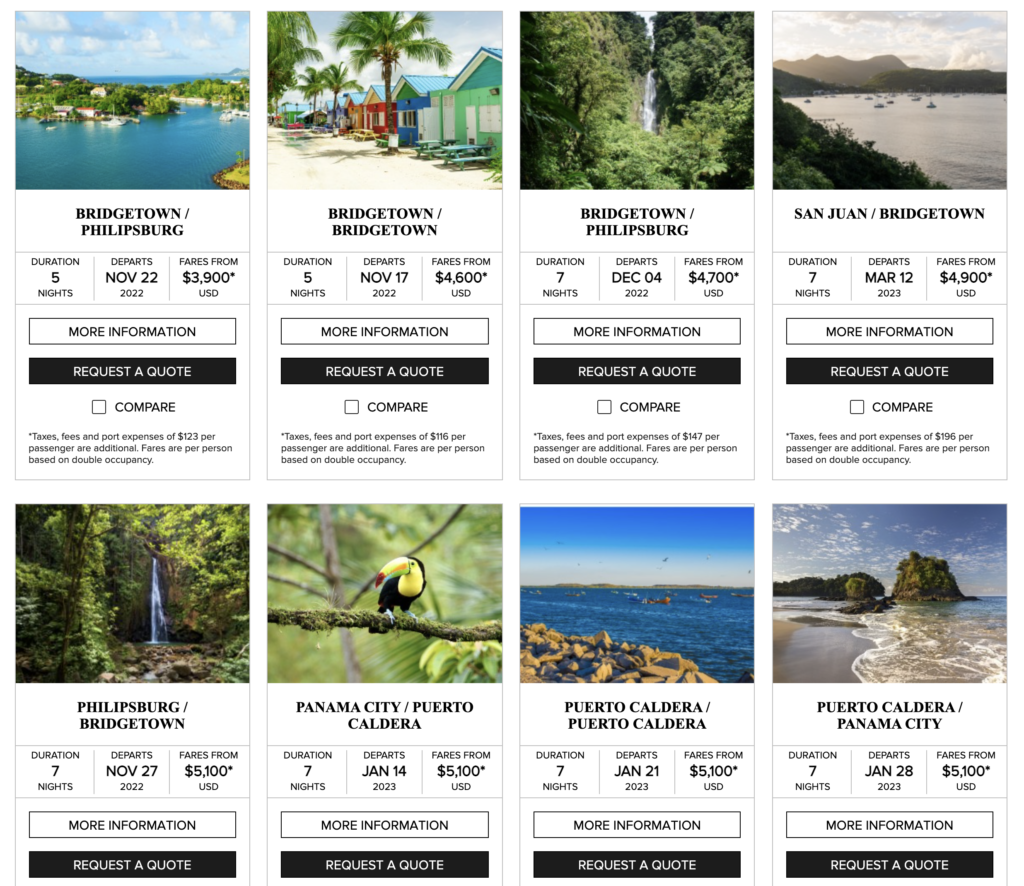

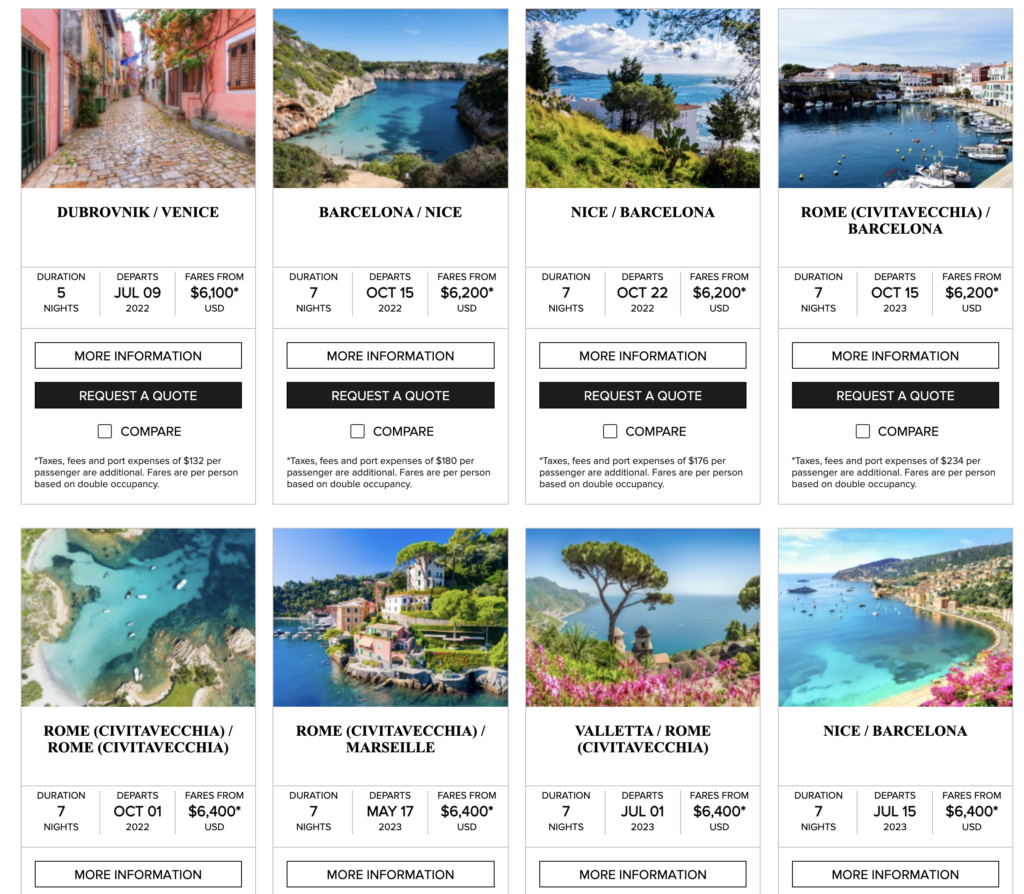

How much do Ritz Carlton Cruises cost?

I did a quick search and the cheapest are Caribbean cruises which start around $4k per person for the cheapest room. To put that in perspective point wise, you’d need to redeem 720k Marriott Points per person to offset the cost.

And here’s a list of the suites available…

Overall

Overall

It’s nice to see that you can earn Marriott points via Ritz Carlton cruises, but I can’t imagine ever redeeming. I do have to say that these ships look incredible; however, if I was to throw this kind of cash at a cruise, it’d likely be for Antartica 🙂

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.