This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG One Rewards Free Night

Chase currently offers 3 different IHG credit card products: The IHG One Rewards Traveler ( no fee ), IHG One Rewards Premier Credit Card ( $99 fee ), and the IHG One Rewards Premier Business Credit Card ( $99 ) of which the latter 2 offer free night awards every year on your cardmember anniversary. You should also note, that the now retired, Chase IHG Rewards Select also offers a free night certificate, but the redemption use is different. Let’s walk through the various ways you can use these certificates to maximum value.

I have used free night awards to stay in some incredible hotels around the world. The ability to now add points to the free night awards issued by IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card yield even more options for ideal aspirational usage.

I’d love to revisit the Regent Hong Kong ( formerly the Intercontinental Hong Kong)

How do you book your IHG One Rewards Free night

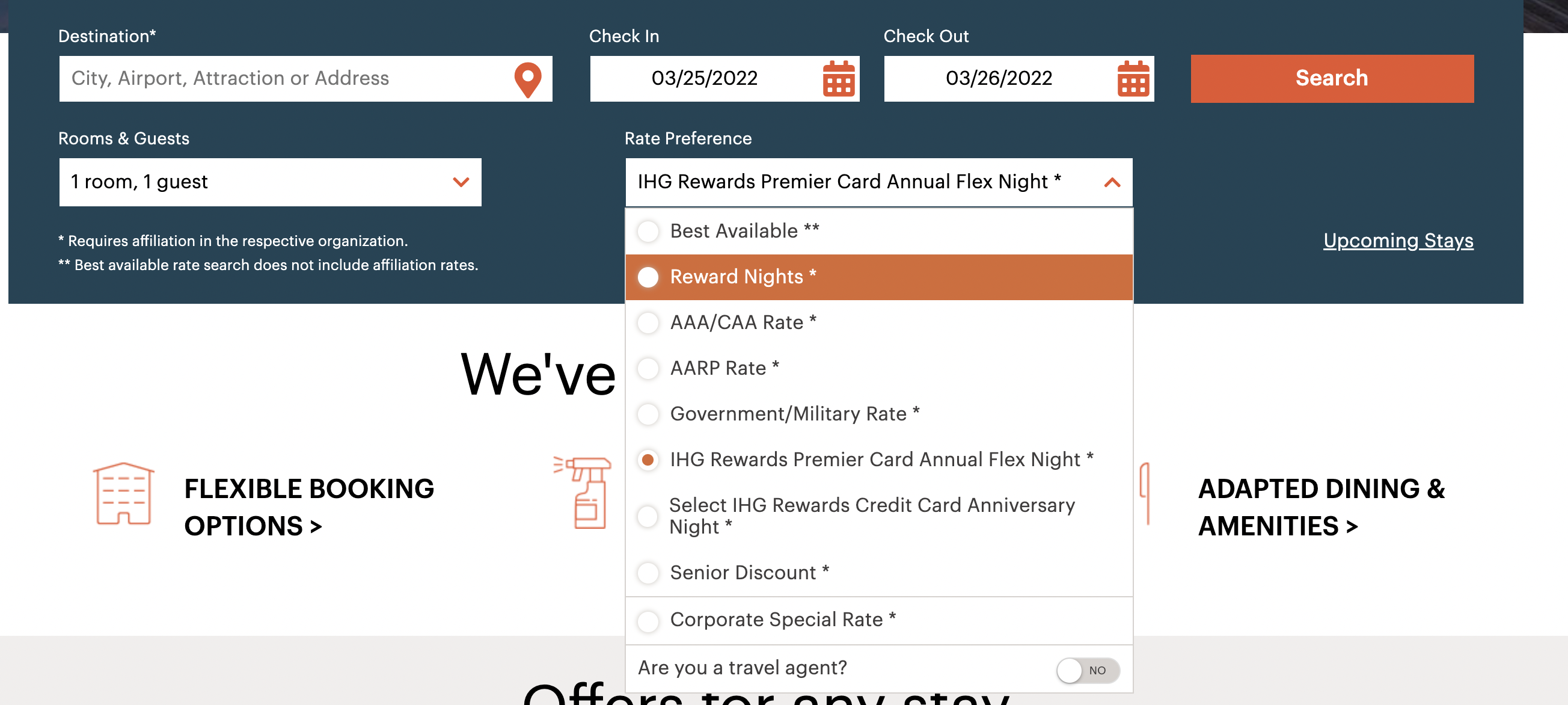

The easiest is on the main booking page, you’ll see the option for two different free night certificate redemptions

Let’s look at the IHG One Rewards Premier Credit Card free night award first

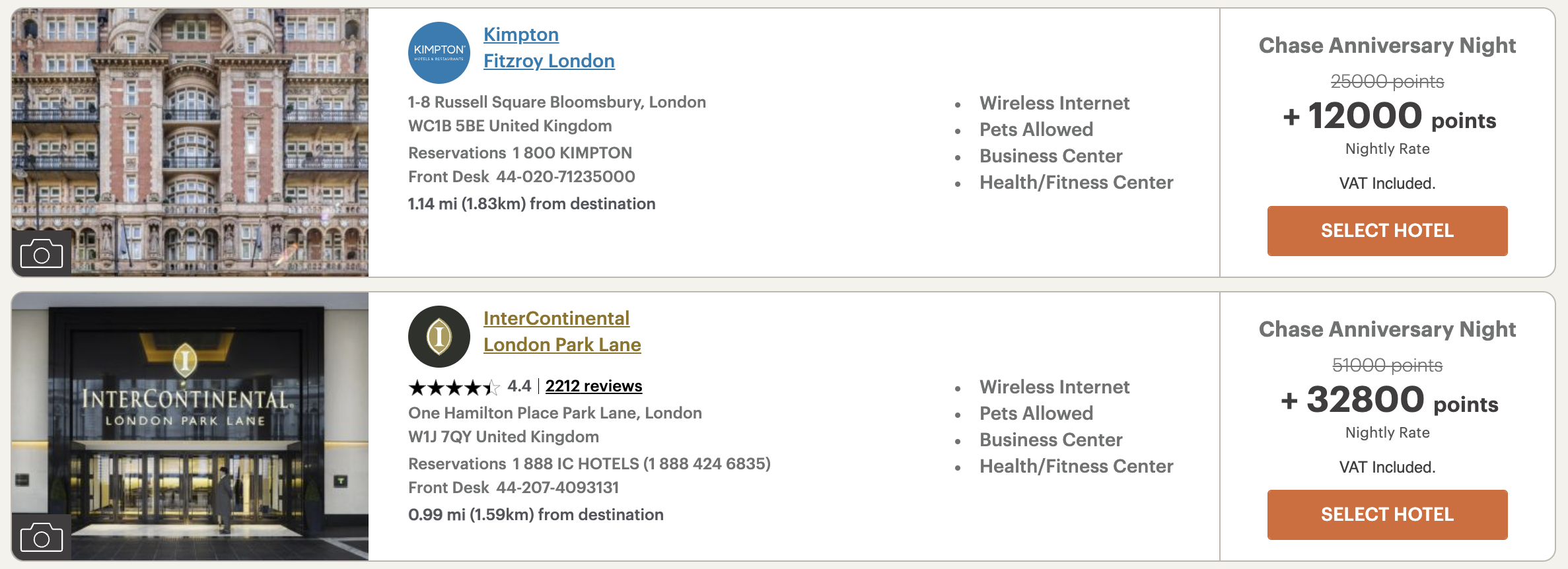

I did a search in London and here is how the results populate. Both of these hotels are fantastic and you can apply points straight to the booking and not only use up the full value of your 40k free night, but access higher end properties.

- Kimpton Fitzroy – full review

- Intercontinental London Park Lane – full review

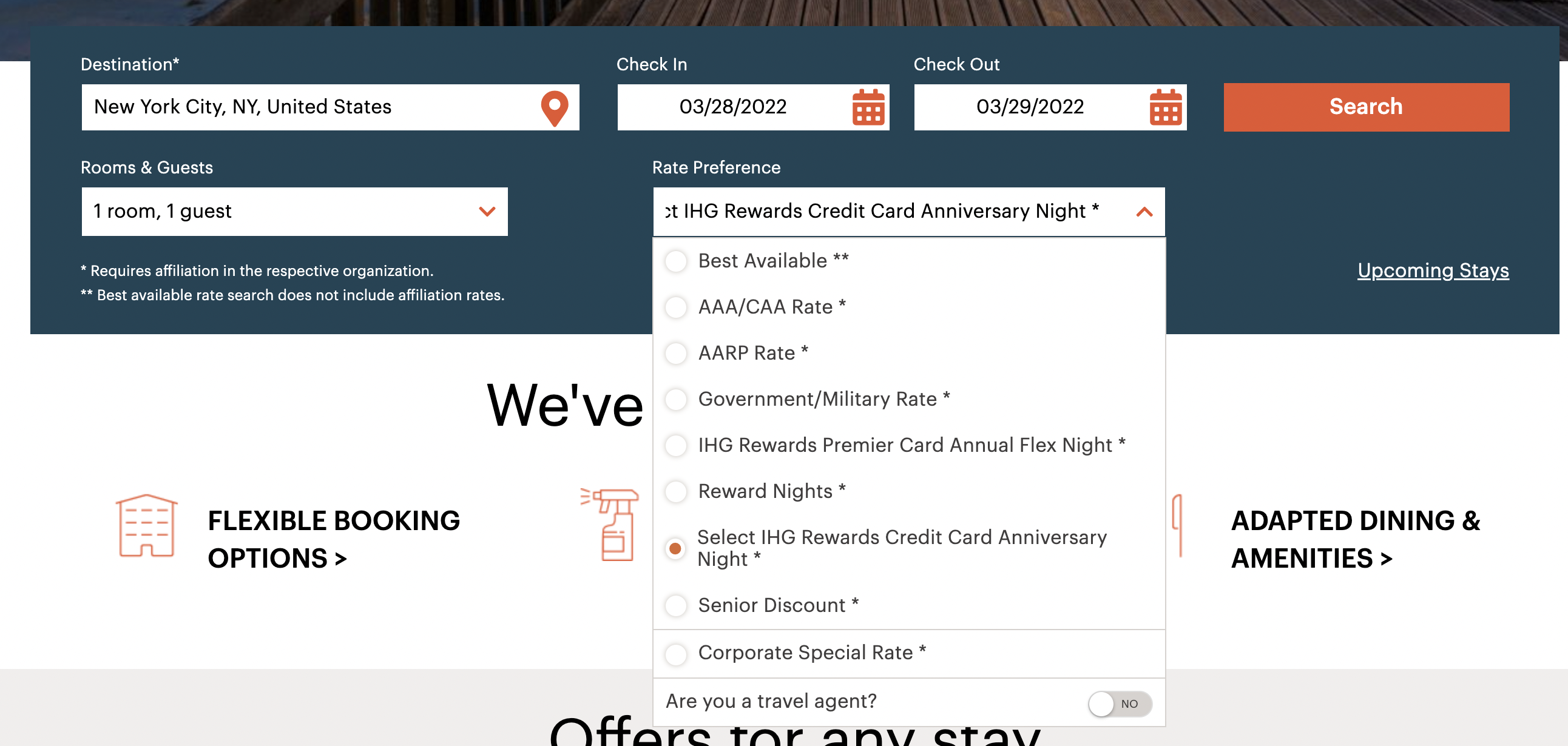

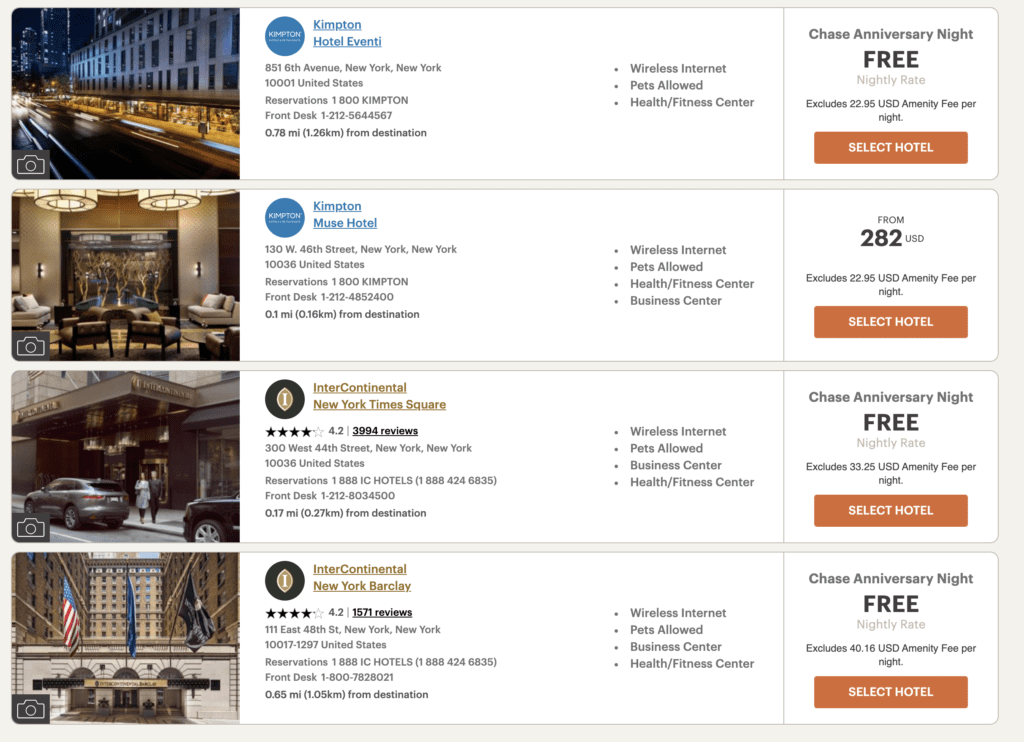

Let’s look at the IHG One Rewards Select next

You’ll need to choose Select IHG Rewards Credit Card Anniversary

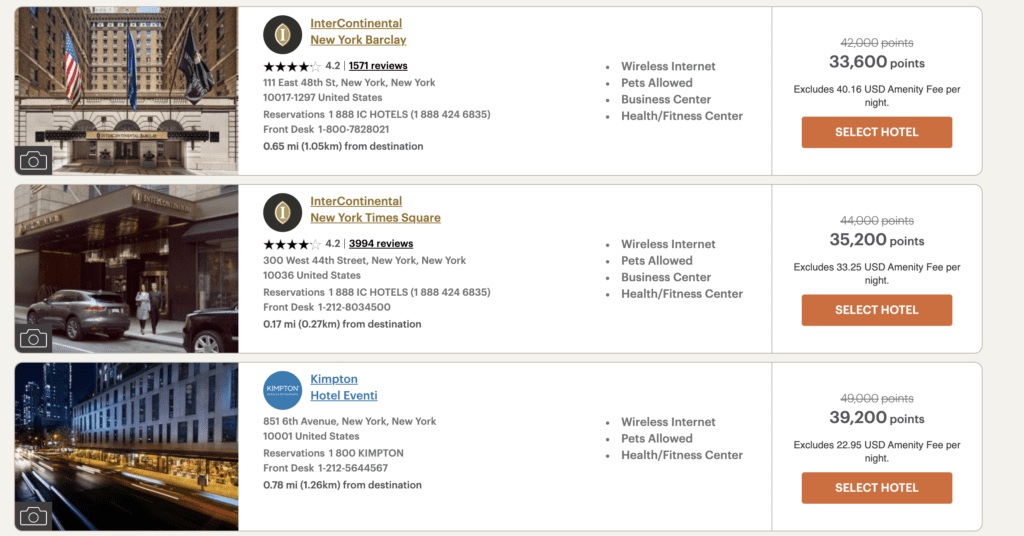

From there you will be given options where it works or doesn’t…which you can see are all under 40k

When do IHG One Rewards credit card anniversary nights post?

Interestingly enough, I’ve found that they post before your annual fee hits on the credit card. This is probably due to when you actually applied and was approved for the card. If that happened to be in October, you may see the night post early in the month, and see you fee charged later.

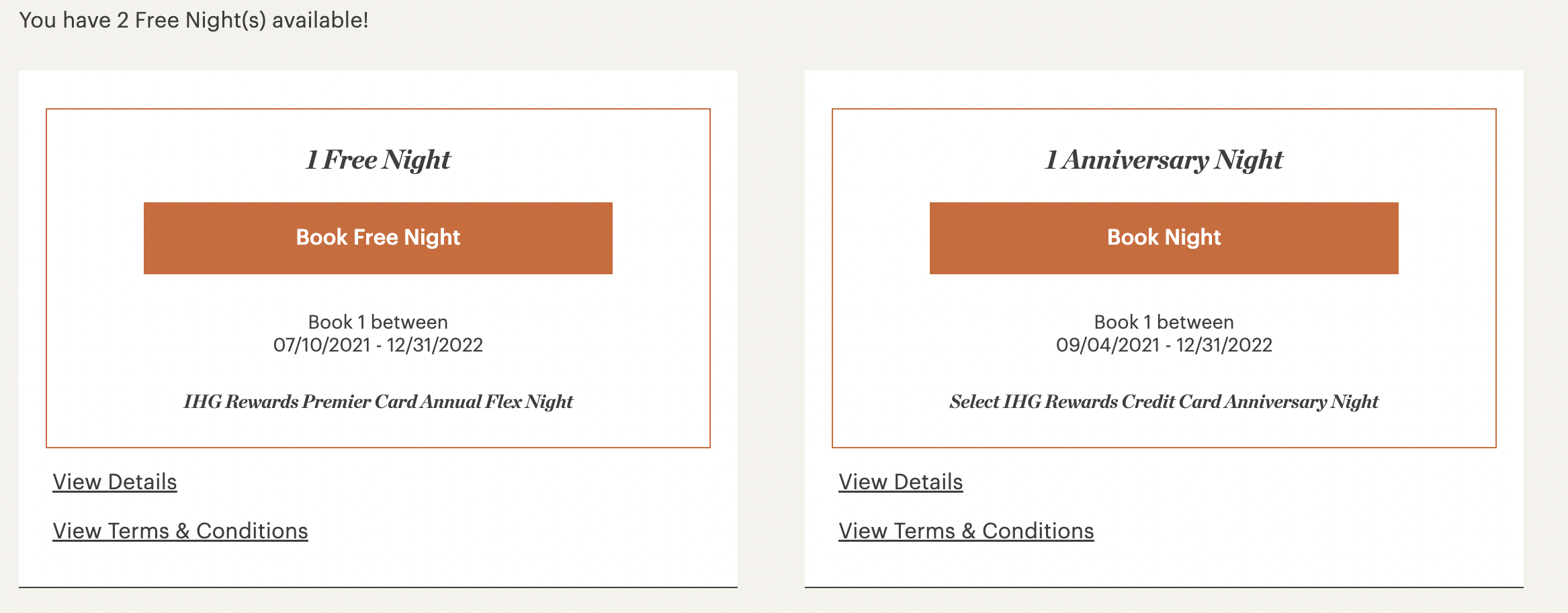

How can I tell when my IHG One Rewards Free Nights will expire.

Log into your IHG account and you’ll see your free nights in your main loyalty page.

Once you click on those, you’ll see the free nights that are valid and when they expire

Once you click on those, you’ll see the free nights that are valid and when they expire

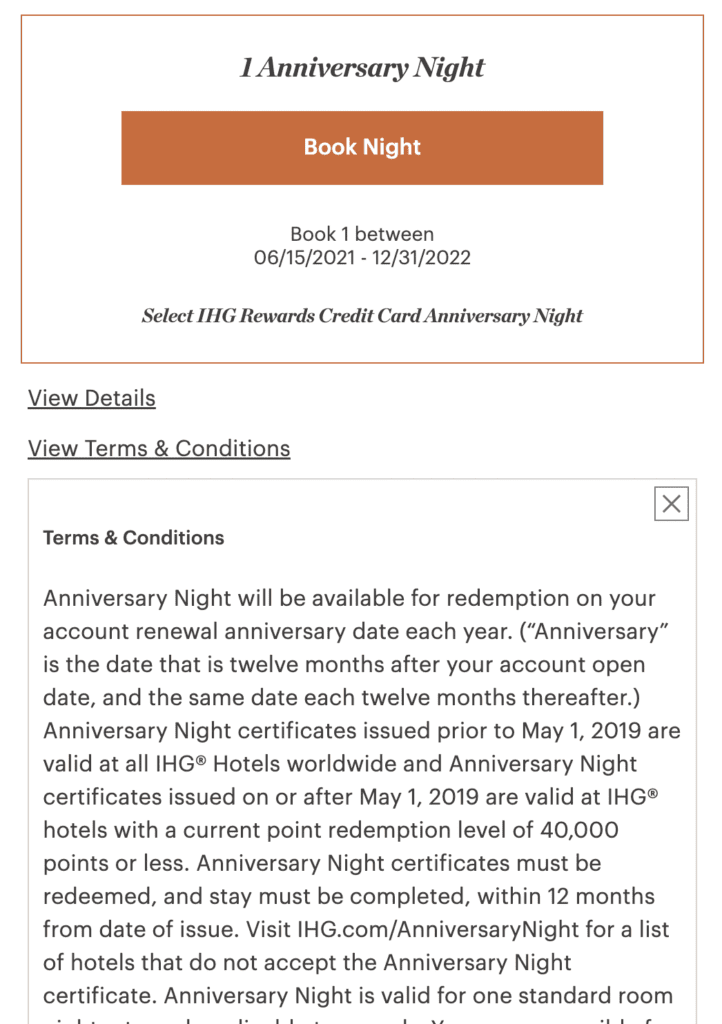

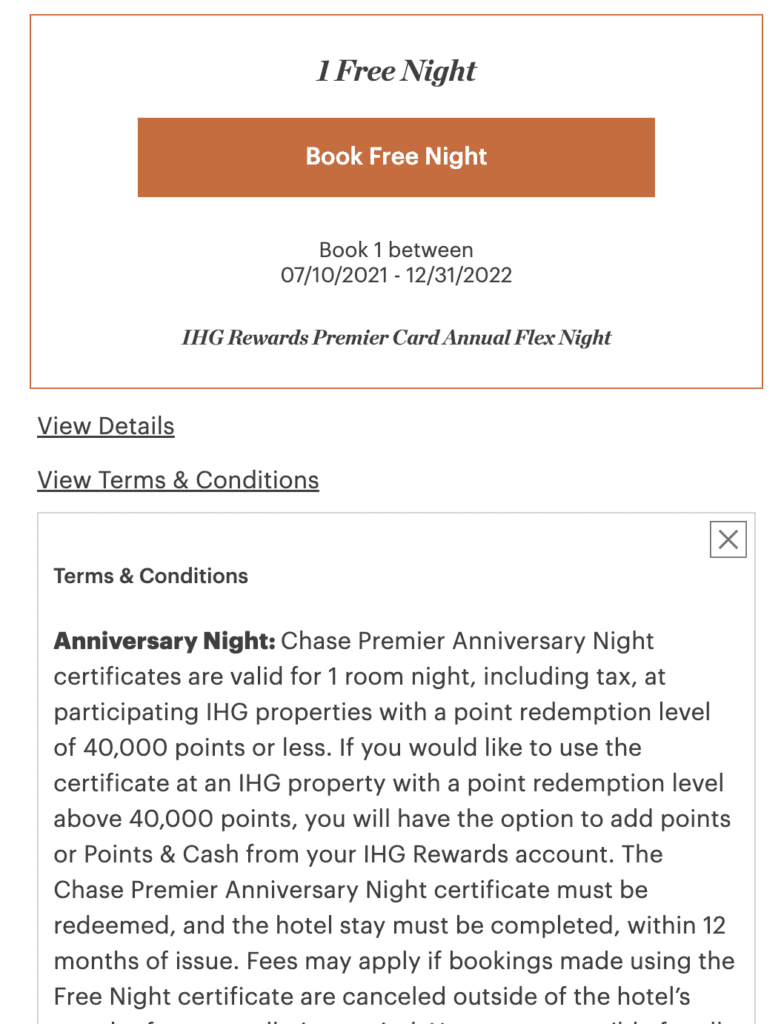

What’s the difference between the award given to old IHG Rewards Select cardmembers and new IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card cards?

If you still hold an IHG Rewards Select ( I do ) then you get 10% back on all IHG Rewards redemptions up to 100k back per year. This is the main reason I continue to hold on to the card + you get a free night on your anniversary. When IHG changed the rules on the free night award everyone was hoping that you’d be able to not only add points to free night awards issued to IHG Rewards Premier/Premier Business cardholders, but also the legacy IHG Rewards Select.

That is not the case. Only free night award nights that are issued to IHG Rewards Premier/Premier Business cardholders can add points to access higher redemption hotels.

You can see this in the terms and conditions of each free night award.

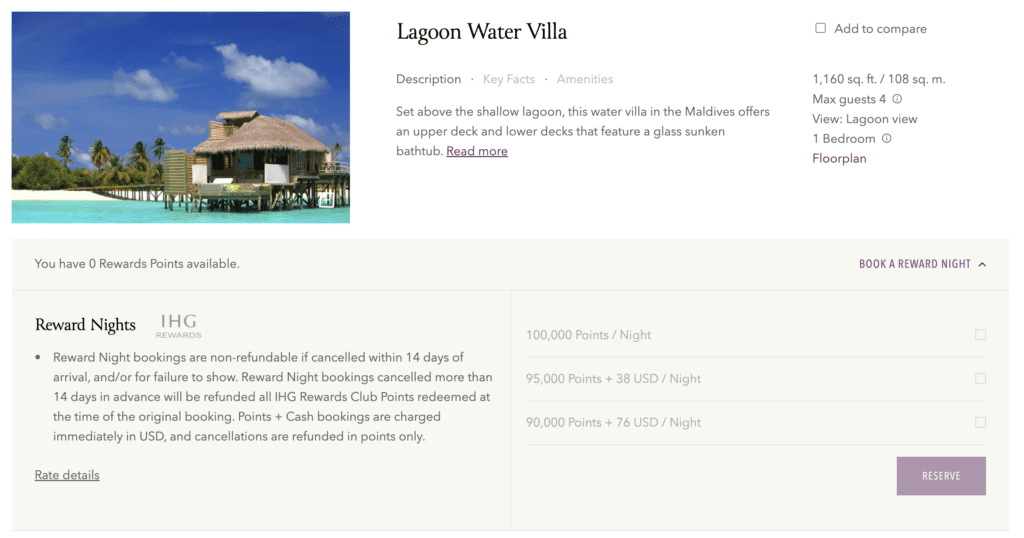

Can you add points to IHG One Rewards Premier Credit Card Free night awards at any IHG property?

Yes, but for Six Senses you’ll have to call in to do it – you can read our full review here of the Six Senses Maldives

Can you convert the free night into points?

It’s worth a try…no guarantees but readers have said they had success with these numbers

- 1-877-318-5890

- 1-877-275-7258

What are some good uses of IHG One Rewards free night awards?

Here is how I will go about using the free nights since they each have different avlue

The IHG One Rewards Premier Credit Card or IHG One Rewards Premier Business Credit Card Free night ideal usage

I will strategize to use this night on properties over 40k a night and add points to it. The reason I’m obsessed with points and miles is the ability to stay in aspirational properties around the world. For instance… I’ve stayed at the Intercontinental Hong Kong a few times. It will soon reopen as a Regent hotel and it looks like it will be spectacular and probably cost an arm and a leg. I’d happily add points to my free night to access this property.

Ideal 5 night stay

Ideally, my allocation of this free night certificate would be in conjunction with a 4 night stay where I’m able to get a 4th night free on award bookings. You’d then add on your free night to the front or end of the trip.

5 night stay

- Use Points

- Use Points

- Use Points

- Free Night

- IHG Premier Free Night certificate + points

Ideal 7 night stay

If you have IHG Ambassador status you could use the BOGO free certificate at Intercontinental properties to get something like this

- Sunday – Use Points

- Monday – Use Points

- Tuesday – Use Points

- Weds – Free

- Thursday – IHG Premier Free Night certificate + Points

- Friday – Paid night

- Saturday – free night

You’d need to book 3 different reservations to make this happen since they can’t all be combined, but after doing so, you’d just phone in and have the different reservations linked. Pretty awesome way to do a week somewhere and only pay cash for a single night.

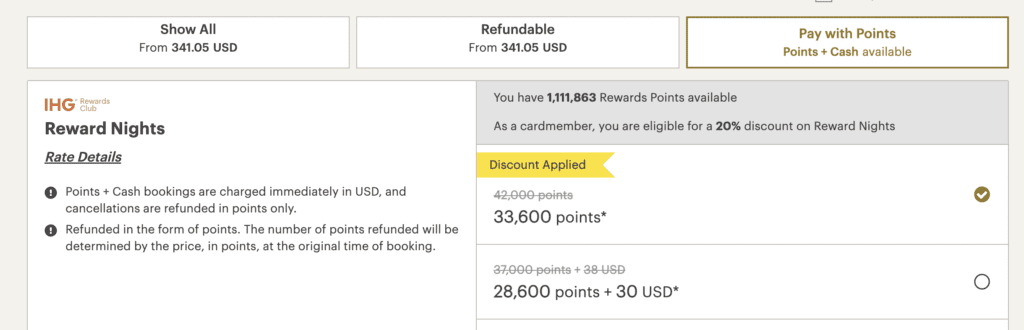

The IHG One Rewards Select Free night ideal usage

If you only have the IHG Rewards Select, then I’d probably try and use it at a property whose cash price is quite high compared to the 40k points. For instance, the Intercontinental Barclay will drop award rate below 40k, especially if you do it during a cardmember discount. Retail rates are over $340 but you could use use free night award since it’s pricing under 40k points.

If you have Ambassador you could employ a similar strategy as described above

IHG Ambassador Program details and benefits:

I mentioned this up above, but stacking the free night alongside Ambassador is a great way to extract more benefits. The program is absolutely stuffed with perks if you stay at Intercontinental Hotels. The program was specifically designed for Intercontinental, and in the past was extended to other properties, but for 2023 it reverted back to Intercontinental exclusively.

For stays at Intercontinental Hotels

- Joining costs either $200 or 40k points

- Guaranteed upgrade upon arrival

- Usually the upgrade shows on the account prior to arrival

- Complimentary Weekend Night – Buy One Get One

- must be booked via their site

- Enjoy a 4 pm guaranteed late check out

- Choice of refreshments on arrival, in-room welcome gift, and mineral water.

- Comped Platinum Status

- $20 bar or restaurant credit per room per stay

- E-Delivered Free Weekend Night

- This is overdue and greatly appreciated.

- Extra benefits in China

- One Breakfast for each night you stay

- 15% discount on bar and restaurant purchases

The $20 Food and Beverage credit could come in handy at the iconic bar at the Intercontinental Hong Kong

Overall

It’s pretty easy to see how you can extract a lot of value from these free night awards that are far in excess of the annual fee on any of the IHG Rewards credit cards that offer them. Stacking them with 4th night free benefits, and IHG Ambassador memberships is the ideal time to use them; however, anything that puts you cash ahead is a homerun in my book.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.