We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: AA’s Revenue Based Earnings Start Today

It was announced last year that American would be rolling out a new award chart and a new earning structure. Both were devastating to what was once one of the best loyalty programs out there. What stung more than the devaluations specifically was the lack of warning that they gave us BOTH TIMES. Holy schmoley. Well the 2nd wave of bad news announced AA would switch to a revenue based earnings structure for their RDM ( redeemable mileage). Well get ready for it folks because AA’s revenue based earnings start today.

What are Revenue based earnings?

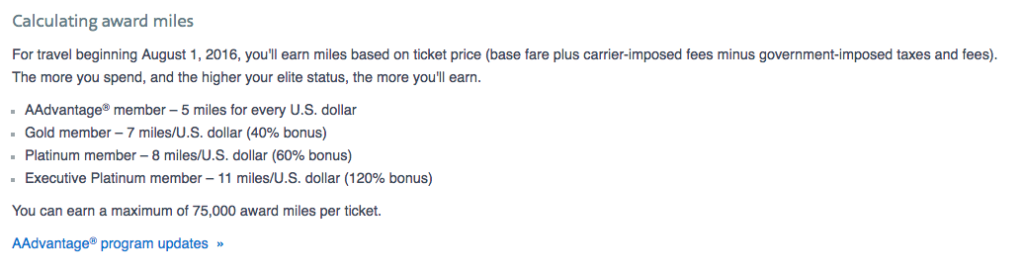

You will earn RDM ( the miles you can use to redeem for future flights ) based on the below chart:

An example: if your flight from LAX to JFK, in coach, cost you $400

- 4950 miles rountrip

- cost you $400 ( exclusive of government imposed taxes and fees)

- you would earn the following under the new chart ( and under the old chart )

- Base: 2000 miles ( 4950 )

- Gold: 3200 (~6200)

- Platinum: 3600 (9900)

- Executive Platinum: 4400 (9900)

As you can see it’s a big hit across the board for the casual traveller, and potentially a big score for the business traveller who is flying on high priced flights, last minute. Although there is cap of 75,000 miles per ticket…if you’re flying on a ticket that would earn you more miles than that, split it up into two one-ways.

At least AA tells you how many RDM and EQM you will earn now prior to purchase

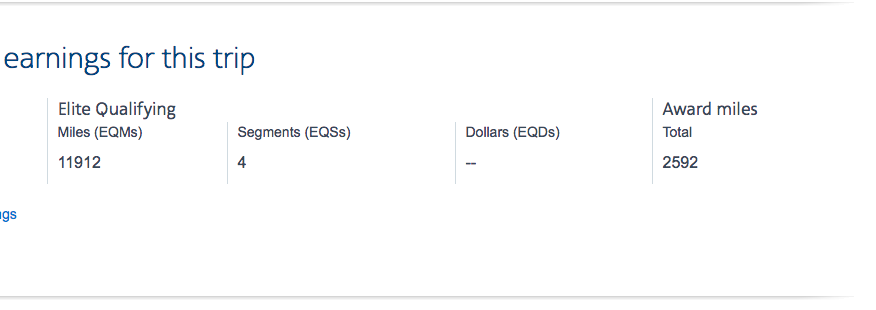

Here are the details from a booking I’m looking at this fall from Dublin to Los Angeles. There are incredible deals out of Dublin and I found this one for $472 roundtrip. The routing is DUB-LHR-LAX-LHR-DUB. It’s 11912 miles roundtrip. As Platinum, if I were to have flown to flight prior to Today… I’d have earned a 100% bonus on the 11912 or just shy of 24000 AA. Here’s how AA tells you what you’d earn:

Now I’ll earn 2592 miles vs almost 24000. Before this devaluation…I would have earned just shy of a roundtrip domestic on this flight alone. Now I’ll earn about a tenth of it.

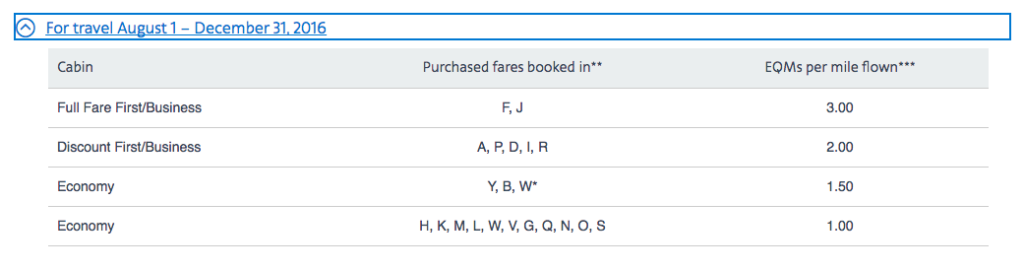

EQM will stay the same

This is good news and also means that mileage running will be more about status, if anything at all. However, with the perks of top tier Executive Platinum being diluted, justifying the mileage run becomes an even murkier argument.

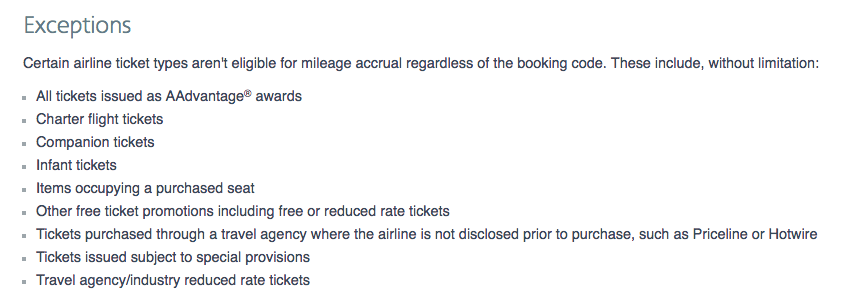

There are some exceptions.

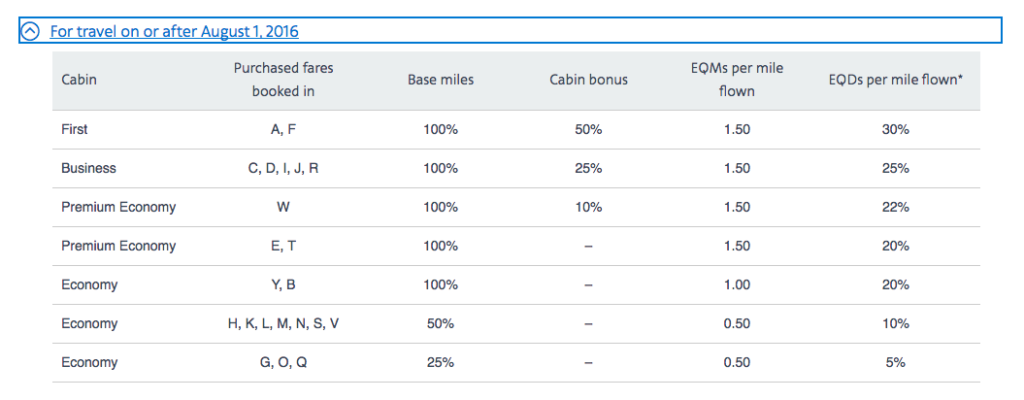

Take at look at these exceptions published by AA.com

How does this change my Mileage accrued with Partners?

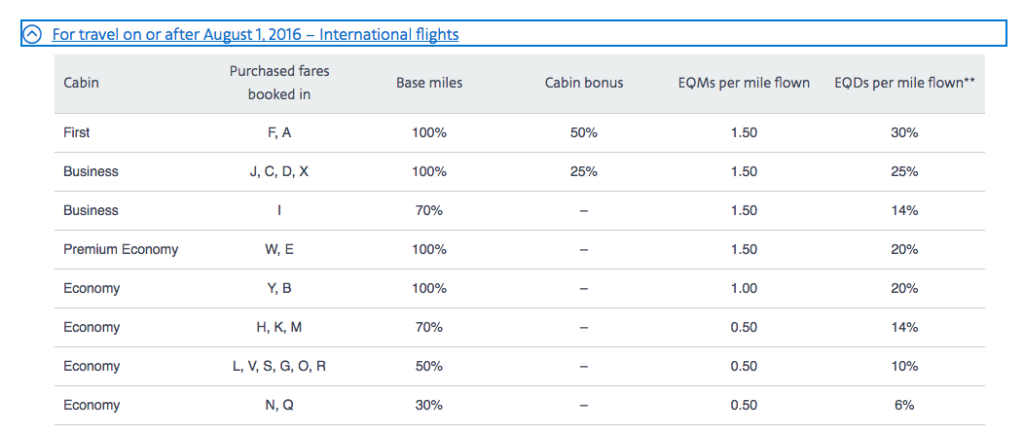

The simple answer is it makes it a much more complicated task. Every airline is going to have different accrual rates. Here is a look at a couple:

British Airways:

Japan Airlines

Things that don’t take effect til 2017:

You probably also noticed the EQDs – Don’t worry til 2017

American also announced that they were going to impose minimum spend requirements for elite stats. It hasn’t been revealed to us yet whether or not credit card spend could negate the EQD requirement. If you’re unfamiliar with this, cards like the Delta Reserve have a certain benchmark spend threshold that eliminates having to spend a certain amount of money with Delta to obtain Delta’s top tier Diamond status. If you earn enough EQM with Delta, you will obtain status.

Here’s what it will look like:

- Gold: $3k

- Platinum: $6k

- Platinum Pro: $9k

- Executive Platinum: $12k

You probably noticed that there is a new level of status…Platinum Pro – Don’t worry til 2017

They also announced that they would be debuting a new level of status called Platinum Pro – splitting the difference between Platinum and Executive Platinum.

- You need to accumulate 75K EQM in a calendar year to qualify

- A shown above, spend $9k.

- Will earn 9 miles per dollar ( 1 more than Platinum)

- Auto requested upgrades between North and Central America

- Same as Platinum with 2 free checked bags and One World Sapphire.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.