We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: What’s the difference between RDM and EQM?

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo focuses on the difference between RDM and EQM.

What do RDM and EQM mean?

-

RDM: Redeemable Miles.

-

EQM: Elite Qualifying Miles.

What’s the difference between a Redeemable Mile and an Elite Qualifying Mile?

- Redeemable miles refer to the miles that you can use to get a free flight.

- Elite Qualifying Miles refer to miles that earn you elite status.

How do you earn RDM and EQM?

An Example with American Airlines:

Let’s say you are a base member of American Airlines. You’ve purchased an amazing coach ticket from Los Angeles to New York and it set you back $200.

American Airlines RDM is based on revenue. This means the amount of RDM that you can earn is calculated by the price of your ticket and your status with the airline.

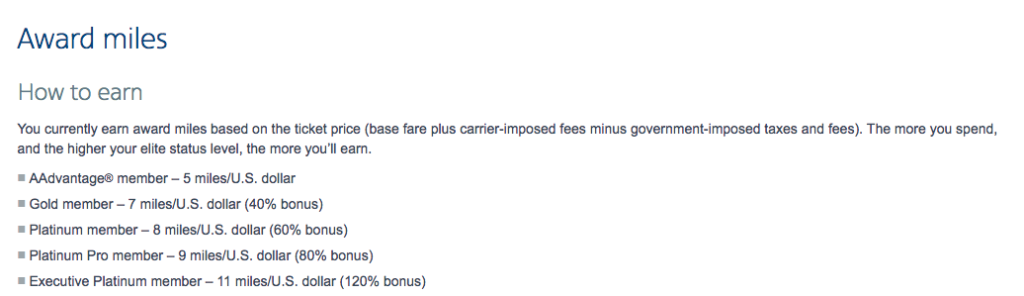

Here’s AA’s RDM earn chart.

Since you are a base member and your ticket cost $200 ( let’s say there were no government imposed taxes and fees ) your RDM would look like this

- ‘AAdvantage member’ earns 5x the ticket price

- 5x $200 = 1000 AA RDM earned

This means that you would have accumulated 1000 Aadvantage Miles to use towards a future flight.

How many EQM would you earn on this flight?

EQM ( Elite Qualifying Miles) are earned by the distance you fly and the cabin of service. Cabin of service is broken down into categories: First, Business, and Economy. Within each of those cabins are fare buckets ( F, J, A, P, K, M, etc ) Those fare buckets are how the Airline determines the EQM that you earn.

Looking at the chart below we can see that even the most discounted economy tickets earn 1 EQM per mile flown. And if you notice Full Fare first and business class tickets ( F, J) earn 3x EQM per mile flown – that makes earning status MUCH EASIER. This is why I was so happy when my British Airways flight got cancelled and I was rebooked into J. I earned 3x EQM on a flight from LAX-LHR. That was over 16k EQM on one flight alone. CHA-CHING!

Here’s AA’s EQM chart

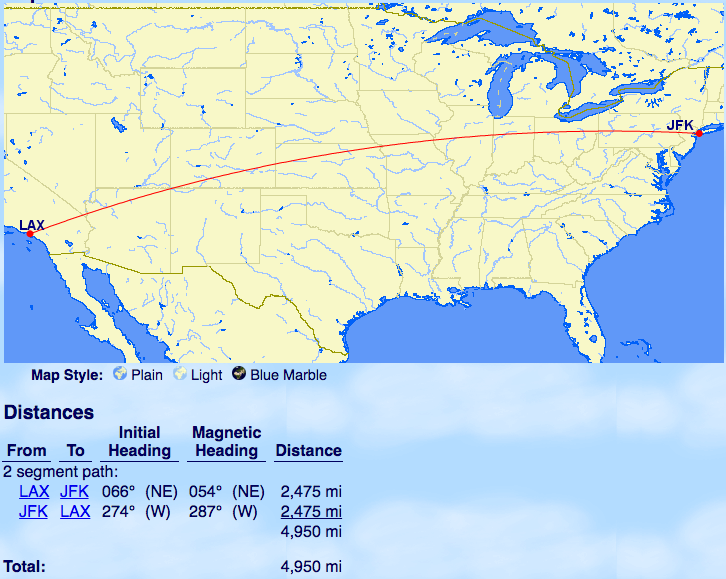

Our Example of a $200 ticket from LAX-JFK roundtrip.

Since this was a cheap coach ticket you’d earn 1 EQM per mile flown. As we can see below, the trip would put you in the air for 4950 miles roundtrip.

Coach tickets that are discounted ( meaning not coded as Y,B, W) all earn a base rate of 1 EQM per mile. So you would earn a total of 4950 EQM for this flight.

BONUS INFO. How many EQMs do I need to get status?

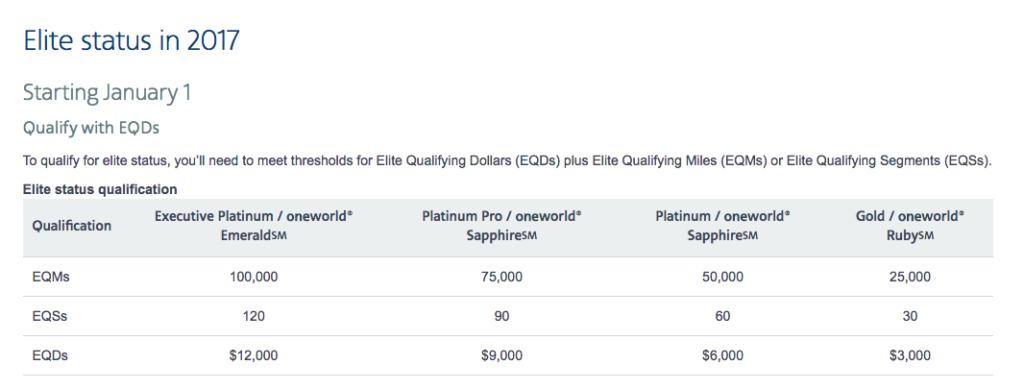

This is a bit of trick question. Starting in 2017, AA will make you hit a spend threshold in addition to EQMs. These are called EQDs or Elite Qualifying Dollars. Check out the chart below.

This means the following

To earn

- Gold

- 25,000 EQM but also spend $3000 on tickets

- Platinum

- 50,000 EQM but also spend $6000 on tickets

- Platinum Pro ( A new tier)

- 75,000 EQM but also spend $9000 on tickets

- Executive Platinum

- 100,000 EQM but also spend $12,000 on tickets

Some of you may have noticed the EQS line item as well. These stand for Elite Qualifying Segments. A segment is essentially a leg on your itinerary. If you fly from Los Angeles to Phoenix and then on to Chicago, you have flown 2 segments. EQS represent an Either/OR status requirement with EQM. You can earn status with the required EQM or the required EQS, but you still need to satisfy the EQD requirement for that status.

Example.

In order to gain Executive Platinum status, members can either earn 100,000 EQM OR fly 120 EQSs AND spend $12k. This gives members who may fly a lot of segments, but not accumulate as many EQMs, a chance to earn status a different way. However, this doesn’t preclude the EQD requirement.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.