We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The Chase Southwest credit card offers

Here’s a look at the current offers from Chase and Southwest. These offers vary throughout the year and can be combined and used to strategically to earn a Southwest Companion Pass = you can nominate an companion who will fly with you for just the taxes and fees. I’d suggest checking out the section of this article that illustrates how you could extract nearly 2 years of Companion Pass with an alternate strategy.

The biggest differences between the cards aside from the annual fees is derived from the annual point bonus, whether you want a Southwest travel credit ( Priority ), and either EarlyBird check-in or upgraded boarding.

Personal Cards

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards® Premier Credit Card

-

Southwest Rapid Rewards® Priority Credit Card

Business Cards

- Southwest® Rapid Rewards® Performance Business Credit Card

Table of Contents

Southwest Rapid Rewards® Plus Credit Card

There are three levels to Southwest cards and the Southwest Rapid Rewards® Plus credit card has the lowest annual fee but still provides that 10k Companion Pass boost, a 3000 point anniversary bonus, and a $69 annual fee. If you’re looking to dip your toe in the Southwest credit card pool, this could be added to your wallet with lowest annual fee.

- 3x on Southwest purchases

- 2x on transit including commuting and rideshare apps

- 2x on internet, cable, phone, and select streaming

- 3000 point anniversary bonus:

- After you account anniversary you’ll receive 3000 Southwest points

- 2 EarlyBird Check-In(R) each year

- 10k Companion Pass Point boost each year

- $69 Annual Fee

Southwest Rapid Rewards® Premier Credit Card

This is the midrange Southwest Personal card that offers 2 EarlyBird Check-In® each year + 6000 Southwest points upon account anniversary, a 10k Companion Pass point boost each year, and comes with an $99 annual fee. Personally, I think the Southwest Rapid Rewards® Priority card is a better bang for buck if you’re going to spend more on an annual fee, but this card does add some extra benefits compared to the entry level Southwest Rapid Rewards® Plus credit card.

- 3x on Southwest purchases

- 2x on transit including commuting and rideshare apps

- 2x on internet, cable, phone, and select streaming

- 6000 point anniversary bonus:

- After you account anniversary you’ll receive 6000 Southwest points

- 2 EarlyBird Check-In(R) each year

- 10k Companion Pass Point boost each year

- $99 Annual Fee

Southwest Rapid Rewards® Priority Credit Card

If you fly Southwest quite a bit, I would hone in on this bad boy. This is the premium Southwest credit card and offers extra perks like a $75 travel credit to use on Southwest and 4 upgraded boardings a year so you can slide into the A1-A15 boarding group and it gives you 7500 Rapid Rewards on your account anniversary. It also comes with the 10k Companion Pass Point boost each year.

- 3x on Southwest purchases

- 2x on transit including commuting and rideshare apps

- 2x on internet, cable, phone, and select streaming

- 7,500-point anniversary bonus:

- After you account anniversary you’ll receive 7500 Southwest points

- $75 annual Southwest travel credit:

- During your cardmember year, you’ll get a $75 travel credit to use on Southwest – these don’t include upgrades or inflight purchases, but the great thing is that it does count towards purchasing tickets.

- Four upgraded boardings per year ( when available ):

- Want to get in that sweet A1-A15 spot? You can use these at the ticket counter or gate to jump to the front.

- 10k Companion Pass Point boost each year

- Annual Fee $149

Southwest® Rapid Rewards® Performance Business Credit Card

If you sign up for this card alongside a Southwest personal card the points combine and help boost you to Companion Pass. Remember that Companion Pass is good during the year you achieve it as well as the year after. So if you can earn it during Jan/Feb you can get it for nearly 2 years.

- 80,000 Rapid Rewards® points:

- 80,000 points after $5,000 spend in the first three months from account opening

- 3X points on Rapid Rewards® hotel + car partners

- 2X points

- rideshare

- social media and search engine advertising, internet, cable, and phone services

- 9,000 bonus points after your Cardmember anniversary

- 4 Upgraded Boardings per year when available.

- Annual Fee $199

- Member FDIC

You may be a small business and not even know it

If you have a side hustle, earn money from the gig economy, or even now what people are referring to as the creator economy…the odds are strongly in your favor that you qualify for a small business credit card. So many people earn money that isn’t W2 income, but they haven’t established formal LLCs or S-corps that have EIN ( Employer Identification Number), and they aren’t taking advantage of what that income opens the door to….but they can still apply and get approved for small business credit cards.

If you’re earning income on a 1099, you’re good to go. Some examples of those are…

- Online Coaches, tutors, etc

- Uber and Lyft drivers (assuming they still get 1099s whenever you’re reading this).

- DoorDash, GrubHub and Postmates

- Social Media income ( TikTok, Instagram, YouTube )

- Cater Waiters

- Personal Trainers

- Dog Walkers

- Freelance graphic designers and web designers

- Singers, artists, dancers, models, etc

- Virtual Assistants

- Ebay, Amazon and Facebook resellers

What is the Southwest Companion Pass?

It’s really pretty simple, and as I mentioned one of the topics I’m asked about most. Every single time you fly, whether you used cash or points to book your Southwest ticket, your companion flies with you free. In 2023, this requires earning 135k Qualifying Rapid Rewards points in a year in order to qualify. Note that the Southwest credit cards will come with a 10k Companion Pass credit each year.

- You still have to pay the companion taxes and fees

- You have to select the companion that will fly free with you while your companion pass is valid

- You can change who this is 3x in the year

- This is based on calendar year so you could change it 3x this year, and then again 3x in 2022

- You can make changes by calling this number 1-800-435-9792

- You can change who this is 3x in the year

How to get almost 1.5 to 2 years of the Southwest Companion Pass

Sometimes we Southwest offer large bonuses on their credit cards at the end of the year. It sets you up perfectly to land a Companion Pass for nearly 2 years and these offers are quite advantageous to make this work. How?

The Southwest Companion starts when you hit 135k miles and expires the year after the year you hit that threshold. So if you got a personal and business version of this card when they are offering more than 135k miles combined, you’d blow past 135k needed for the year you hit the spend threshold to earn the bonus, and you’d have that pass all the way through next year.

This current offer is just straight up giving you Companion Pass through 2/28/24

What miles counts towards the Companion Pass?

*If you transfer points from Chase to Southwest – they do not count towards Companion Pass

The following do count:

- 6x points whenever you fly

- All the credit cards shown up above earn miles that count towards Companion Pass

- The anniversary points count as well

- As do referral points

- Make sure your get drop you referrals on our Chase Refer-a-friend page

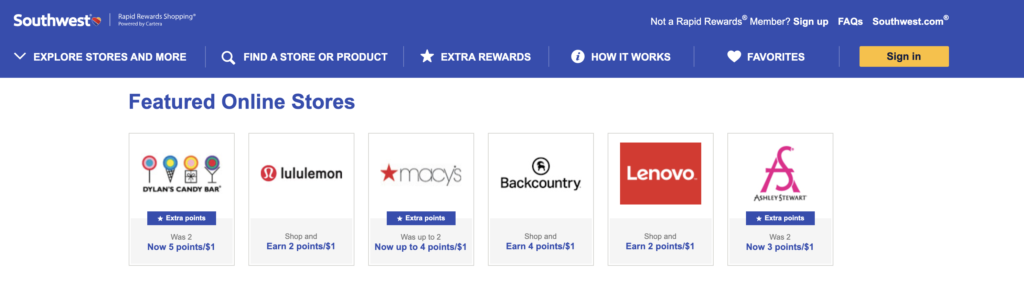

- The Southwest shopping portal + Dining Portal purchases count toward Companion Pass

Did you know there is a Southwest Shopping Portal where you can buy the stuff you may ordinarily buy online but earn Southwest points? Usually I’d advocate for using other shopping portals with higher rates of return, but when you’re aiming at the Companion Pass it will help you get there quicker and start saving on flights. You can go here

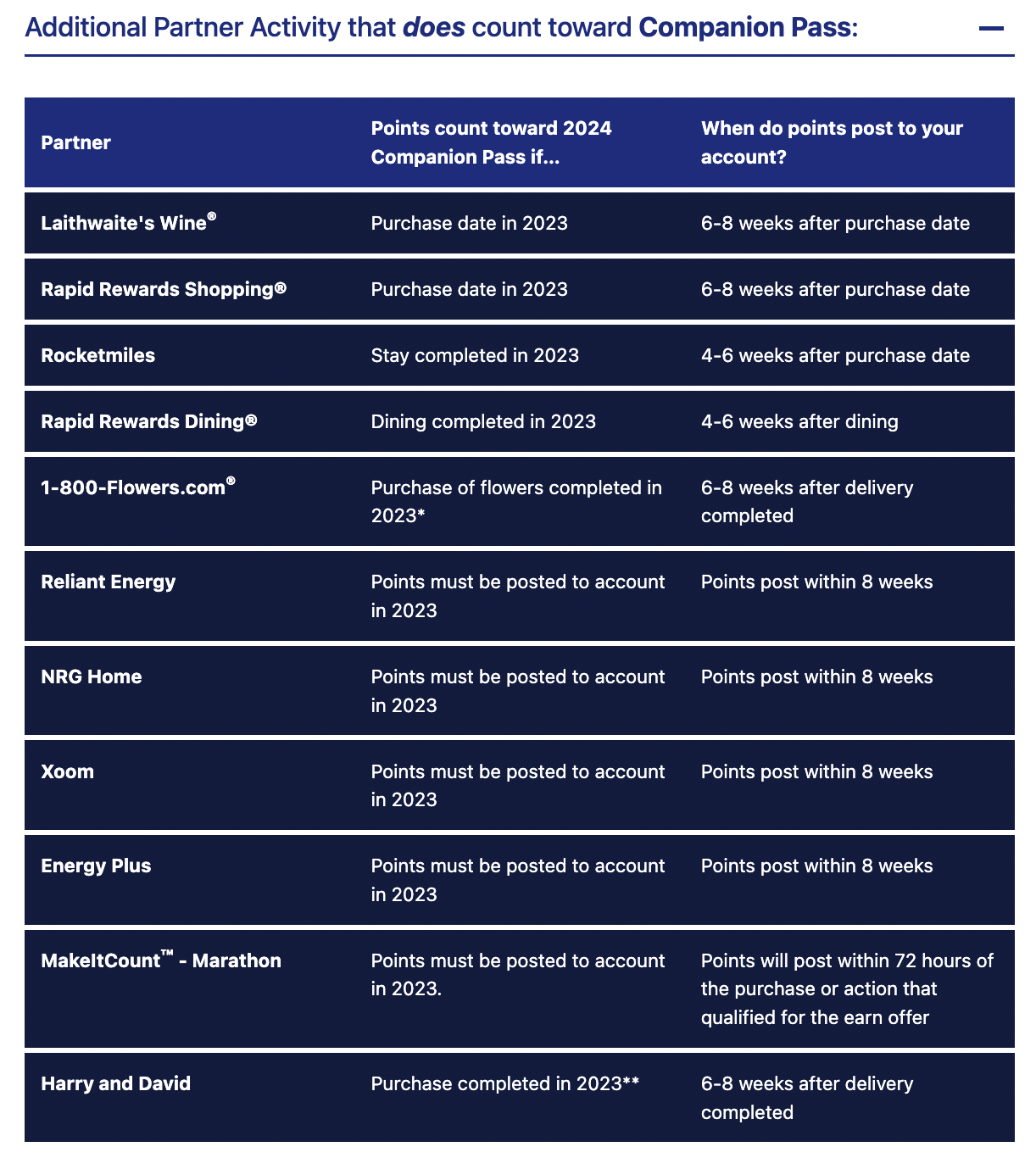

You can also reference this nifty chart to see where else you can earn Companion Pass qualifying miles.

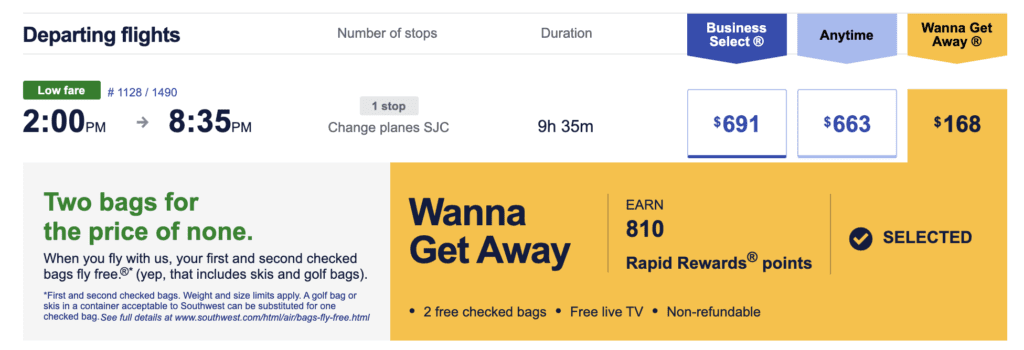

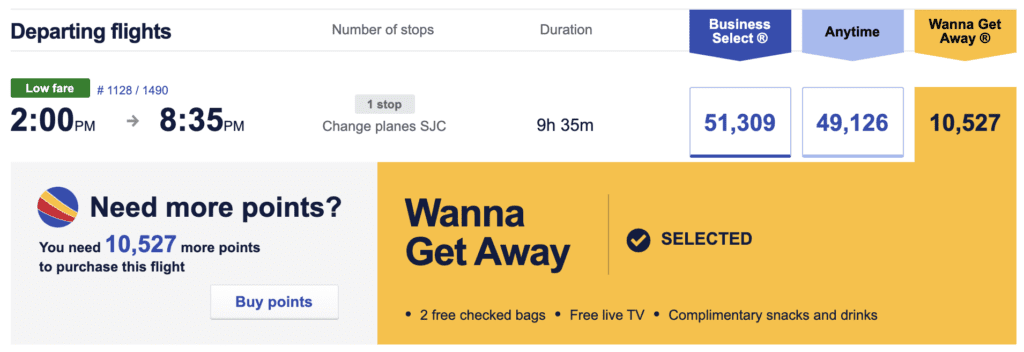

How much are Southwest Points worth?

On average, I would say that Southwest Points rattle around 1.3 to 1.6c. You can see in this example that the wanna get away price is $168 or 10,527 points. That is roughly 1.6c. However, you can see the Business Select fare of $691 would cost you 51,309 or roughly 1.35c a point. That range puts 30k Southwest Points worth $390 to $480. At least twice the annual fee, not including the Companion Pass.

Don’t forget that the Companion Pass works on flights purchased with points. So the fare listed below that costs 10,527 points would actually fly two people.

Chase Ultimate Rewards

Don’t forget that you can shore up your Southwest balance by transferring Chase Ultimate Rewards 1:1 – this could be quite good value when flying with a Companion Pass. However, remember that these transfers don’t count toward earning your Companion Pass, they are only redeemable for flights.

Go here to see our favorite Chase Ultimate Reward earning credits cards.

Important Eligibility Info – Southwest Family restrictions

This is a strategy that Chase employs with their Sapphire cards as well, but with a little twist. While you can apply for and get approved for another Southwest personal credit card there are some rule you should be aware of:

- These cards all fall under Chase’s 5/24 rule – meaning if you have added more than 5 new credit cards in the last 24 months you won’t be approved. These are specific to your personal credit report, so most business credit cards don’t count.

- If you have received a Southwest bonus on ANY personal card in the last 24 months, you wont’ be eligible.

- If you’re currently holding a personal Chase Southwest card, you would be ineligible as well

If you’re under 5/24 and you haven’t received a personal SWA credit card bonus in the last 24 months, you should be good go to as long as you’re approved.

Overall

This is an increased Companion Pass offer for Southwest cards across the board – sometimes we have seen a 100k offer in the past as well.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.