This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to transfer Chase Ultimate Rewards to travel partners

Chase Ultimate Rewards are one of the very best point programs in existence. A large part of the Chase ecosystem is created around this program and one of its best features is its ability to access valuable transfer travel partners. What do I mean by this?

Chase offers the ability to convert your Ultimate Rewards into one of their travel partner programs via transfer. When you do this, you’re taking your Chase Ultimate Rewards and populating points or miles into that travel program to use within its system. The reason you’d do so is because that system has advantageous redemption options that make it more valuable than using within the Chase Ultimate Reward system.

Utilizing this technique is how I’ve been able to extract so much value from my points over the years and flown like this over and over again.

Chase Cards that I would recommend:

Note that in order to transfer into travel partners you need to hold a Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred. The other cards mentioned below are amazing cards in tandem, but earn cashback. These points can be combined into a one of the 3 aforementioned premium Chase cards in order to access transfer partners, but can’t transfer if you hold them on their own. This is why I strongly advocate holding at least one Chase premium card and a Freedom Unlimited/Ink Business Unlimited since this will increase your earn rates and give you the possibility of transferring into partners.

- Chase Sapphire Preferred® Card is a great starter premium card and one that I actually carry

- I use my CSP as a cornerstone card.

- Chase Freedom Flex® and Chase Freedom Unlimited®have amazing offers currently running and I would highly recommend both cards

- They were improved in September of 2020 and at least one should be in your wallet

- They offer higher category bonuses than the CSP so if you were to hold both, you could earn more points, but have the ability to combine points and access transfer partners.

- I currently keep a Chase Freedom.

- Chase Sapphire Reserve® has an increased offer currently running and comes with added perks and benefits

- This is the most premium card that Chase offers. I personally don’t carry it, but it comes packed with perks and benefits.

- Chase Ink Business Preferred®is one of the best business cards you can carry

- I actually have two of them in my wallet ( different businesses )

- 3x on a litany of categories and earns transferrable points

- Chase Ink Business Cash®

- rotating quarterly 5x categories make this a great card to keep in your wallet to maximize spend

- I hold this card as well

- Chase Ink Business Unlimited®

- Get 1.5x on every single purchase your business makes.

- I hold this card as well

Chase Ultimate Reward Travel Transfer Partners

Chase has a total of 13 travel transfer partners and will be adding Aeroplan later this year. That will be an incredible addition to the fleet of travel transfer partners and make the program even more valuable.

Why would you want to transfer points into a partner program?

The most simple explanation is you can get a lot more value out of your points this way. It’s not guaranteed, but it’s how I have made use of my points more often than not.

Each program that you can transfer into will price their award rates differently. For instance, you can fly Emirates First Class between Europe and Dubai for 102k points + $700. That’s a lot of money to pay in surcharges, but they release quite a few tickets. They will also sell them for $5000 to $10000 a ticket. If you were to transfer them to Emirates, you could book for 102k Chase Ultimate Rewards and pay the fees vs redeeming in the Chase Ultimate Rewards Travel portal and getting 1.25c per point or 400k to 800k points for the very same flight.

The same goes for hotels, I’ve gotten extremely good value moving points to Hyatt for great hotels like the new Hyatt Regency Blackfriars for 20k points…it was going for almost $600 a night!

How do you transfer Chase Ultimate Rewards to travel transfer partners?

Step 1: Log in to your Ultimate Rewards account and click Earn/Use

Step 2: Select the partner you wish to transfer into

You’ll see a list of Airlines and Hotels:

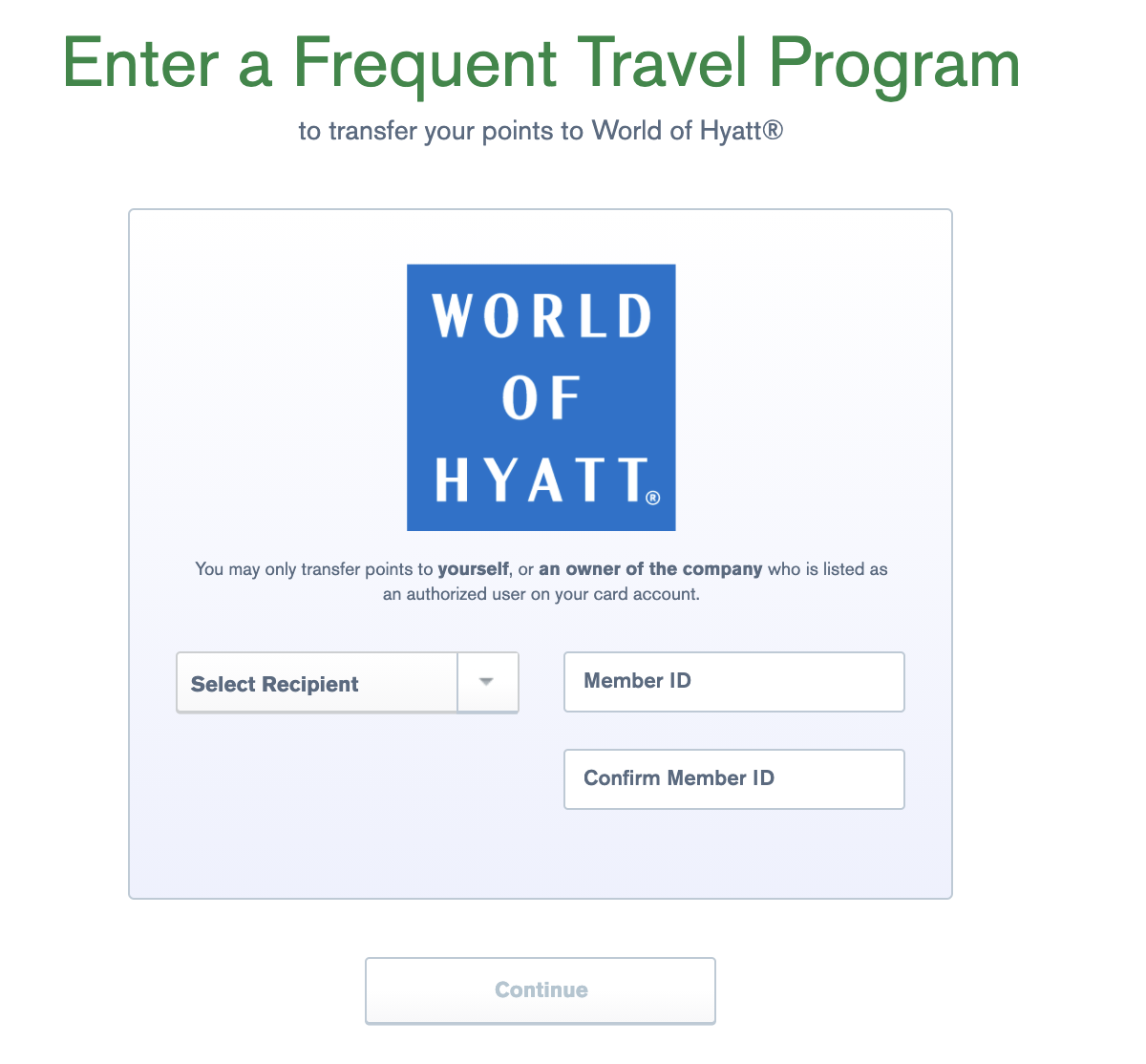

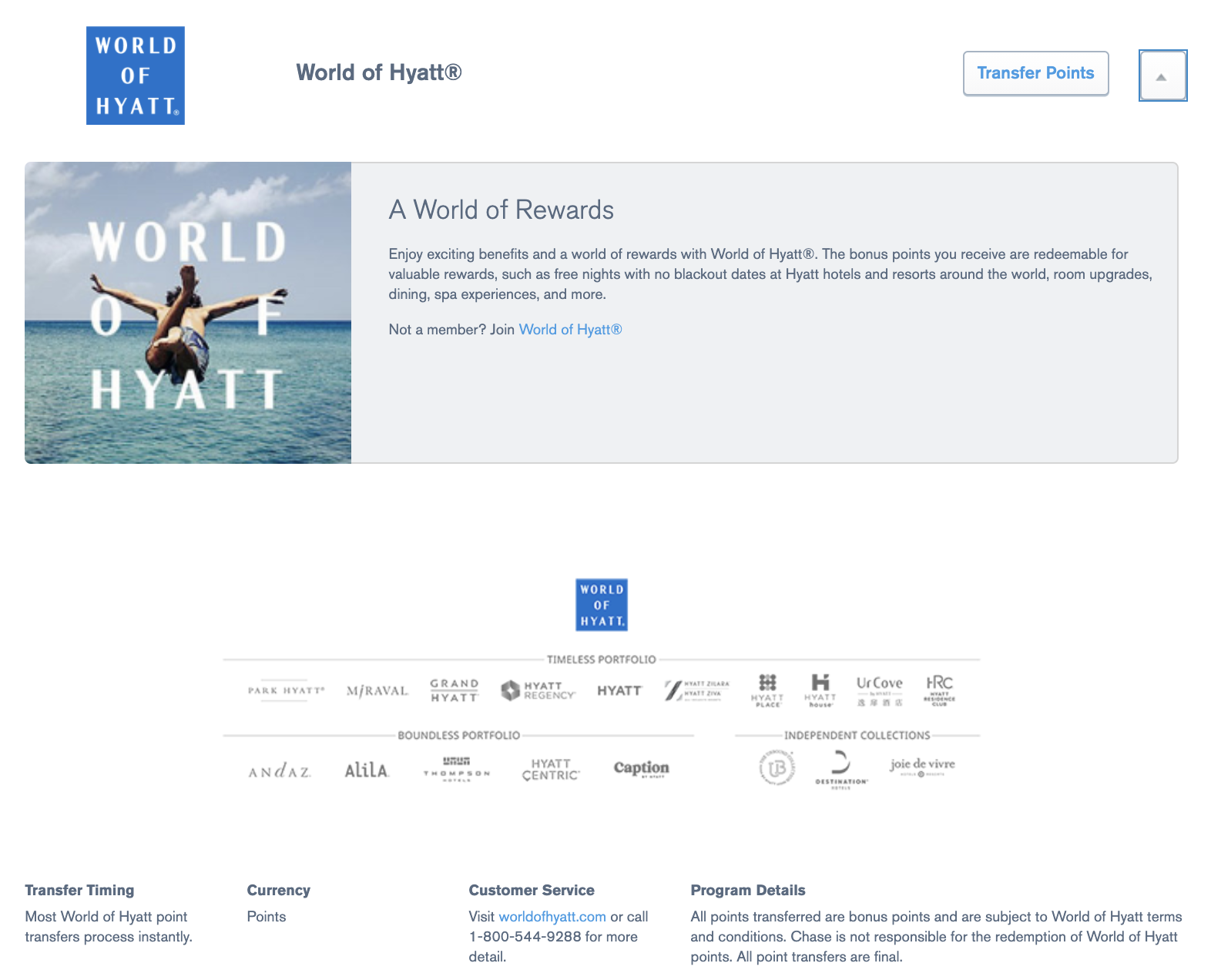

02Step 4: Let’s use Hyatt as an example

Select it form the list and click transfer points

Step 5: Enter your account information

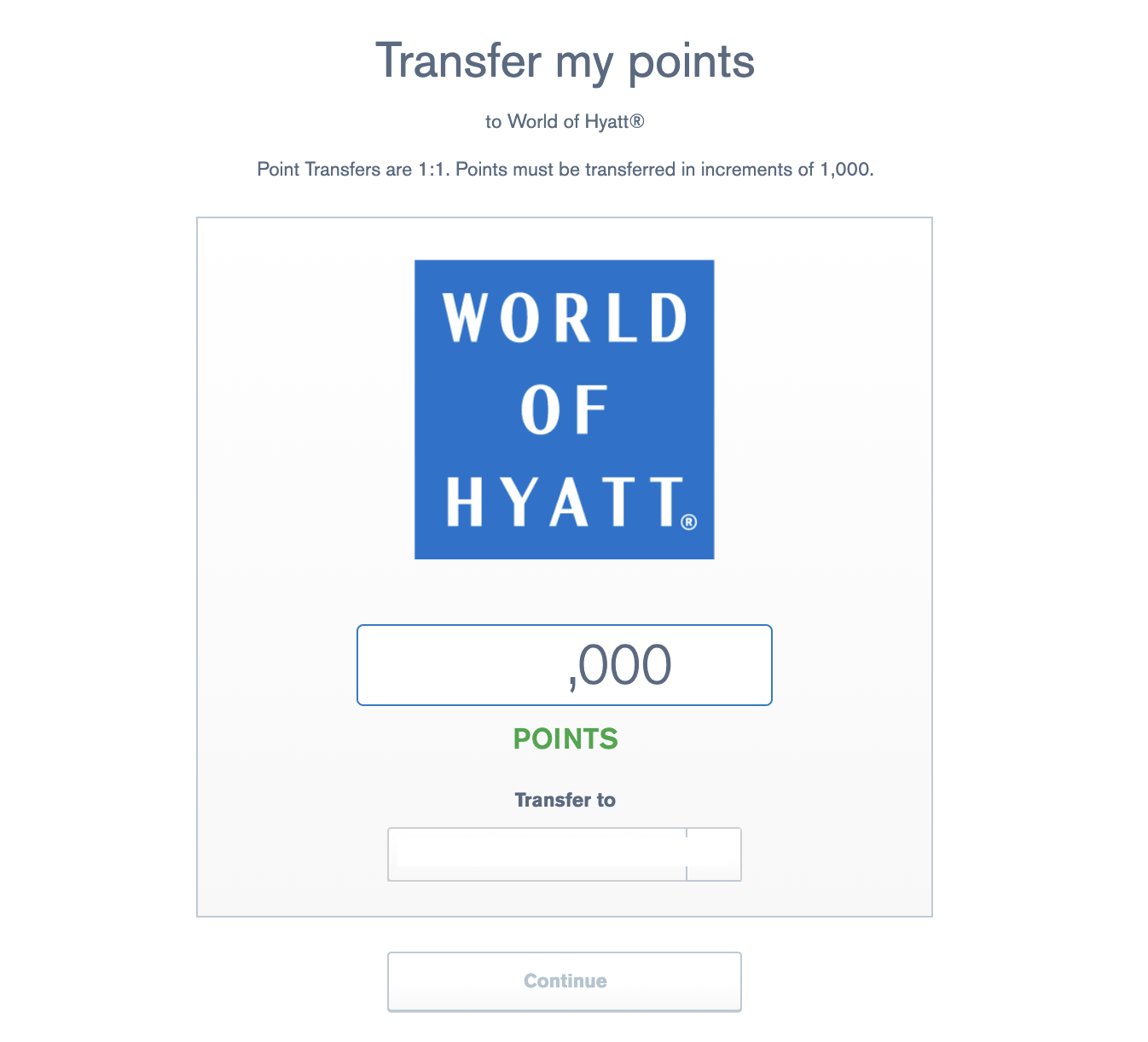

Step 6: Transfer your points

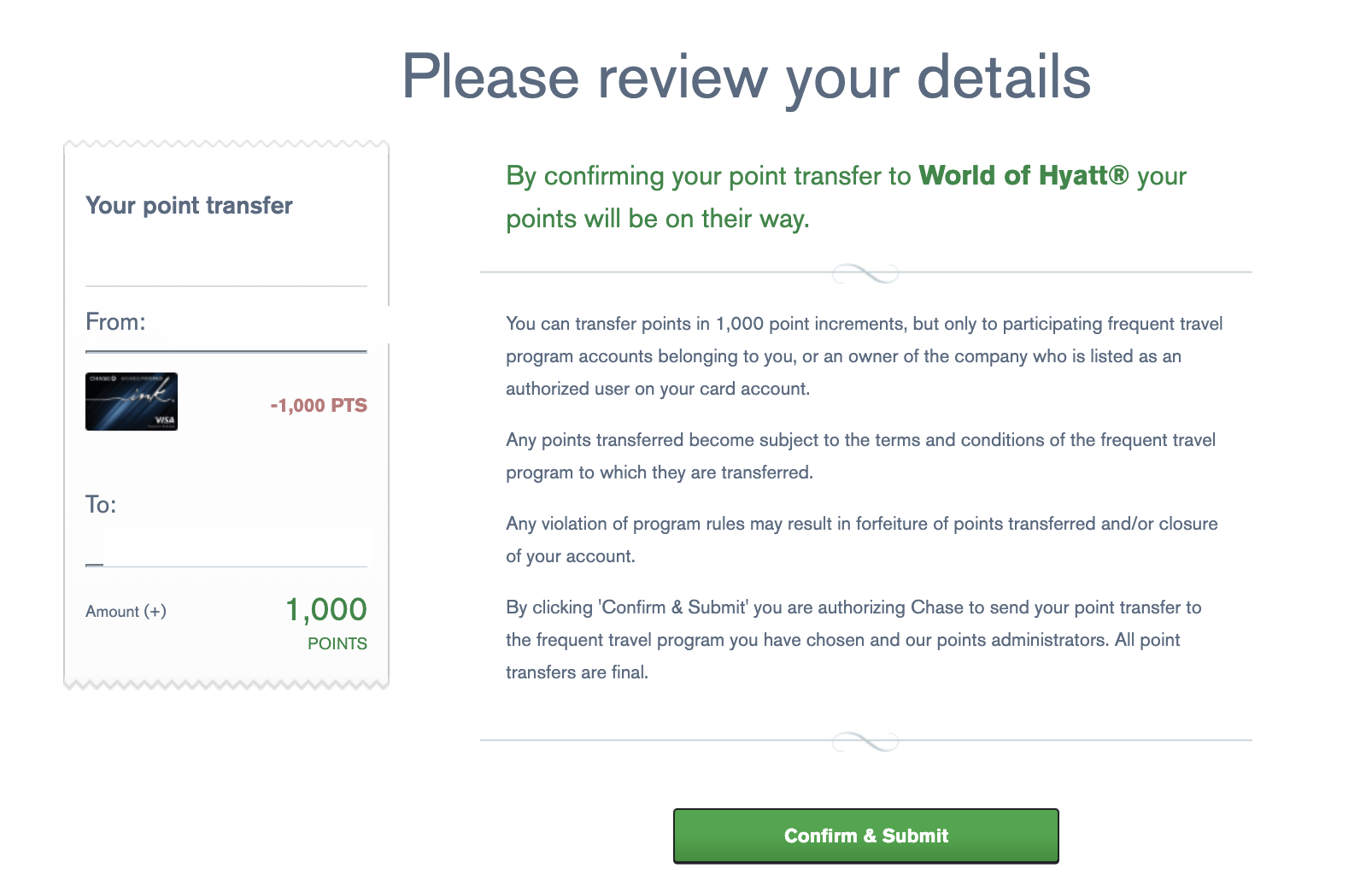

Step 7: Confirm your transfer

You’re all done! Let’s Recap

Using points that you earn off of your suite of Chase cards can unlock a plethora of aspirational redemption opportunities that can make your bucket list travel dreams come true. This is how I make use of MOST of my Chase Ultimate Rewards and hopefully this guide will make transferring points much easier.

What are some dope ways to use Chase Ultimate Rewards?

Check out Virgin’s new Upper Class aboard the A350.

We transferred Ultimate Rewards over and flew it for 47.5k points and $600

Air France/KLM Flying Blue program has a ton of great redemptions especially if you utilize their promo rewards

I booked a roundtrip Business Class ticket on Iberia using just 68k points.

You can read our review here

Or transfer to Hyatt and stay in entry level to truly aspirational world class properties.

We used Hyatt points to stay in a wide array of properties, but none have been quite like the Alila Villas Uluwatu which we consider to be the best Hyatt in the world.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.