This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG has gone dynamic. That means that there is no longer a fixed award price set for any hotel, and the price you pay in points will vary depending on the night. This has been widely reported – you can read about some great options on Frequent Miler, OMAAT, VFTW, so I won’t list them here, but there are loads of deals. Some properties will have Tuesday at 20k points and Wednesday at 40k+ so it could really pay to price your trip over many dates. That got me thinking…how would the 4th night free feature work with the IHG Premier card from Chase. It’s a great feature, and what I discovered is even better – it discounts the literal 4th night instead of an average. Let’s check it.

In fact, if you have the same combination of IHG cards and elite status as my family, you could actually stay 5+ nights for the same price as the expensively priced award night. Crazy.

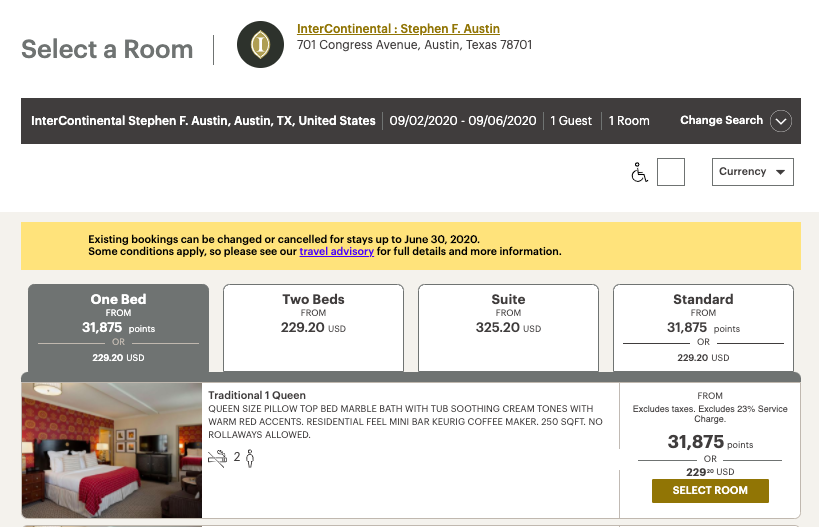

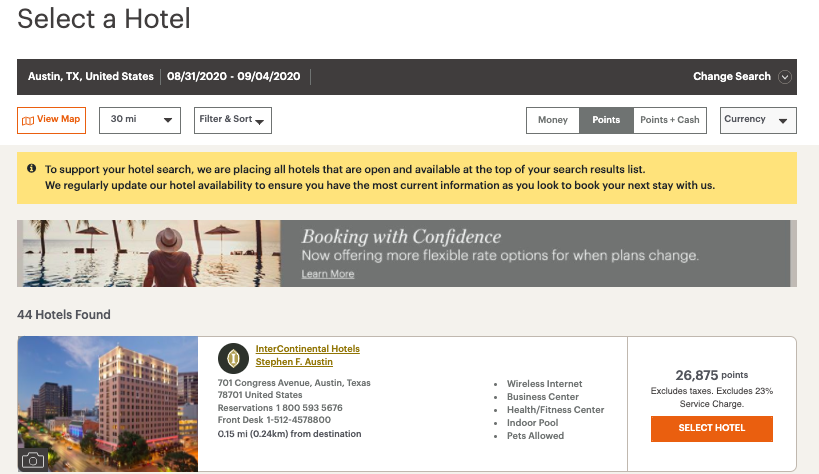

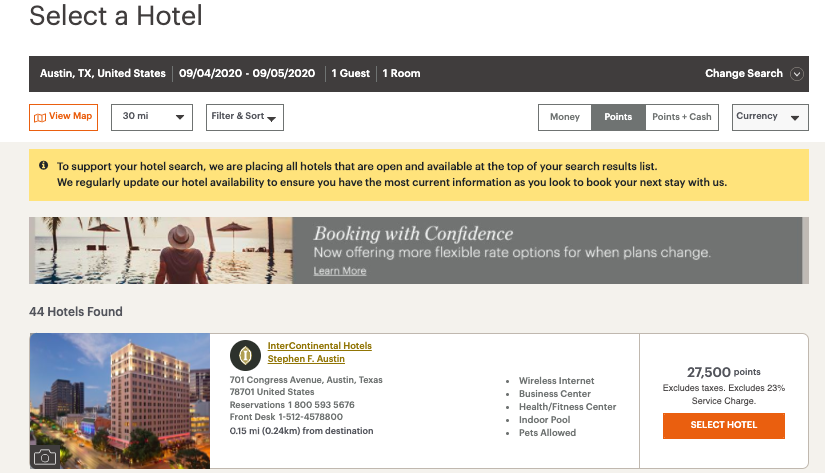

I picked the Intercontinental in Austin, Texas as an example

I stayed a this property a few years ago and it’s a historic hotel in a great location. I priced out two different stays in September. You can read the full review here.

Here’s a look at the first set of dates 9/2/2020 until 9/6/2020: 31,857 per night

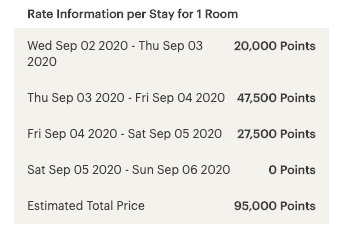

When you dig into the dates you see that the first night is pricing at 20k followed by two more expensive nights. I thought…I wonder what happens if we back it up to check out on the 4th, making the 47,500 night the most expensive.

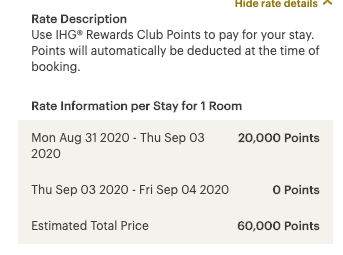

The total price dropped…can you can see why. It credited the most expensive night and we could stay 4 nights for 60k points. 15k per night

Once you go all the way through to check out…you see the 4th night credit. So, in total, you would have 3 nights at 20k and then the 4th night at 47,500 which gets fully refunded.

You could also pair this with the Free night the card offers – 12k per night

The IHG Premier also gives you an annual night certificate to use that is effectively worth 40k points or less. Since prices now vary, you just need to find a night that is under 40k points. In the scenario above, that would be the Friday night since it priced at 27,500

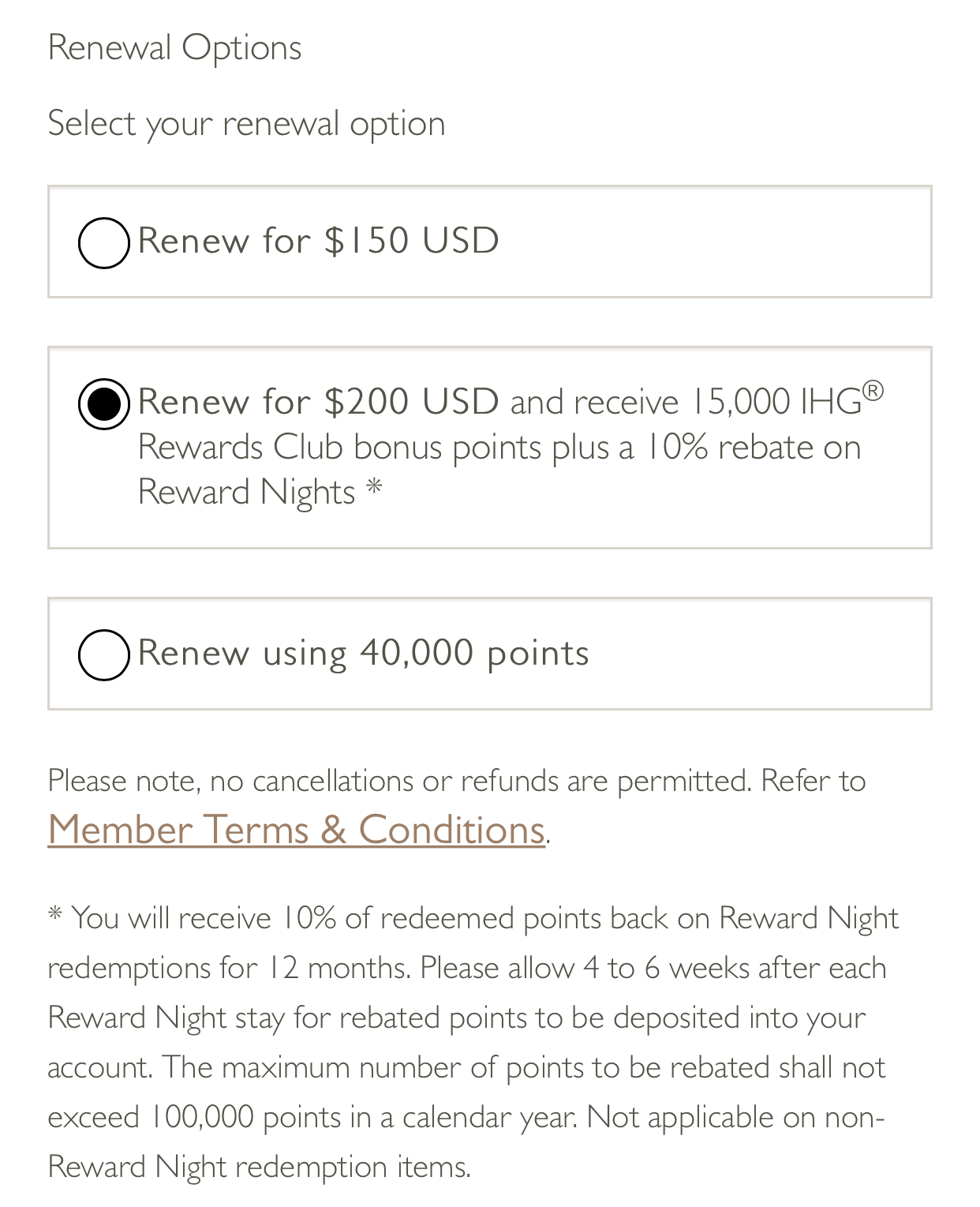

Are you Ambassador? You could get it even cheaper still. 10,800 per night

One of the major perks of being an Intercontinental Ambassador, their pay to play elite status, is upon renewal you can score a 10% off Intercontinental bookings. That would refund an additional 6k points

You could stack this even further by scheduling your dates to take advantage of the Ambassador Free Weekend Night certificate as well. This would mean something like this – 7700 per night + $280

- Sunday – sub 40k IHG Premier redemption

- Mon – 20k

- Tues – 20k

- Wed – 20k

- Thurs – Free 4th Night

- Fri – Paid night ( $280 )

- Saturday – Ambassador Free Night

In total… pay for one night, 3 nights on points + 2 free nights.

Still have the IHG Select? Get Another 10% off points or 6850 pts per night + $280 for a week.

If you have the now retried IHG Select in addition to all of these wonderful stacking options, you’d reduce your point cost another 10%, or 6k points.

This would mean in total you’d shell out just 48k points

Overall

This is a pretty incredible option and warrants the time and effort to search. I’ve obviously expanded this into a big time stack, but you guys get the idea. Also…$280 is the most expensive night that week, so if you played around with your dates even more, you could probably get that weekend night even lower choosing a non-holiday weekend.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.