We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: Citi’s 24 month language

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo focuses on Citi’s 24 month language

Why are we talking about Citi’s 24 month language?

Over the weekend I applied for a CitiBusiness Aadvantage Platinum card without the 24 month language. What I found was that quite a few people didn’t realize why it was such a great deal. It was offering 50k after $3k spend, but that’s not the allure. The allure was the removal of a very restrictive policy Citi has employed around the “24 month language.” So let’s take a moment to look at that language and why this deal is attractive…

What is Citi’s 24 month language?

It limits your ability to earn a bonus if you have opened or closed any card in the last 24 months that would earn the same type of bonus points earned off your new card application.

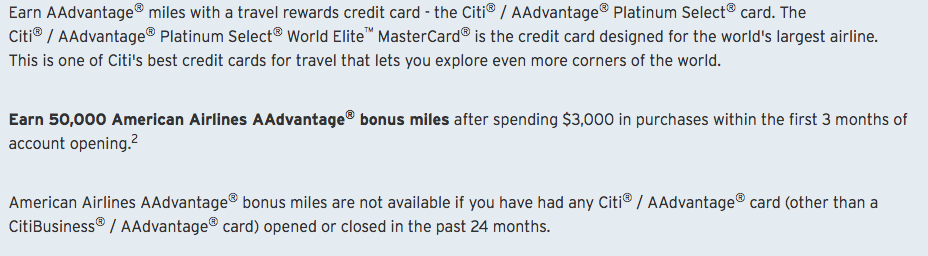

Here is a screen cap from the Aadvantage Platinum Select card. As you can see in the last line it says ” bonus miles are not available if you have had an —- opened or closed in the past 24 months.

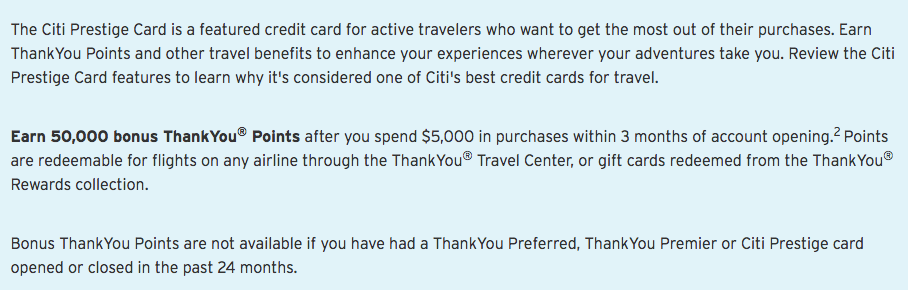

The language is also in the Citi Thank You based cards.

It’s not if you’ve earned a bonus of this specific card/product – Citi has created a once in a ‘card family’ bonus every 24 months ( from opening or closing)

If you’ve recently been approved for a Citi Prestige…you can still get a Citi Premier, but you won’t get the signup bonus. If you got an Aadvantage Platinum bonus, you won’t get an Executive bonus, and so on and so forth.

This differs from Chase’s 24 month policy because it includes closing cards as well

If you picked up a Thank You Points earning card 3 years ago and just closed it today. You’d have to wait 2 years from today to receive a sign up bonus on any Thank You Point earning card. Chase would allow you to sign up tomorrow and receive a bonus because more than 2 years have lapsed since you received your bonus.

So when a card application doesn’t have the 24 month language it’s a big deal

When the CitiBusiness Aadvantage Platinum pops up without this language it means that you can get the bonus points EVEN if you’ve earned bonus points 6 months ago. This is great for those of us who sign up for cards more often than not.

The CitiBusiness AA card doesn’t get reported on your personal credit report either so it doesn’t affect your 5/24, AND as you can see in the above graphic, you can still receive a bonus on the Citi Aadvantage Platinum if you’ve received a CitiBusiness bonus because business cards are separate. That’s pretty awesome.

Now, what I’d love is if a Citi AA Executive card popped up without the language and offered a 100k reasons to sign up. You know, circa 2014 😉

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.