We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Blue Cash Everyday + Blue Cash Preferred offering 10% back on restaurants up to $200

This limited time special offer gives new cardmembers 10% cash back on U.S. restaurant purchases made in the first six months, up to $200 cash back. That’s a great deal. It’s in addition to the sign up bonus of $100 after $1000 spend on the Blue Cash Everyday, and $150 after $1000 spend on the Blue Cash Preferred. These are both limited time offers and you must apply by 5/3/2017. Regardless of which card you go with both the Blue Cash Everday + Blue Cash Preferred are offering 10% back on restaurants up to $200 within the first 6 months.

*REMEMBER…Amex sign up bonuses are once in a lifetime. These are credit cards not charge cards and they will affect your 5/24. Must be U.S. restaurants.

Blue Cash Everyday

Perks of the card:

- no annual fee

- 10% cash back up to $200 in the first 6 months

- 3% cash back at grocery stores up to $6k in purchases

- 2% cash back at gas stations and department stores

Everyday Preferred:

Perks of the card:

- $95 annual fee

- 10% cash back up to $200 in the first 6 months

- 6% cash back at grocery stores up to $6k in purchases

- 3% cash back at gas stations and department stores

Will I be getting these cards?

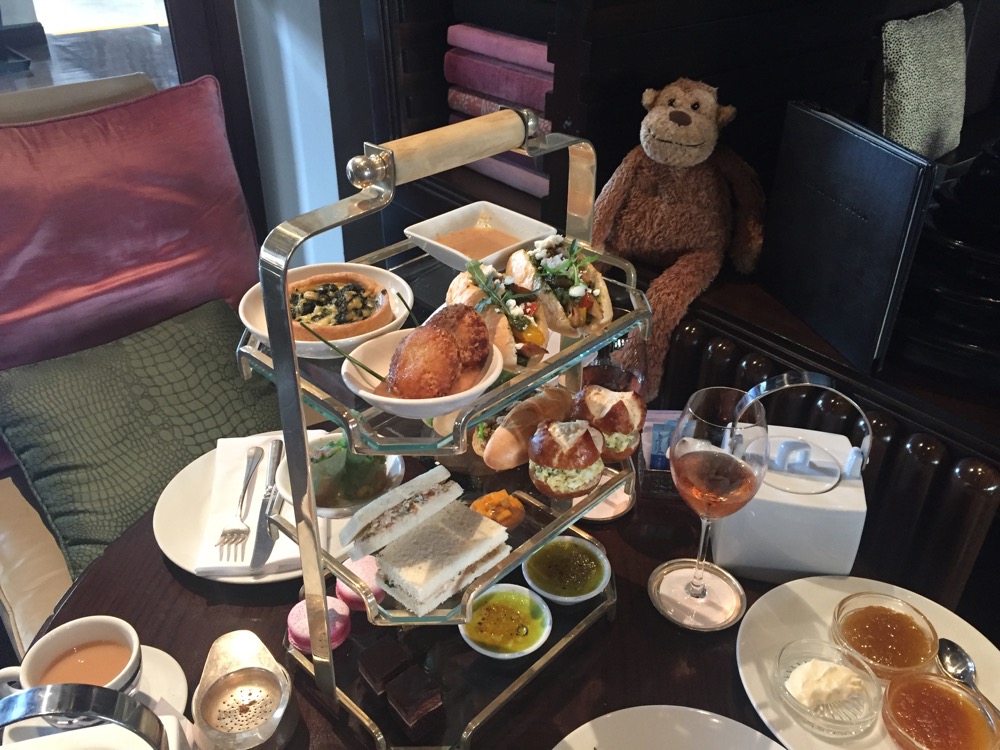

I’m not a cash back kinda guy. I like points and using those points to fly in super nice cabins or cruise the tarmac in a porsche. Although I recently picked up an Amex blue for business which offered the same 10x bonus on restauranst for 6 months. So if that’s any indication of how I value deals like this, I bit when it earned me points.

If I were a cash back kinda guy I think this is a very good deal, especially the Everyday as it carries no annual fee and earns 3% back on groceries. Lemme know if you decide to go for this offer and how you like the card!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.