This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase and GoPuff have partnered to give a $10 statement credit every month you make a minimum $10 purchase. Up until this promo, I’d never heard of GoPuff, so clearly I’m the target market this campaign is trying to reach. Long story, short – GoPuff is a delivery service that will plop a lot of consumer goods from their “micro fulfillment” centers around the country to your doorstep in minutes… They advertise delivery within 30 minutes ( on average )…although I haven’t put this to the test.

How does GoPuff/Chase $10 statement credit work?

- You need to add your qualifying Chase card as the default payment on GoPuff

- Runs through 12/31/23

Which Chase cards qualify for the GoPuff credit?

It’s pretty much any Chase card that is in existence, but here’s the full list

- Chase Freedom card,

- Chase Freedom Unlimited card,

- Chase Freedom Student card,

- Chase Freedom Flex card,

- Chase Sapphire Preferred and Reserve Cards,

- J.P. Morgan Reserve Card,

- Aer Lingus Visa Signature® Card,

- British Airways Visa Card,

- British Airways Visa Signature® Card,

- Disney® Premier Visa® Card,

- Disney® Visa® Card,

- World of Hyatt Credit Card,

- Iberia Visa Signature® Card,

- IHG® Rewards Club Premier Credit Card,

- IHG® Rewards Club Select Credit Card,

- IHG® Rewards Club Traveler Credit Card,

- IHG® Rewards Club Classic Credit Card,

- Marriott Bonvoy™ Credit Card,

- Marriott Bonvoy™ Premier Credit Card,

- Marriott Bonvoy Boundless™ Credit Card,

- Marriott Bonvoy BoldTM Credit Card,

- The Ritz-Carlton™ Credit Card,

- Southwest Rapid Rewards® Credit Card,

- Southwest Rapid Rewards® Plus Credit Card,

- Southwest Rapid Rewards® Employee Credit Card,

- Southwest Rapid Rewards® Premier Credit Card,

- Southwest Rapid Rewards® Priority Credit Card,

- Southwest Rapid Rewards® Performance Business Credit Card,

- Starbucks® Rewards Visa® Card,

- United ClubSM Card,

- UnitedSM Presidential PlusSM Card,

- United MileagePlus® Select Card,

- United MileagePlus® Awards Card,

- United MileagePlus® Card

- UnitedSM Explorer Card.

How does GoPuff work?

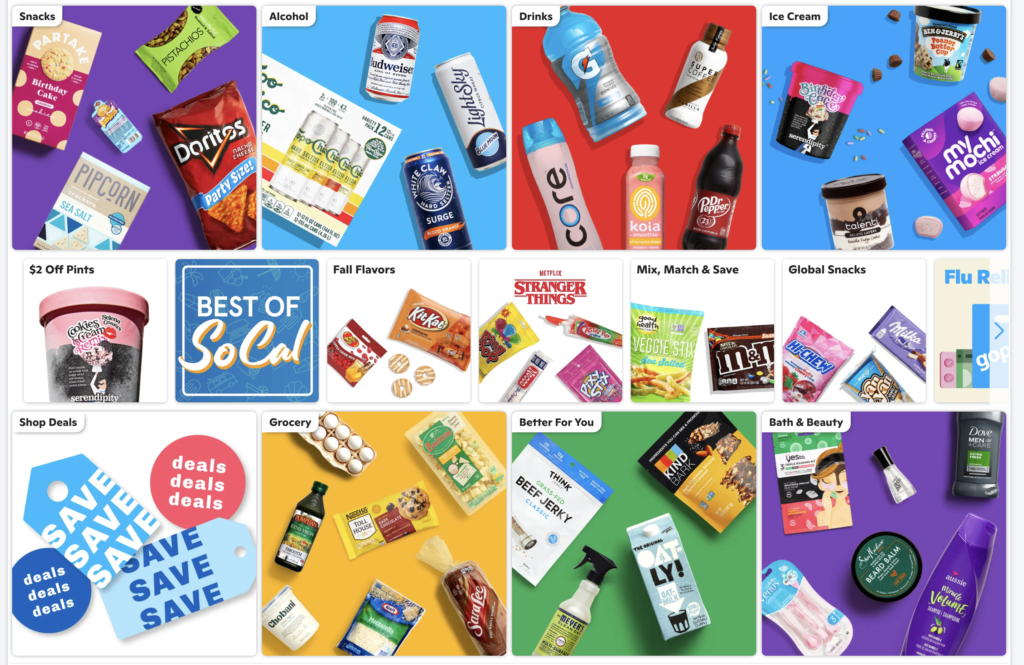

I did a quick search in the LA area and loads of products populated

- They say it should, on average, take 30 minutes to get to you

- Pay a $1.95 delivery fee

- The Fam is $5.95 a month and offers unlimited deliveries

- Orders must be $10.95 or more

- $2 surcharge for alcohol

You order must be $10.95 or more

Recap

Recap

This is nearly 2 years of a $10 monthly credit. The prices seem quite inflated compared to what you’d spend going to a store yourself, but if you’re wanting items delivered quickly and to your doorstep, it could be a good solution

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.