This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

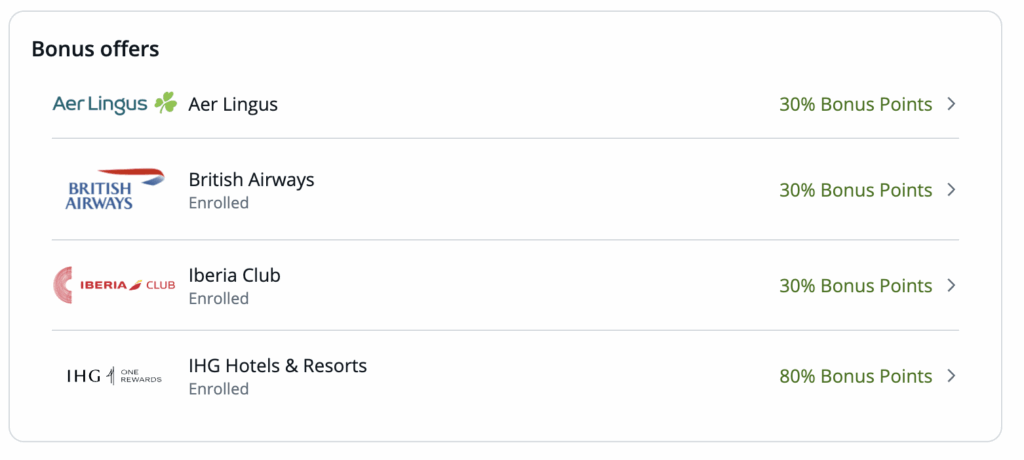

From now until 10/31/25 you can transfer your Chase Ultimate Rewards to IHG One Rewards and get an 80% bonus. One thing to pay attention to is the changes IHG One Rewards has done to their award program which is fully dynamic now ( no award charts ), so more than likely you’re not going to get a great redemption value even with this transfer bonus. Don’t forget we keep an up to date transfer bonus page that lists all the transfer bonuses across programs.

What cards are eligible?

Your card needs to earn transferrable Ultimate Rewards so you need to have one of the following cards to qualify.

- Chase Sapphire Preferred®

- Chase Sapphire Reserve®

- Chase Sapphire Reserve for Business(SM)

- Chase Ink Business Preferred®

As long as you have one of those cards, your points can be moved from Chase and into any of the programs listed below, including Marriott. If you have a Chase Freedom Unlimited, Chase Freedom Flex, Chase Ink Business Cash or Chase Ink Business Unlimited AND one of the cards listed above, you can merge those points into the account with transfer capabilities. If you’re unfamiliar with that feature, read this article.

Best Ever?

- Oct 2025 = 80%

- Sept 2025 = 100%

- July 2023 = 80%

Is transferring Chase points to IHG One Rewards a good idea?

Ordinarily I would say that Chase points are worth close to 2 cents a pop while IHG One Rewards are worth about 1/2 a penny. So, no, under normal circumstances I would advise against such transfers…but there is a always a caveat like a really expensive hotel that you can get high value for via rewards. Also remember that you can redeem your CSP, CIP in the Chase portal for 1.25c and your CSR at 1.5c – so at the bare minimum you need to beat that.

IHG One Rewards offers credit cards holders a 4th nights free…

If you concurrently hold one of the following cards you get a 4th night when using points.

- IHG One Rewards Premier Credit Card

- IHG One Rewards Traveler Credit Card

- IHG One Rewards Premier Business Credit Card

Crunch the numbers, the transfer bonus ends 10/31/25

If you’re sitting on a healthy balance of Chase points and looking to take an experiential trip at an expensive property…this could be a wonderful time to get more bang for you buck. If you’re looking at run of the mill hotels – personally I wouldn’t advise using your Chase points unless you’re getting more than 2 cents per point in value especially when you can buy up to 500k IHG One Rewards per year ( and they run a lot of sales for $0.005 per point ).

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.