This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase World of Hyatt Business Credit Card

Let’s get into the details of the Chase World of Hyatt Business Card and see if it fits your wallet and how it compares to the personal version

Is this the highest bonus we’ve seen?

Arguably the best we’ve seen is a 75k welcome offer after $7500 spend in 3 months.

5 elite nights for every $10k spend

This is a difference between the business and personal versions ( the personal gives you 5 elite nights every year for holding vs the business version which yields 5 elite nights every $10k spend ).

What are Hyatt points worth?

I believe the cheapest they’ve ever been directly sold was roughly 1.7c a pop

Earn up to 2x bonus where you spend most

Every quarter, you will earn a 2x point bonus on the 3 categories where you spend most

- dining;

- airline tickets purchased directly with the airline;

- car rental agencies;

- local transit and commuting;

- gas stations;

- internet, cable and phone services;

- social media

- search engine advertising;

- shipping

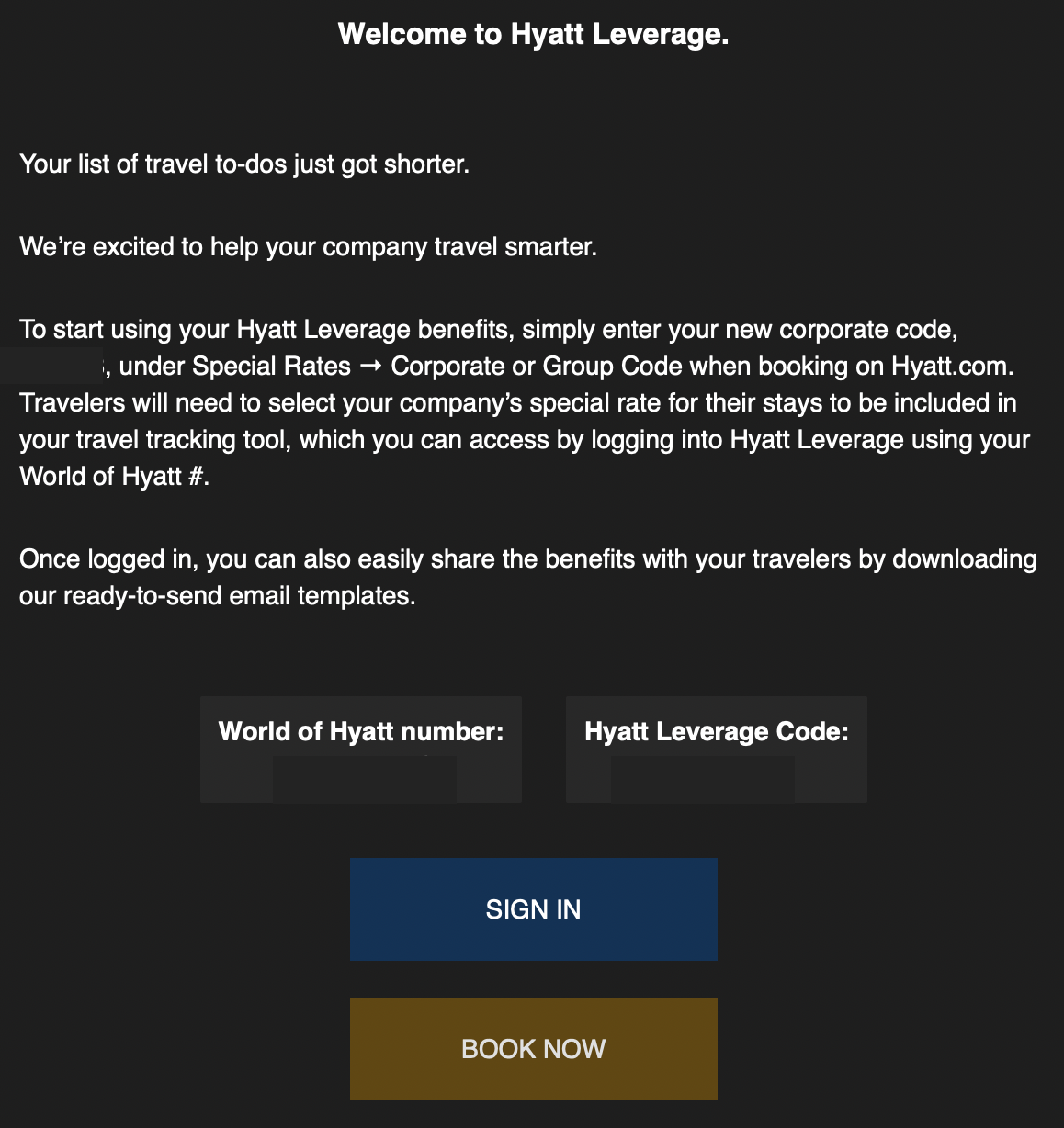

What is Hyatt Leverage?

It’s a program whereby you can get discounts between 5 and 15% when making business bookings. You can join here.

How does the $100 statement credit work?

It’s divided into 2 separate $50 statement credits and can be used at Hyatt properties worldwide. You don’t need to stay at the hotel to use the credit, so if you’re a fan of the local Hyatt restaurant…you’ll get credit there.

Is this card affected by 5/24?

Yes, you will not be approved if your credit report reflects opening 5 or more new accounts in the past 24 months

Can you hold the business and personal versions?

Yes, that’s not problem at all as long as you fall below Chase’s 5/24 rule

How does this card compare to the personal World of Hyatt Credit Card?

Here are the biggest differences in my opinion:

The personal version includes:

- A free night up to category 4 after each account anniversary

- Category 1-4 night after spending $15k

- 2 elite nights every $5k you spend

- Annual fee is $95

The business card includes

- Adaptive Accelerator

- earn 2x on the categories you spend most

- dining;

- airline tickets purchased directly with the airline;

- car rental agencies;

- local transit and commuting;

- gas stations;

- internet, cable and phone services;

- social media

- search engine advertising;

- shipping

- earn 2x on the categories you spend most

- 5 nights every $10k in spend

- 10% back on award nights after hitting $50k in spend

- Hyatt Leverage

What are some of my favorite Hyatt stays?

I have used points to stay at the following properties

- Park Hyatt Buenos Aires

- Carmelo Resort – Uruguay

- Park Hyatt Siem Reap

- Park Hyatt Saigon

- Park Hyatt Washington D.C.

- Park Hyatt Vienna

- Andaz New York

- Andaz West Hollywood

- Grand Hyatt San Diego

- Grand Hyatt Atlanta Grand Suite

- Grand Hyatt Dubai

- Andaz Abu Dhabi

- Hyatt Centric Santa Barbara

- Grand Hyatt Taipei

- Grand Hyatt Tokyo

- Andaz Shanghai

- Hyatt Ziva Puerto Vallarta – all inclusive

- Alila Villas Uluwatu

- Hyatt Regency Churchill London

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.