We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Doctor of Credit posted a very interesting Rumor ( which looks to be a leak more than a rumor) that Chase will be unveiling a new business product called the Chase Ink Unlimited. You can click over to his link to view the image ( it’s his not mine) but essentially the card would be similar to the Chase Freedom Unlimited, but for small businesses. It looks to be released on May 20th, will offer a $500 cash back bonus ( that’s 50k Ultimate Rewards when internally transferred) after $3k spend, and earn 1.5 cents back on every purchase ( or 1.5 UR ). Like the Freedom Unlimited it would carry no annual fee, and like all Chase branded cards it would be restricted by 5/24.

Makes total sense to me

I have to say this isn’t a surprise at all, and what would be more surprising is if we didn’t learn of a Chase Ink Business Reserve debuting at some point this year or next. To have a personal and business line up that reflect one another only makes sense, and Chase has been very effective in utilizing Ultimate Rewards to penetrate a premium card market that once was Amex’s territory to rule. Once the card is officially released, I’ll have to do some assessing as to my business spending patterns and evaluate whether this card could potentially make more sense than an Ink Cash that I currently hold. I have two Ink Cash cardss, one for each of the two businesses that I run, so I could find beneficial application of each card.

Another rumor to consider

This news comes on the heels of another rumor that Chase may limit the ability to internally transfer points between accounts ( hence devaluing the points of cards less than the Reserve). This should be taken into some consideration, but with a grain of salt as there are no firm reports that it exists or will be implemented anytime soon, if your goal of holding one of the cash back cards is to effectively earn Ultimate Rewards instead of Cash Back. Which I’d certainly advocate is the better strategy.

How to use this to earn 2.25 cents back towards travel.

I personally don’t carry a Freedom Unlimited, but one of the uses that many people enjoy is pairing it with a Chase Reserve. This allows you to earn 1.5 points on every purchase, transfer to Reserve, and then redeem them for 1.5 cents through Chase Travel. This effectively means you’re getting 2.25 cents on every dollar you spend.

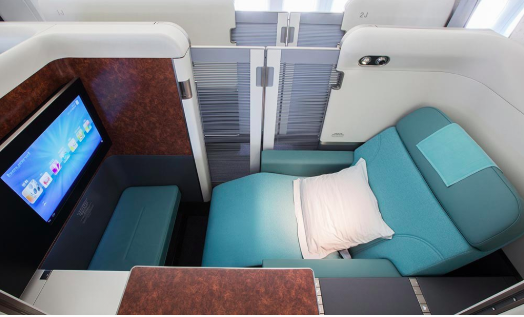

*Feature Image provided by Korean Airlines – One of the best uses of Chase Ultimate Rewards ( their first class) just 80k points from the U.S. to Asia

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.