This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express Uber Credits

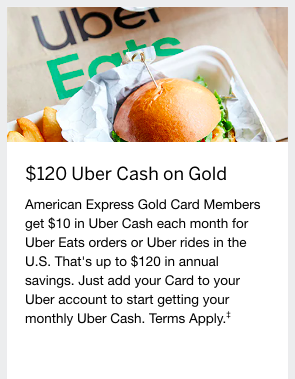

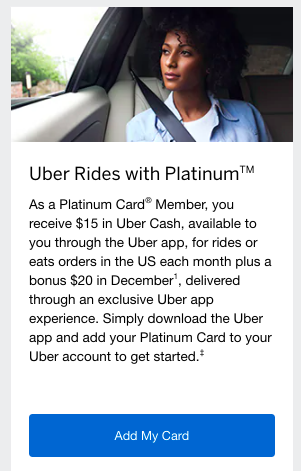

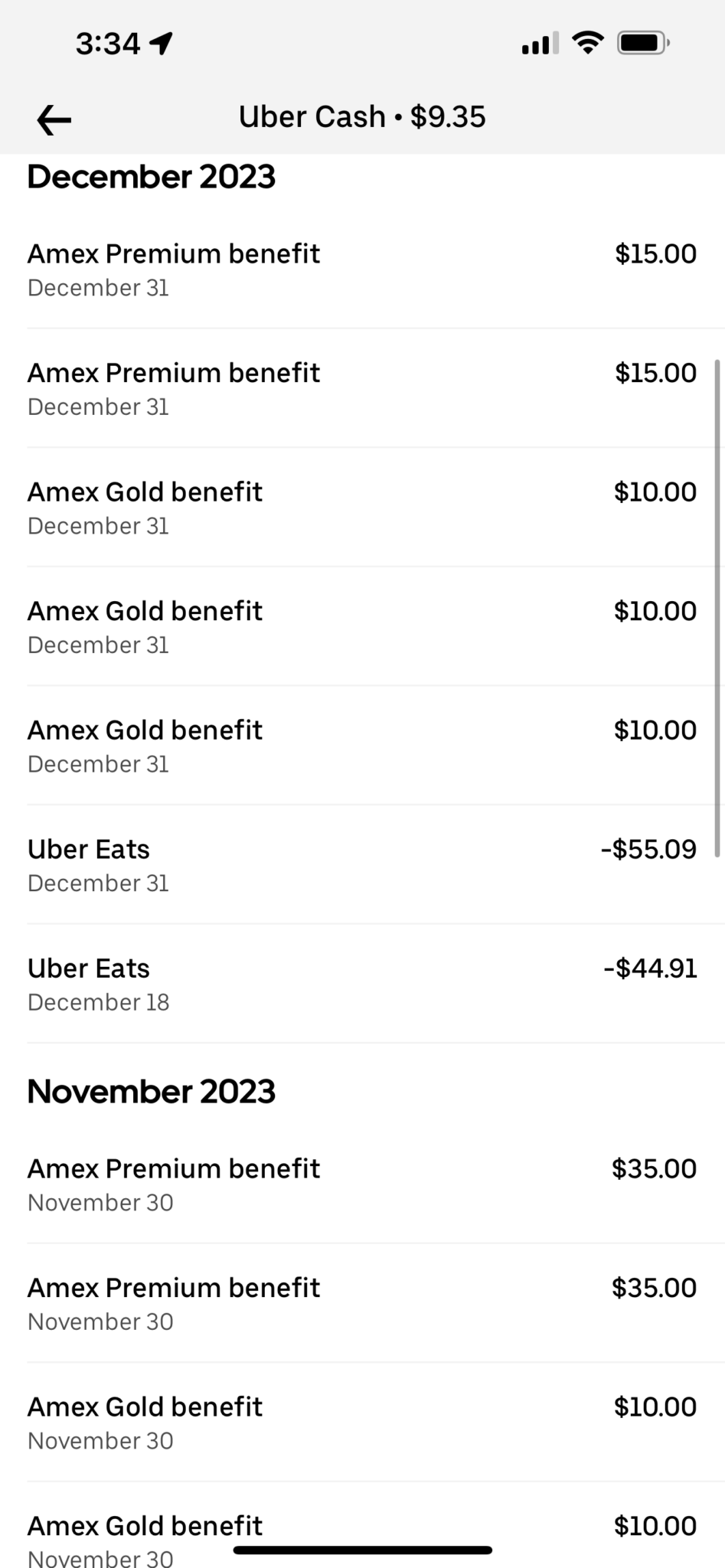

One of the benefits of an The Platinum Card® from American Express and American Express® Gold Card is the monthly Uber credits. The Amex Platinum offers $200 a year in Uber credit split into $15 monthly credits with a $35 credit in December. Amex Gold gives cardholders a $10 monthly uber credits. In order to enjoy these credits your card needs to be enrolled.

What if more than one person in a family carries an Amex Platinum or an Amex Gold? Can you load those credits onto a single Uber account? The answer is yes.

Read more about the current Amex Platinum offers

I make use of Uber all the time; however, my parents rarely used their credit in the midwest. So, for the last few years we’ve been loading their cards onto my Uber account so I’d have access to their Uber Credit.

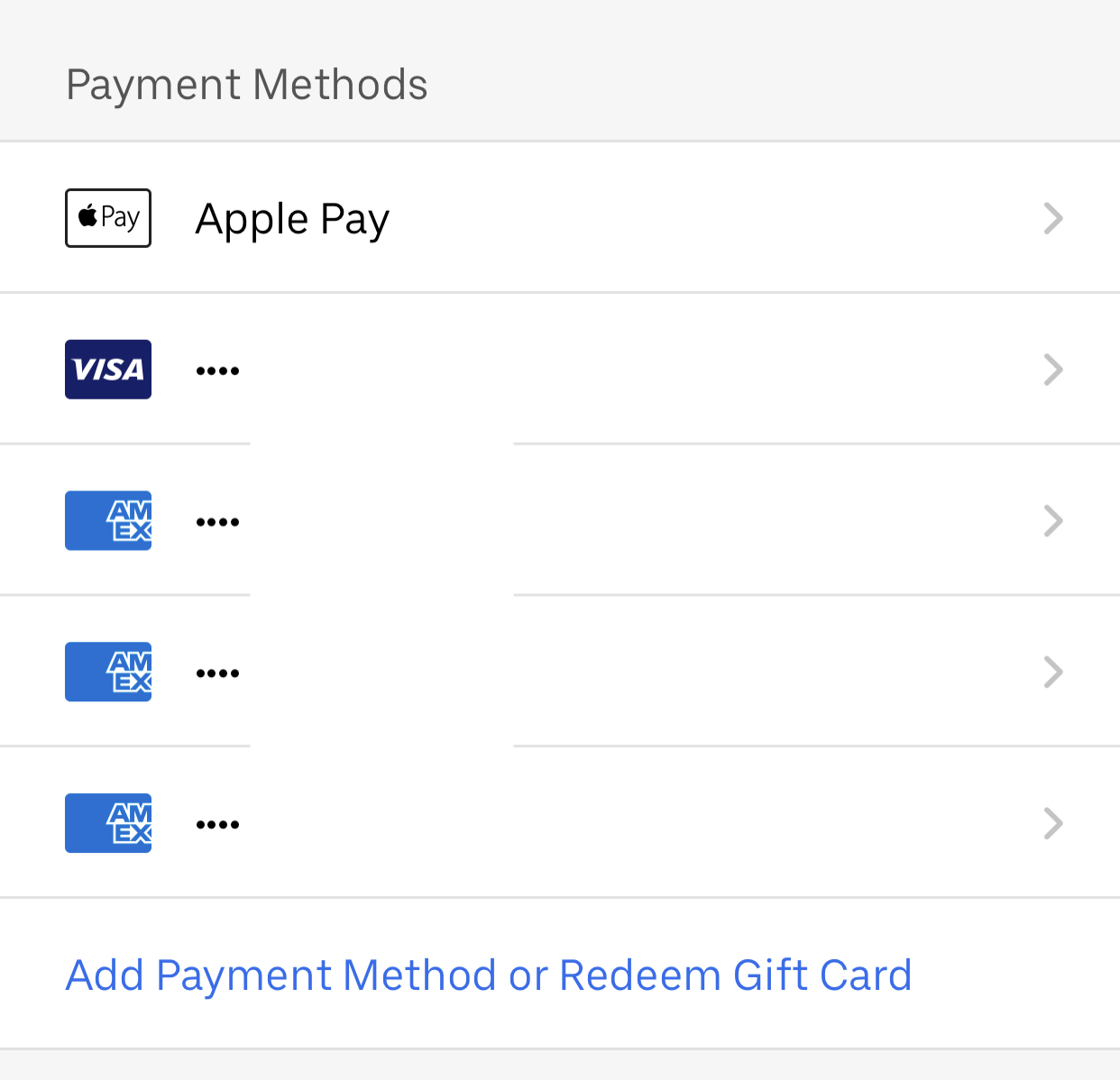

I now have 5 Amex cards linked to my Uber profile. Between my parents and I we carry 3 Amex Gold cards and 2 Amex Platinums. That’s $60 a month in Uber credits loaded on my card every month, and in December…a whopping $100.

That’s a ton of monthly uber credit! Obviously…this requires giving someone your account info, so don’t do it if you don’t trust them.

American Express Platinum and Gold Uber Benefits

I found with both of these benefits that simply adding my Amex to my Uber account enrolled me. However, if for some reason this doesn’t work, you can do so here as well.

Read more about Current Amex Gold Offers

How do you do it? So simple…just load the card on your account

Go to add payments and throw the card on it.

Once you’ve done so, close and restart the app. The credits should appear

Once you’ve done so, close and restart the app. The credits should appear

Which breaks down into the month and card…

Another way is to use this link

Get those points and use those credits!!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.