This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Best Ever: SPG Amex 35k personal and business offer

Last year Amex ran SPG Amex 35k personal and business offers and they are back! Remember that Marriott and SPG have merged and you can transfer SPG into Marriott 3:1. That means if you were to sign up for both of these cards and make the min spend you would earn 70k SPG Starpoints or 210k Marriott Rewards. If you add in the spend of $13k you’d wind up with 83k Starpoints or 249k Marriott Rewards. That’s a pretty amazing deal. If you’re interested in the SPG Amex 35k personal and business offer you have until 4/5/17.

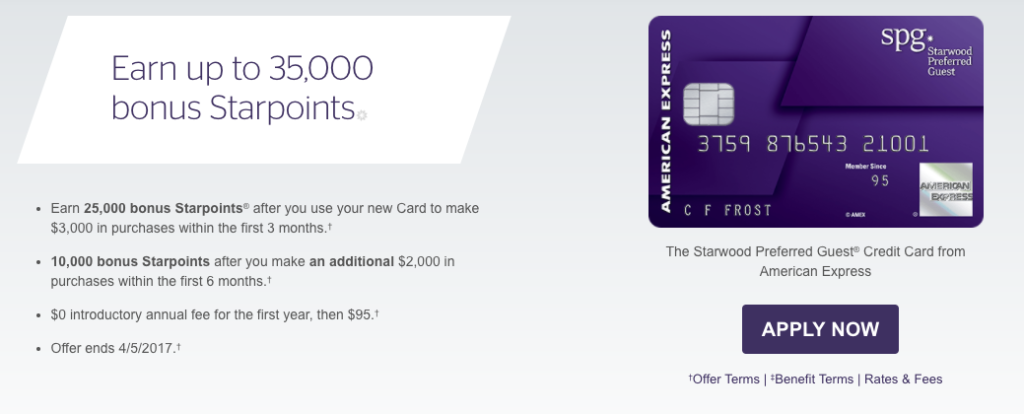

Here is the SPG Amex 35k personal offer

- 25k Starpoints after $3k in 3 months

- 10k Starpoints after another $2k in 6 months

- Sign up by 4/5/17

- Annual fee waived the first year. $95 after that

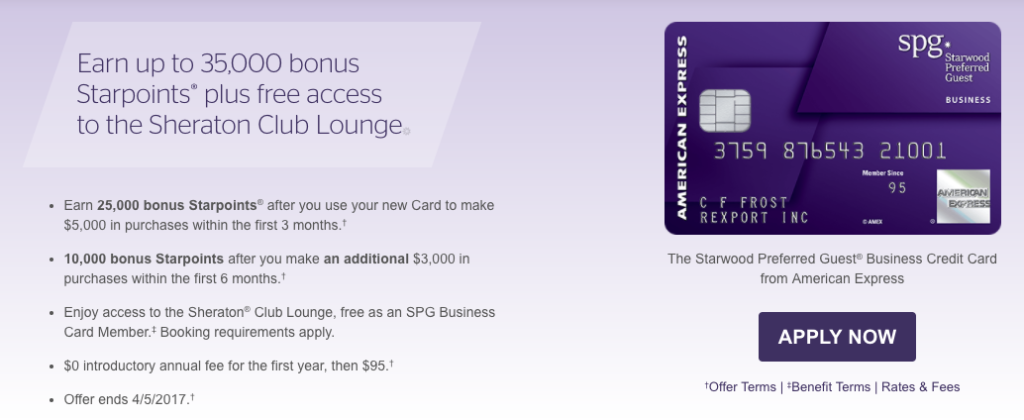

And the SPG Amex 35k Business Offer

- 25k Starpoints after $5k in 3 months

- 10k Starpoints after $3k in 6 months

- Sheraton Club access

- Offer ends 4/5/17

- Annual fee waived first year. $95 after that

These two sign ups could have you staying at the Super Luxe Marriott Park Lane in London. 45k Marriott rewards ( 15k Starpoints) per night, buy 4 get the 5th free. You could stay 5 nights on Park Lane and still have 23k Starpoints leftover.

Besides hotels, SPG Starpoints are incredibly valuable when transferring to Air Partners. Every 20k points you transfer earns you a bonus 5k points.

If you were to get both of these cards you’d earn 70k bonus points. You’d have to spend $5k on the personal and $8k on the business in 6 months to get the max bonus. In total, you’d earn 83k Starpoints. Here are the SPG transfer partners:

| SPG Transfer Partners |

|---|

| Aegean |

| Aeromexico |

| Aeroplan/Air Canada |

| Air Berlin |

| Air China |

| Air New Zealand 65:1 |

| Alaska |

| Alitalia |

| ANA |

| American |

| Asia |

| British Airways |

| China Eastern |

| China Southern |

| Delta |

| Emirates |

| Etihad |

| Air France/KLM |

| GOL |

| Hainan |

| Hawaiian |

| Japan |

| Jet |

| Korean Air |

| LAN |

| Miles and more |

| Qatar |

| Saudi Arabian |

| Singapore |

| Thai |

| Untied 2:1 |

| Velocity |

| Virgin America |

| Virgin Atlantic |

65k Starpoints = 80k AA miles and that will fly you from Tokyo to the US in First Class. And lemme tell you. It’s worth it.

This is a very good offer. Remember that Amex business cards do not hurt your 5/24 and all Amex card bonuses are once in a lifetime.

H/T: Reddit r/churning

*featured image is the Ritz Carlton Tokyo

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.