This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to use CreditKarma.com to see when you opened accounts

There has been a lot of chatter lately about Chase’s supposed 5/24 rule. If you aren’t familiar with 5/24, it restricts you from getting an approval on a new Chase card if you’ve opened more than 5 cards in the last 24 months. Is it enforced? Who is it enforced on? The debate could go on and on, but the thing we do know is that there is some of evidence to support applications being denied due to recently opened accounts. So how do you see how many applications you’ve opened and when you will dip back below the 5/24 threshold? I use creditkarma.com to keep an eye on my credit and I’ll show you how to use creditkarma.com to see when you opened accounts.

If you don’t have a creditkarma account…get one, it’s freeeeee!

You should be keeping an eye on your credit and this is my go to site to do just that. If you have one already, good on ya. If not…stop reading and sign up.

Log in: Check out the left column

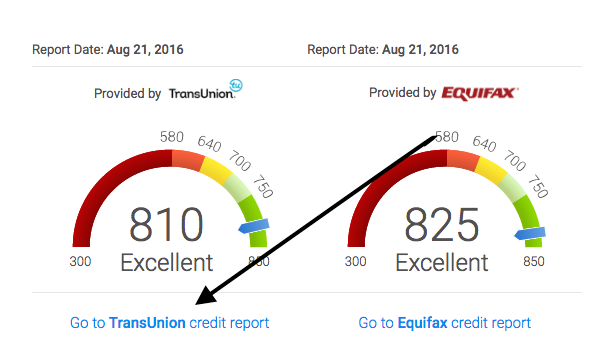

You’ll then see your credit scores pop up

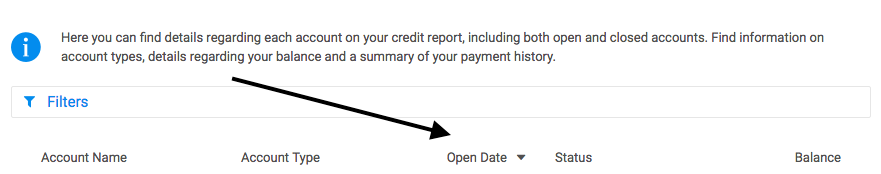

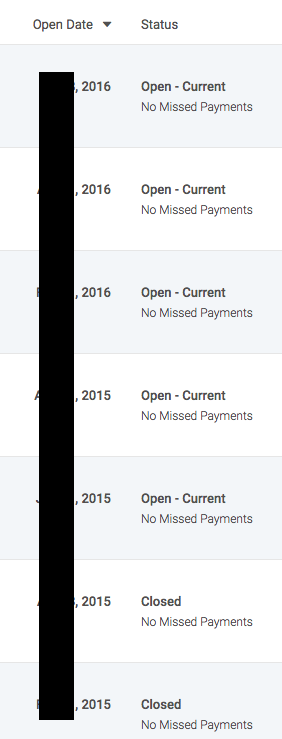

Click on either report, I clicked on TransUnion. Organize by Open date

While inquiries won’t show up on individual reports unless pulled, opened accounts will who across the board.

You can now start counting backwards

Ya…gonna be a little bit before I’m under 5/24

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.