This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The American Express Platinum Card®

The American Express Platinum Card® is one of the most talked about cards in the marketplace, and the rumor mill has been abuzz since we learned Amex would be revamping the card this year. Well, a new mirrored version, chock full of hefty new credits, is here. It immediately draws attention anytime someone whips it out especially since its made of hefty metal. But, all that glitz and glam comes with a hefty $895 annual fee (Rates and Fees).So, is it worth it?

Personally, I keep Amex Platinum because it provides a lot of value for WHEN I travel, and ultimately put more spend on my American Express® Gold Card to earn points TO Travel along with other cards. Both are great cards, but let’s break this bad boy down so you can make an educated decision on whether it’s worth it to you or not.

A quick overview of the benefits:

What do you get for $895 a year?

- Earn 5X Membership Rewards® points

- All flights and prepaid hotel bookings through American Express Travel®, Including Fine Hotels + Resorts® and The Hotel Collection bookings.

- Flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- Lounge Access

- Global Lounge Collection®,

- Access to Centurion Lounges,

- 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations),

- Priority Pass Select membership (enrollment required), and other select partner lounges. * As of 07/2025.

- $200 Uber Cash + $120 Uber One Credit:

- You can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction.

- Plus, when you use the Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- $300 Digital Entertainment Credit:

- Get up to $25 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners.

- Now includes Paramount+, YouTube Premium, and YouTube TV alongside Disney+, a Disney+ bundle, ESPN, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required

- Enrollment required.

- Get up to $25 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners.

- $600 Hotel Credit:

- Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the Platinum Card®.

- *The Hotel Collection requires a minimum two-night stay.

- $400 Resy Credit + Platinum Nights by Resy:

- When you use the Platinum Card® to pay at U.S. Resy restaurants and to make other eligible purchases through Resy, you can get up to $100 in statement credits each quarter

- Platinum Nights by Resy,

- you can get special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you, enrollment required.

- $209 CLEAR® Plus Credit:

- CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. You can cover the cost of a CLEAR Plus Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR Plus with the Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit:

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the Platinum Card® Account*. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- $300 lululemon Credit:

- Enjoy up to $75 in statement credits each quarter when you use the Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That’s up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit:

- Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the Platinum Card®. *Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- $100 Saks Credit:

- Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on the Platinum Card®. That’s up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. No minimum purchase required. Enrollment required.

- Up to $200 ŌURA Credit: (enrollment required )

- Up to $200 back in statement credits each calendar year when Card Members use the Platinum Card to purchase an ŌURA Ring through OURAring.com. Enrollment required.

- Rental Car Status (enrollment required )

- Hertz President’s Circle

- Avis Preferred Plus

- National Executive

- Hotel Status (enrollment required )

- Marriott Bonvoy Gold

- Hilton Honors Gold

- Leading Hotels of the World Sterling Status

- $895 annual fee.

- Terms Apply.

- See Rates & Fees

Personally I will undoubtedly use the $600 hotel credit (enrollment required ), $209 Clear Credit (enrollment required ), $200 Uber Cash, $400 Resy Credit, ( enrollment required ) and $200 incidental airline free credit (enrollment required ). That’s $1609 of the $895 without including Lulu Lemon, Priority Pass, Saks Centurion Lounge, etc. Wait, that’s more than the card is worth itself.

Do you qualify?

Amex has a once in a lifetime clause that limits the ability to get a welcome offer more than once, so if you’re had the Platinum card before, you may not qualify for the welcome offer.

Is this the best offer we’ve seen?

Check our best offers spreadsheet

Great ways to use American Express points: transfer partners

Amex points are some of the most valuable points in the biz. Just look at all of these partners listed below, but if you really want to get a good taste of how luxuriously you can travel with them, read this article on their best uses.

As I mentioned, I have an entire post dedicated to some truly awesome ways you can use your points. The best ways, in my opinion, to make use of American Express points are by utilizing their long list of transfer partners.

One of my favorite ways to fly is Lufthansa First Class which can be accessed by transferring to Aeroplan, Avianca, ANA, or Singapore Airlines.

Here are benefits I think outweigh the $895 fee

1) 5x points on airline purchases made with the airline of your choosing or Amex Travel

- This is the highest earn rate for any card on the market for indiscriminate airline spend ( Jetblue has a 6x card solely on Jetblue). If you value Amex points at 2 cents a piece…you’re essentially getting 10% off every qualifying flight.

If you spend $1000 a year on your card – you’re earning 5k points back. That’s $75 at a 1.5 c valuation and $100 at 2c.

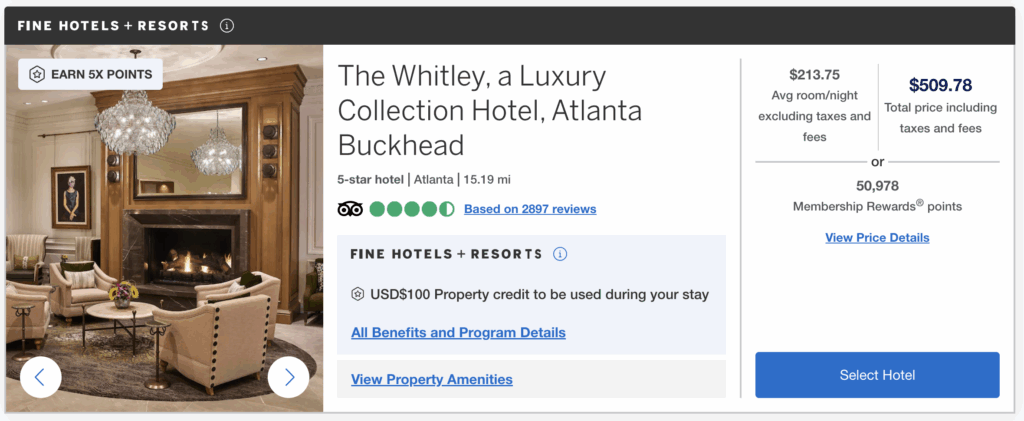

2) Up to $600 Hotel credit

This is a brand new credit that applies to pre-paid bookings with Amex Travel on American Express Fine Hotels and Resorts and The Hotel Collection bookings. I absolutely love the Fine Hotels and Resorts program and will undoubtedly make use of this credit every year

For instance, if you were to book the Whitley in Atlanta for 2 nights over Valentine’s Day 2026, you’d knock $300 off the final bill. Pretty awesome.

Plus you’d get all of the typical FHR benefits which include another $100 food and beverage credit, upgrade, breakfast, and 4pm check out. More on this program down below.

4) Up to $400 Annual Resy Credit ( Enrollment Required )

Get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at over 10,000 U.S. Resy restaurant.

This will be super easy for me to use since some of my favorite restaurants are listed.

4) Up to $200 Uber Cash Credit

- $15 a month and $35 in December on Uber

- Valid in the US Only

- You need to enroll your card by adding it to your profile and selecting it as a payment option

Not everyone makes use of this perk like I do, but I’d be spending $15 a month on uber every month regardless of the perk. It’s an easy $200 recoupment for me. .

5) Up to $120 Uber One Credit ( enrollment required )

As a Platinum Card® Member, you can get up to $120 in statement credits each calendar year after you purchase an auto-renewing Uber One membership with your Card.

What do you get with Uber One?

- Rides: Receive 5% in Uber One credits on eligible rides.

- Uber Eats: Get a $0 delivery fee and 5% off eligible orders.

6) Up to $200 Airline Incidental credit ( enrollment required )

- You must select an airline for the fee to trigger – this will enroll you.

- Each calendar year – which means if you apply now, you’ll get $200 this year, and then another $200 starting 1/1/21

I easily make use of the card each and every year I hold the card. Read this for tips, but it’s a solid $200.

7) Up to $120 Global Entry Fee Credit or $85 TSA PreCheck® credit ( enrollment required )

- Up to $120 Global Entry or $85 TSA PreCheck® credit (enrollment required )

- Receive either a $120 statement credit every 4 years for a Global Entry application fee or

- a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

Global Entry is a phenomenal program that expedites your immigration when entering the country. It’s saved me hours and hours of time over the years.

8) Up to $209 CLEAR® Plus Credit

Clear basically expedites your security experience. If you already have TSA Pre this will pop you to the front of that line. If you don’t, you’ll just skip to the front of the normal line. Either way, it’s saved me many a time.

- you need to enroll in Clear to qualify

I’ve had Clear for a few years now, and it’s extremely helpful if you live at a busy airport, not as much elsewhere. In LA, Atlanta, and NYC it’s literally been the difference between making and missing my flight.

Travel is ramping up, and security lines are getting fuller and fuller. It’s a no brainer to pay for it with your Amex Platinum.

Don’t forget to link your Delta SkyMiles account, you’ll get a discount on the yearly subscription which easily puts it under the credit your card gives you.

9) Up to $300 annual Lululemon Credit ( enrollment required )

NEW – $300 lululemon Credit: Up to $75 back in statement credits each quarter for eligible purchases at retail lululemon stores (excluding outlets) or lululemon.com in the U.S. when Card Members pay with the Platinum Card

10) Up to $300 yearly Equinox credit (enrollment required )

I have several friends who are loyal Equinox members and this would be a benefit they’d surely make us of. Personally, I may download the Equinox+ app and see how the workouts are…it’s discounted for Amex Platinum cardholders so it’s a push. Regardless, for those who are members…it’s an easy $300 if you have an eligible membership:

- The credit goes towards monthly Equinox All Access, Destination, E by Equinox, or Equinox+ memberships fees

11) Up to $300 digital entertainment credit ( enrollment required )

You get $25 in statement credits each month (up to $300 each calendar year) on Paramount+, YouTube Premium, and YouTube TV alongside Disney+, a Disney+ bundle, ESPN, Hulu, The New York Times, Peacock, and The Wall Street Journal. It’s capped at $25, not $25 per company.

Take a look at the restrictions as well.

12) Cell Phone Protection

If you pay your cell phone bill with your Amex Platinum you now have cell phone insurance. The prior’s month bill must be paid with your card, but the actual phone itself doesn’t need to be purchased with your Amex Platinum.

- Reimbursement, up to $800

- Towards the repair or replacement

- If damaged or stolen

- $50 deductible

- 2 approved claims per 12 months.

13) Centurion Lounge access

I probably visit Centurion lounges 1/2 a dozen times a year. At just $5 saved on a coffee or beer it’s worth min $30.

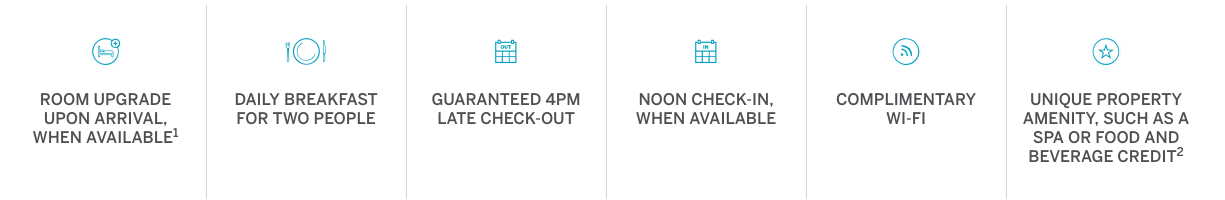

14) Fine Hotels and Resorts

- Insane benefits including

- Upgrade upon arrival when available

- Unique property amenity ( this is usually in the range of a $100)

- Free continental breakfast

- Early Check-in and guaranteed 4pm late check out

FHR offers incredible value if you like to stay at high end resorts and hotels. The breakfast and property credit are easily worth a couple hundred on every stay over 2 nights. I’ve also had great success with double upgrades, and having a guaranteed 4pm late check out is huge when you have a late flight, and a distinct advantage of Virtuoso.

What’s even better…if you pre-pay the hotel…you’ll earn 5x points on it as well.

15) Hotel Elite Status ( enrollment required )

You’ll need to link both of your Marriott and Hilton accounts, and once you do… you are now carrying elite status in two hotel chains.

- Marriott Gold

- Hilton Gold

- Leaders Club Sterling Status from The Leading Hotels of the World®

Why spend a gazillion nights staying at hotels when your credit card can get you mid-tier status. Hilton Gold is especially nice as it gives you free breakfast credit when using points for your stay.

16) up to $100 Saks Fifth Avenue annual credit

- $50 for each 6 months of the year

- note that you need to enroll your card in order to trigger the credit

Once between Jan and June you’ll get $50 back as a statement credit, and then again between July and December. Even if you don’t shop for high end apparel, or accessories, Saks sells a ton of toiletry items that this credit offsets. Think Kiehls, Fekkai, etc

17) Up to $200 Oura Ring statement credit

Oura Ring can help you meet your health goals. You can receive up to $200 in statements credits when you use the Platinum Card® to purchase an Oura Ring at Ouraring.com each calendar year. Enrollment required.‡

This isn’t something that I will personally use, but I have a few friends with Oura rings so perhaps it would be of value to them

18) Priority Pass Membership

- Access to the global network of lounges and restaurants

- You do need to enroll your card in order to enjoy this benefit

19) International Airline Program

I’ve some absolutely fantastic deals on airfare ( Premium Economy and up ) via the IAP. Highly worth checking out before you book elsewhere. Note that you must be on one of the following airlines departing from the US in Premium Economy, Business, or First Class.

Bonus Reasons:

Amex Offers

- These are targeted spend offers that each cardholder can take advantage of by fulfilling spend requirements with certain retailers. The opportunities are frequently updated, and I’ve found that these alone could pay you back for an annual fee.

And Referrals points – 100k a year

You can earn up to 100k points per card every single year. In fact, you can add your referrals to this post. It gets a lot of traffic so many are earning quite a few referral bonuses from us.

Overall:

While the $895 is a lot, I personally, am able to get well over $1400 a year in benefits without even taking into account a welcome offer, upgrade offer, or the other benefits like Rental car status, rental car insurance, global lounge collection, etc. Again.. I travel A TON, and these credits align with how I travel.

What’s even better is how much the card can improve the way you travel. Having a lounge access while you wait can make delays and layovers so much more bearable, and having status at hotels less costly at check out because of comped wifi, upgrades, breakfast, or even just in-room bottled water. Regardless, if you’re a travel geek like me, this card provides an incredible amount of value year after year

To see the rates and fees for the American Express cards featured, please visit the following links: American Express Platinum Card®: See Rates and Fees

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.