This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Offers Marriott Hotels :

American Express regularly runs Marriott “Amex Offers” and their latest batch is quite attractive depending on the ones you’re targeted for and is specific to US cardholders. Historically, Amex rolls out one of these and then shortly thereafter follows it up with a few more. So we will be keeping an eye on additional Marriott Amex Offers in the next week or two.

A few things to note:

- * the terms and conditions stipulate booking must be done through Marriott.com, the app, etc. However, in the past if you were to book a qualifying Marriott Hotel property via Amex Fine Hotels and Resorts, you’d not only get all of the FHR benefits, but if you spent enough while on the property to trigger the Amex Offer, and that was paid directly to the property, you’d get a credit as well.

- So, if you held an Amex Platinum you could take advantage of the $200 hotel credit when pre-paying via Fine Hotels and Resorts or the Hotel Collection. You can read details on that here, and then any overage charge to the hotel and pay with the targeted Amex. This isn’t guaranteed to work, but has in the past.

- * the exclusions explicitly mention gift cards, but in the past, if those were purchased at a property ( which isn’t always easy to do ) they have triggered the credit.

Amex Offers helps me justify why I keep 11 Amex cards

Here are the American Express Cards that I keep and links to their current offers + why we have them in our wallet. We not only get targeted for more Amex Offers, but also receive referral bonuses ( and so can you ) on each and every card. It’s how we earn over 500k points a year without spending a dime.

- The Platinum Card® from American Express

- American Express® Gold Card

- 3x The Business Platinum Card® from American Express

- 3x American Express® Business Gold Card

- Marriott Bonvoy Business® American Express® Card

- 2x American Express Blue Business Plus

Learn more about our favorite credit cards

What we’ve seen in the past and likely to see again shortly:

Marriott: Spend $400 get $100

This is targeted for properties within the Marriott umbrella that aren’t “luxury” per se. Interestingly enough, Autograph Collection, AC, Le Meridien properties aren’t excluded which I’ve found to be quite nice, so if you’re still wanting up market, these could be a great option. Also, if you’re doing a roadtrip and staying in Spring Hill Suites, Fairfield, Courtyard, etc – easy way to get money back.

Details:

- Spend $400 get $100

- Within the following geographical areas

- U.S. and U.S. territories, Canada, Mexico and the Caribbean

- Must be completed by 03/31/25

- Excludes Marriott Vacation Club®, Marriott Grand Residence Club®, Design Hotels™, Protea Hotels®, Marriott Executive Apartments®, Homes & Villas by Marriott International, Vistana Signature Network and Vistana Residence Network. Excludes gift card purchases.

- Not valid for online retail purchases, hotel amenities, or purchases of Marriott Bonvoy® points

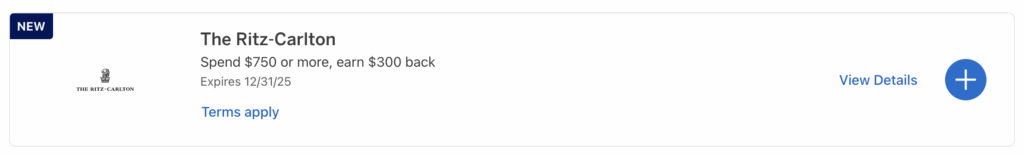

Ritz Carlton Spend $750 get $150

- Spend $750 ( in 1 or more transactions ) get $150 back

- Valid through 12/31/24

- Valid US

- Excludes gift cards, online retail purchases, and Marriott Bonvoy Point Purchases

- Must be on Marriott.com or Marriott app or phone reservation

Marriott: Spend $350 on purchases, get up to $140 back

- Spend $350 ( in 1 or more transactions ) get $140 back

- Valid through 11/23/24

- Valid US + US Territories, the Caribbean, Canada, Mexico

- Excludes gift cards, online retail purchases, and Marriott Bonvoy Point Purchases

- Must be on Marriott.com or Marriott app or phone reservation

Marriott: Get 40% back up to $100

- Limit of $100 total statement credit

- Expires 8/13/24

- Valid at participating Marriott Bonvoy properties

- US, US Territories, Canada, Mexico, and The Caribbean

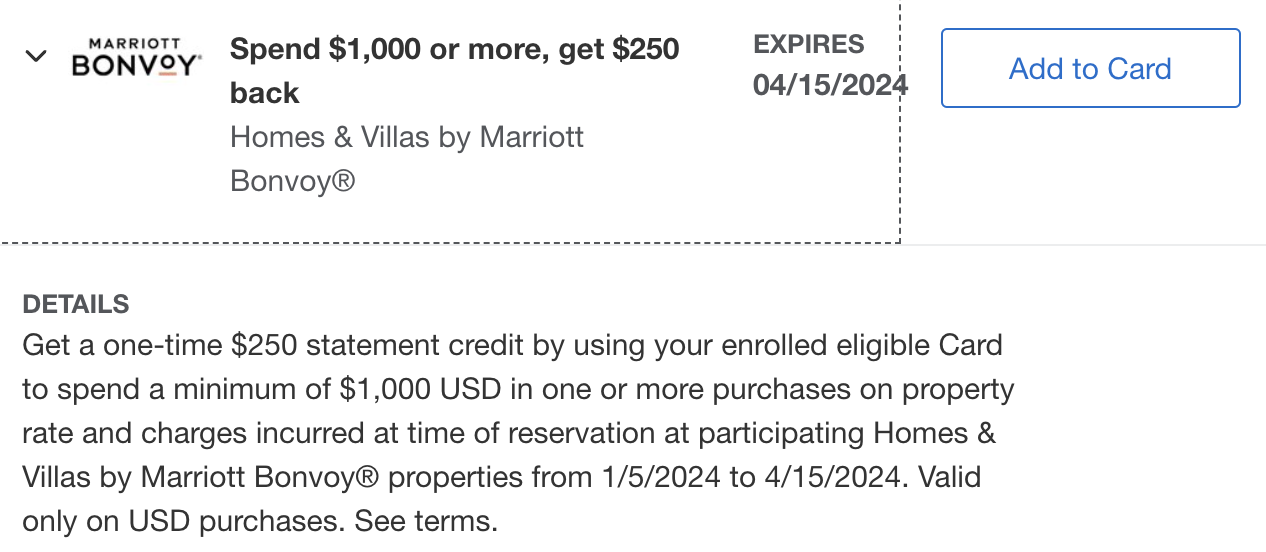

Spend $1000 Marriott Homes and Villas get $250

If you weren’t aware, Marriott has a portal dedicated to Homes and Villas. Take the fam, take the squad, but whatever you do, take the Amex you linked so you can get some money back, baybayyyy.

- Spend $1000 get $250 back

- Valid until 04/15/2024

- See terms for exclusions

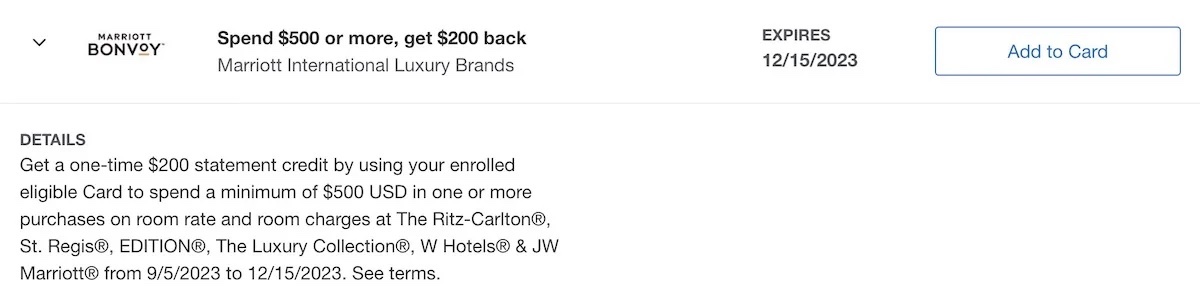

Marriott Luxury Properties: Spend $500, get $200

If you’re looking for a luxurious getaway…this is an easy way to save some dough.

Details:

- Spend $500, get $200

- Within the following geographical areas

- U.S. and U.S. territories, Canada, Mexico and the Caribbean

- Ritz, St Regis, Edition, The Luxury Collection, W Hotels, JW Marriott

- Must be completed by 12/15/23

Overall

Some great ways to save on your Marriott bookings!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.