This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Here are 17 things you should immediately with your American Express Platinum Card®

The American Express Platinum Card® is one of the most talked about cards in the market. It’s the one card that I get asked the most about, and I find that a lot of people don’t take advantage of all the benefits and credits that come with this super premium card.

Yes, it has a very high annual fee, but if you’re willing to mine the value out of the card, you’ll find it yields far more than the fee in benefits, statements credits, and perks.

I keep anywhere from 25 to 40 credit cards at one time. I tailor it throughout the year to suit my spending habits and travel goals. Let’s take a look at the American Express Platinum card and the 15 things you should do immediately after getting one. ( If you’re a cardholder and haven’t done these things…it’ll be our secret, but get going!!! There’s money on the table 🙂 )

Here’s more in on the Amex Plat including the best current offer we have been able to find:

What are all the benefits?

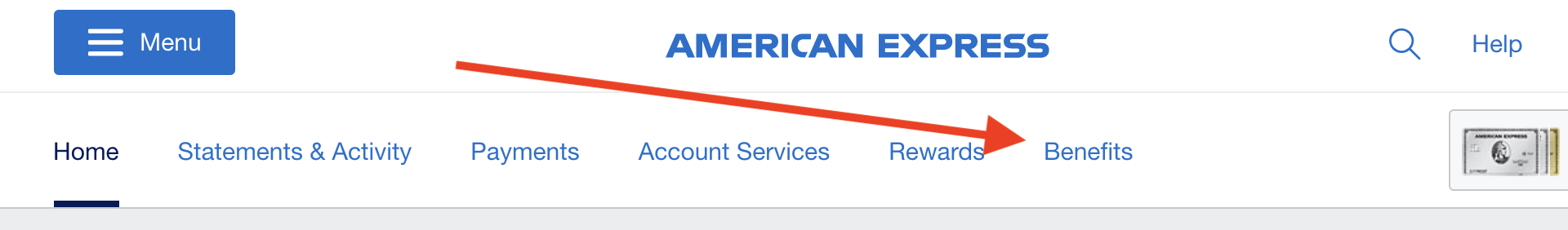

How do I add these benefits to the Amex Plat?

When you log into your account, just click on benefits and you’ll see a list.

Before we get into any of these benefits…you should be aware of the amazing transfer partners you have:

Amex has over 20 incredible transfer partner and using these partner is how we are able to take bucket list trips every single year.

I’d highly recommend you read our article on the Best ways to use Amex points. One of our favorite uses is Lufthansa First Class

1st thing to do after getting your Amex Platinum: Claim your up to $200 Uber credit

Every single year you get up to a $200 Uber cash credit and Uber Vip status ( for basic cardholder only ) terms apply. This is divided across the year as such:

- Up to $15 a month

- Up to $35 in December

You just need to enroll your card in order to claim the credit – it’s super easy. Adding the card to your account should do it, if not, read this article and it walks you through it.

- Effective 11/8/2024, an Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit.

- You must have downloaded the latest version of the Uber App and your eligible American Express Platinum Card® must be a method of payment in your Uber account. The Amex benefit may only be used in United States.

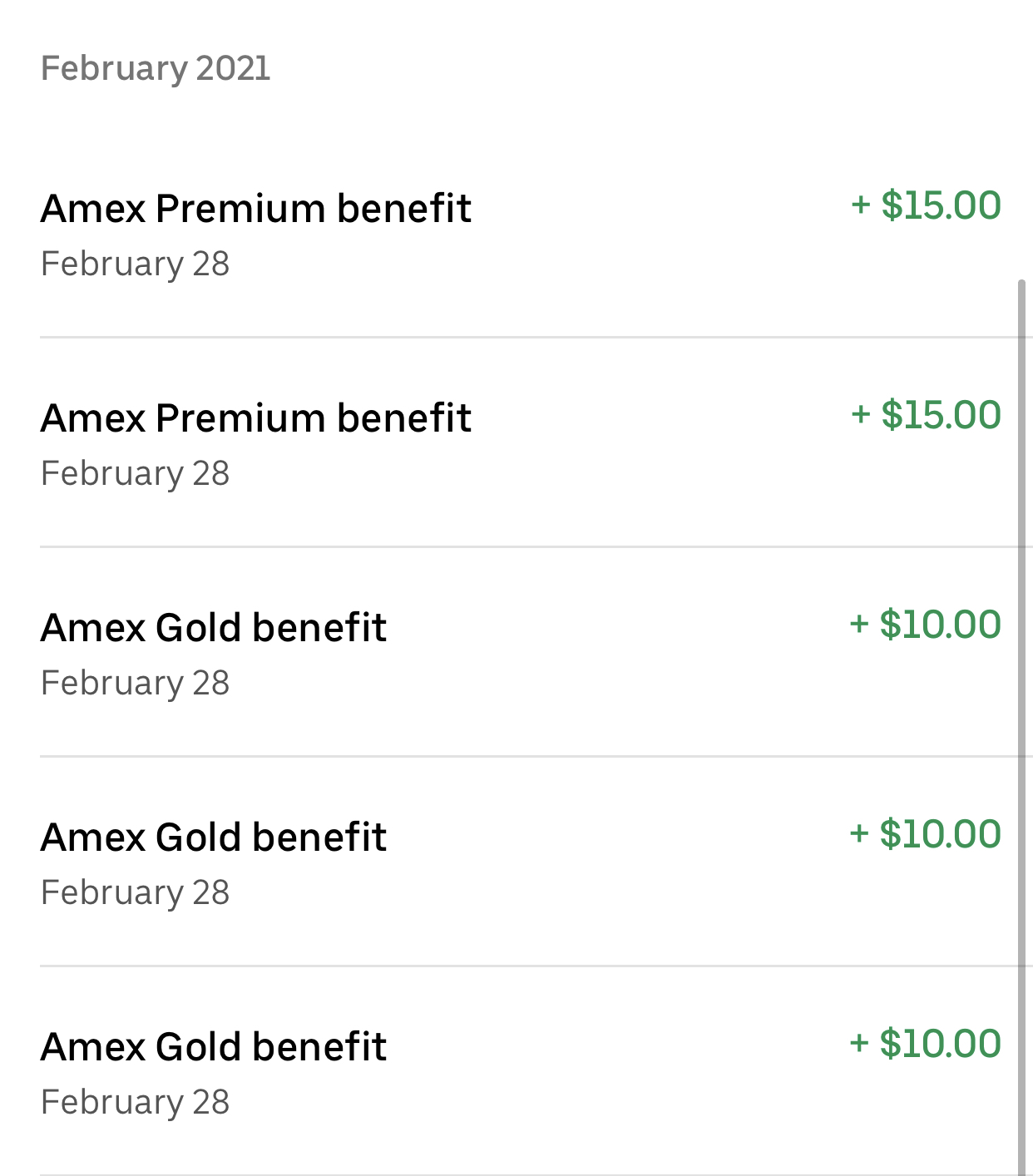

You can actually pool multiple Uber credits. So if you carry an American Express® Gold Card, or anyone in your family has an Amex Platinum or Gold, you can add their cards to your account and the credit is lumped together. You can read about this technique in detail here.

You can actually pool multiple Uber credits. So if you carry an American Express® Gold Card, or anyone in your family has an Amex Platinum or Gold, you can add their cards to your account and the credit is lumped together. You can read about this technique in detail here.

#2 Enroll for Uber One – up to $120 annual statement credits ( Enrollment Required )

3rd: Enroll for up to $400 annual Resy Credits ( enrollment required )

Up to $100 in statement credits each quarter on eligible purchases with Resy

#4 and #5 Claim your complimentary hotel elite status with Marriott, Hilton, LHW

The American Express Platinum card gives you Marriott Gold, Hilton Gold, and LHW Sterling status just being a cardmember, but you need to enroll your card. If you add Platinum Card Authorized users, they get both of these statues as well. If you just add companion cards, they don’t.

It’s super simple – All you need to do is enter your information and you’re good to go. Having hotel elite status can substantially change the quality of your stay with a brand. Both of these statuses are what is referred to as “mid tier” but can often result in upgrades or lounge access where available.

I write about purchasing points quite often as a way to offset the cost of your trip – having elite status with Hilton means you’ll get a 5th night free when you use points to redeem. This is epic when you look at aspirational resorts around the world. For instance, the Conrad Bora Bora, shown below, costs 95k per night. But, if you have Hilton Gold status, you’d get a 5th night free. This is a huge savings in points and you get that status just for being an Amex Platinum cardmember. Hilton Gold also grants club lounge access at many hotels around the world.

6) Claim your Up to $209 CLEAR® Plus Credit

Clear basically expedites your security experience. If you already have TSA Pre this will pop you to the front of that line. If you don’t, you’ll just skip to the front of the normal line. Either way, it’s saved me many a time.

- you need to enroll in Clear to qualify

I’ve had Clear for a few years now, and it’s extremely helpful if you live at a busy airport, not as much elsewhere. In LA, Atlanta, and NYC it’s literally been the difference between making and missing my flight.

Travel is ramping up, and security lines are getting fuller and fuller. It’s a no brainer to pay for it with your Amex Platinum.

Delta Clear Discount

Don’t forget to link your Delta SkyMiles account, you’ll get a discount on the yearly subscription which easily puts it under the credit your card gives you.

United Clear Plus Discount

Alaska Airlines Clear Plus Discount

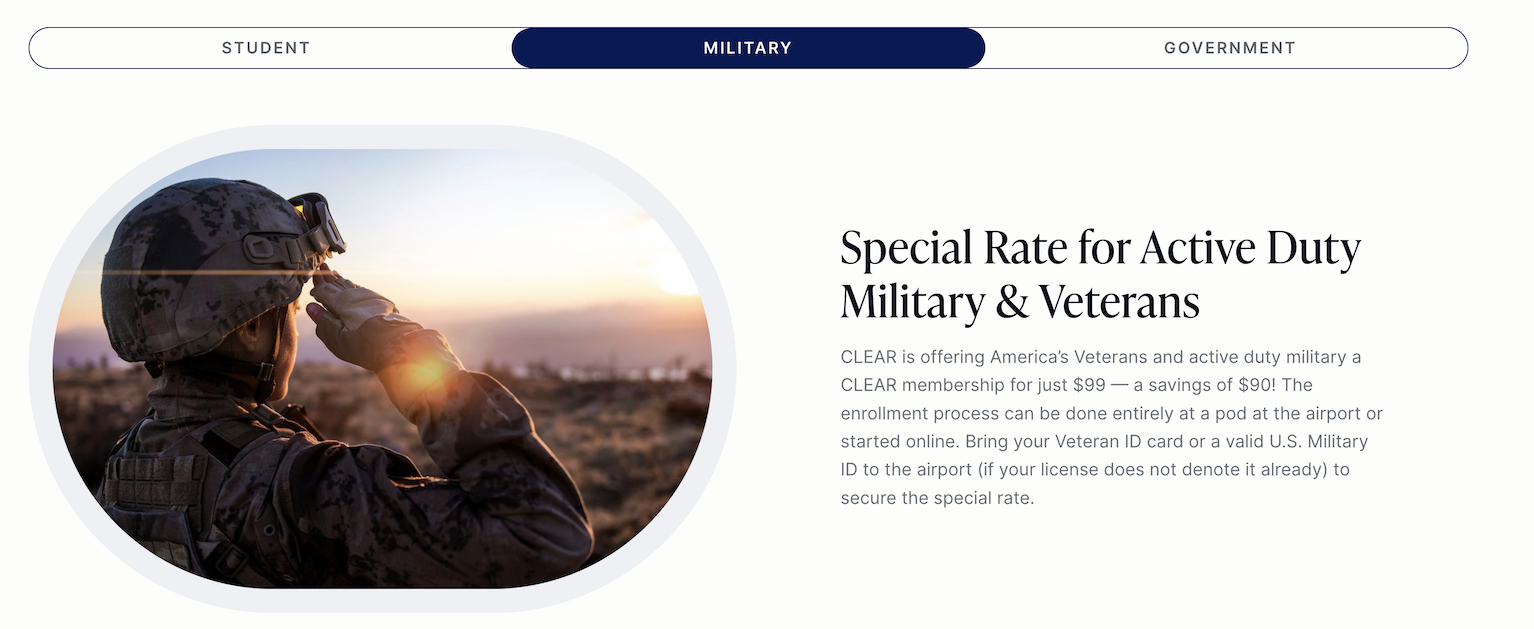

Military Clear Plus Discount

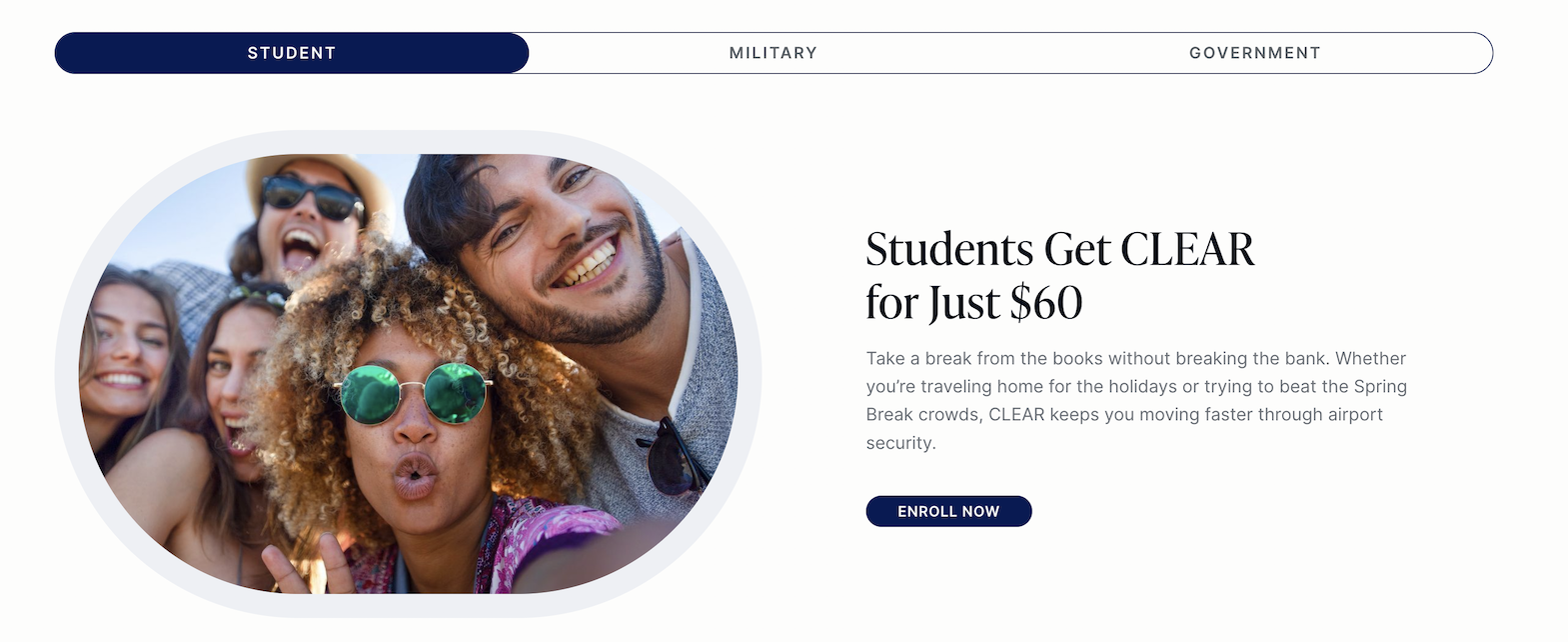

Student Clear Plus Discount

Student Clear Plus Discount

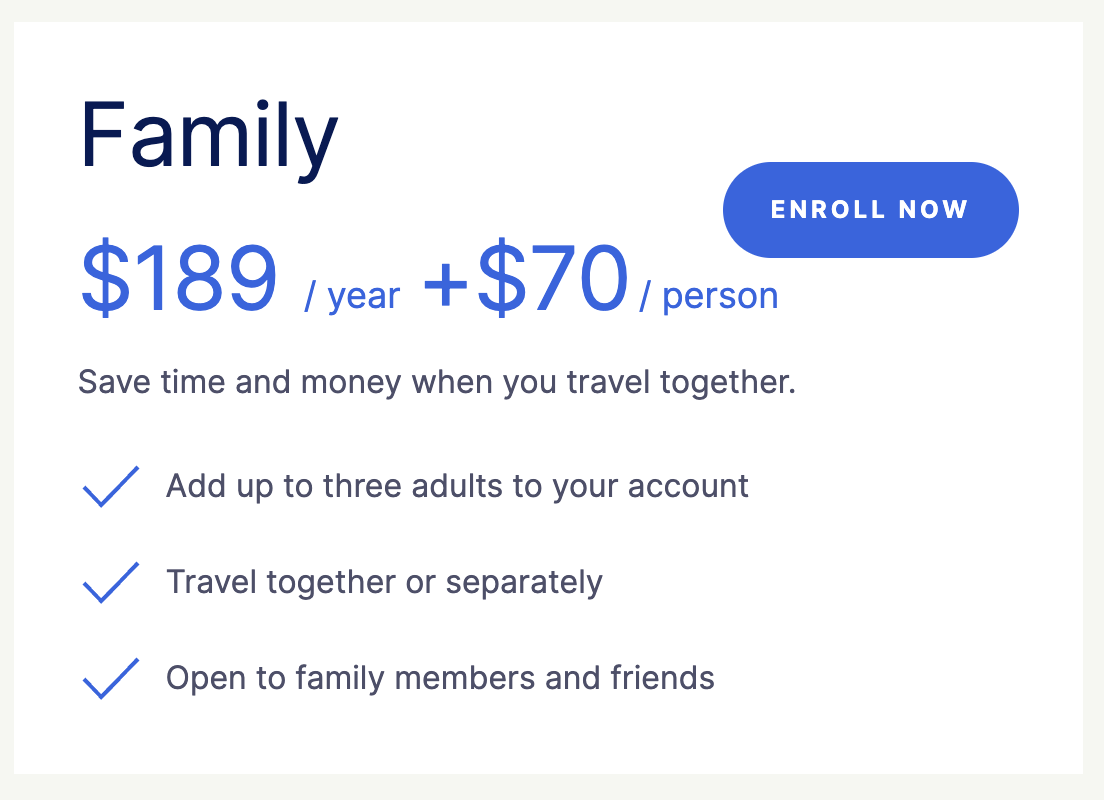

Family Discount

Family Discount

7: Claim your $100 Saks 5th Avenue credit ( enrollment required )

Every year, Amex Platinum cardmembers, get $100 statement credit at Saks 5th Avenue. This is broken into two statement credit periods and you need to enroll your card in order for them to trigger.

- January through June you’ll get a $50 statement credit

- July through December you’ll get another $50 statement credit.

Once, you’ve spent the $50, you’ll receive a statement credit shortly thereafter. It’ll look like this:

Once, you’ve spent the $50, you’ll receive a statement credit shortly thereafter. It’ll look like this:

8th Claim your up to $200 Airline Incidental Credit ( enrollment required )

Every year, American Express Platinum cardholders get up to a $200 airline incidental credit. Usually you have to select your airline by the end of January, but when you get a card mid-year, you can select it then. If you don’t select an airline, your card isn’t enrolled, and you won’t be able to trigger that credit. So make sure you select one!

Here’s a list of airlines that are included

Here’s a list of airlines that are included

-

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

And then these are the expenses that usually qualify

- Airport Lounge membership and passes

- Checked bag fees

- Overweight or oversize fees

- Inflight purchases like food and beverage – note that WIFI may not trigger it since it can be processed by 3rd parties

- Pet flight fee

- Phone reservation fees

- Seat assignment fees

- If you’re get a economy plus, etc

- Ticket Change fees

- Sometimes Southwest tickets under $50 trigger it, but they aren’t technically included

9th: Enroll in Priority Pass Select

Do you like phatty phat lounges to occupy your time during a layover with snacks, beverages, and sometimes whole meals of food? Ya…me too. Enroll in Priority Pass and you’ll gain access to over 1300 lounges worldwide. I can’t tell you how many times I’ve used this feature.

10th: Claim your Car Rental Status with Hertz, Avis, and National

Go here to enroll your card with the various programs and get status – and note that Amex Platinum now comes with top tier Hertz status.

- Preferred Plus Status

- Platinum discount with code: A75690

Hertz President’s Circle Status

- 211762 to save on the base rate of rentals,

- receive a 4-hour grace period on returns within the US, before an extra day charge is applied

- savings up to 20% on published base rates

- guaranteed car-class upgrades on certain class vehicles with a 24-hour advance reservation

- Additional terms and limitations apply.

National Emerald Executive Status

- Have access to a special Executive aisle when renting

11th: Claim your Global Entry or TSA Pre√ credit

- Up to $120 Global Entry or $85 TSA PreCheck® credit (enrollment required )

- Receive either a $120 statement credit every 4 years for a Global Entry application fee or

- a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost

If you are still lining up at the normal security lines…your life just got a lot better. As a benefit of American Express Platinum, you get a statement credit to offset your Global Entry or TSA Pre credit. Simply enroll and then charge your fee to your card and you’ll see the reimbursement.

12th thing to do after getting your Amex Platinum: Switch your phone bill over to get Free Mobile Phone Insurance

American Express Platinum cardholders get a fantastic benefit of mobile phone insurance.

- Covers up to $800 with a $50 deductible

- Damaged, lost or stolen

Other cards provide multiple points per dollar spent as well as coverage in different amounts. Read our article on the complete breakdown of Mobile Phone Insurance benefits to compare and make the best selection for your needs.

13th Up to $300 yearly Equinox credit (enrollment required )

If you’re unfamiliar with Equinox, it’s a high end gym that features the latest and greatest in fitness and workout classes. They don’t come cheap, but they are pretty exceptional.

I have several friends who swear by Equinox, and this benefit will be used to the max Personally, I’m not a member, nor will I join, so this will go unused in my account

- $300 Equinox credit (enrollment required )

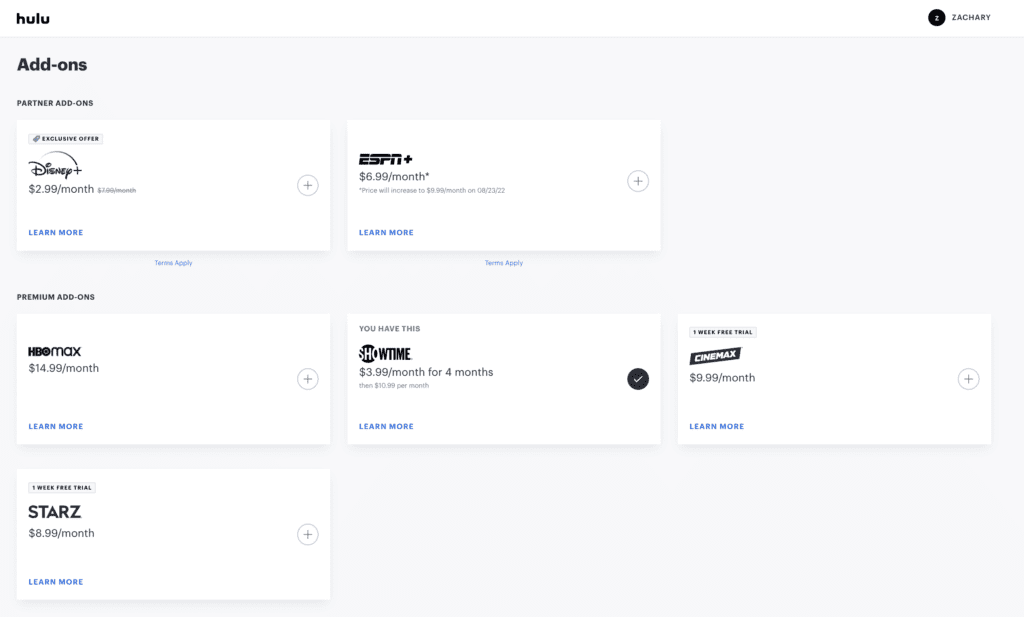

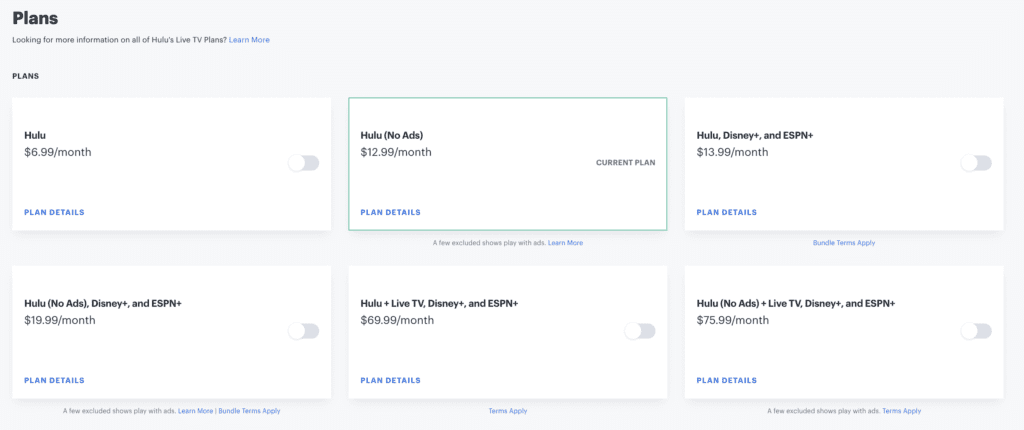

14th Up to $300 digital entertainment credit ( enrollment required )

- Up to $300 Digital Entertainment Credit (enrollment required )

- Get up to $25 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Paramount+, YouTube Premium, and YouTube TV alongside Disney+, a Disney+ bundle, ESPN, Hulu, The New York Times, Peacock, and The Wall Street Journall.

l. It’s capped at $25, not $25 per company, and its per month. You do need to enroll your card, so don’t forget.

A cool thing to do here is pickup Hulu as a bundle…I have ATT&T for mobile and get HBO Max as a benefit so I chose to add Showtime on, but you could do a number of different configurations to add value and use up the whole credit. I end up paying a bit more than the $20 credit

15th: Up to $12.95 + tax WalMart+ credit

I didn’t really have much use for this until mid August 2022 when WalMart announced that Paramount+ Essential would be included in the membership. I may occasionally order things from WalMart, but I have a Paramount+ membership and this means I can cancel it.

16th: Up to $300 Lululemon credit ( enrollment required )

Every year you’ll get up to $300 back in statement credits ( Up to $75 back in statement credits each quarter ) for eligible purchases at retail lululemon stores (excluding outlets) or lululemon.com in the U.S. when Card Members pay with the Platinum Card. Enrollment required

17th: Don’t forget your up to $600 Hotel credit

I’ve included this last since you don’t really need to do anything to “add” this to your account, it’s a benefit that is stagnant until triggered.

This is a $300 semi annual credit when booking a prepaid rate through FHR ( you can do a single night ) or via The Hotel Collection ( you need to book two nights here ). The $300 credit is good on bookings Jan to June and then another $300 July to Dec.

It’s worth noting that if you book a prepaid rate in say November for a stay the following March, the credit will still be valid for the July to December credit even though the stay is the following year. It’s when you pay, not stay.

Recap:

The American Express Platinum card offers a bevy of benefits, services, and statement credits. This is just a list of the 14 most important things you should do immediately after opening your card, or after they add new benefits. If you’d like to read about more ways the Amex Platinum can provide outsized value…read our article on the top reasons why Amex Platinum is worth the annual fee.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.