This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Using Rakuten is a no brainer for online shopping. Not because of cashback, but because you can earn Amex or Bilt points as a kicker.

I value Amex Membership Rewards and Bilt Rewards around 2 cents meaning that for every 1% you see in cashback I apply a 2x multiple. One way to think about this mentally is if you see 10% Cash Back listed you’ll be earning 10x MR or Bilt. Spend $100 get 1000 Amex or Bilt points which I value at roughly $20 vs the $10 if you elected cashback. Let’s get into it.

Join Rakuten with Highest Ever Bonus – spend $50 get $50

You can use our referral link here

Rakuten is a shopping portal and this is how shopping portals work:

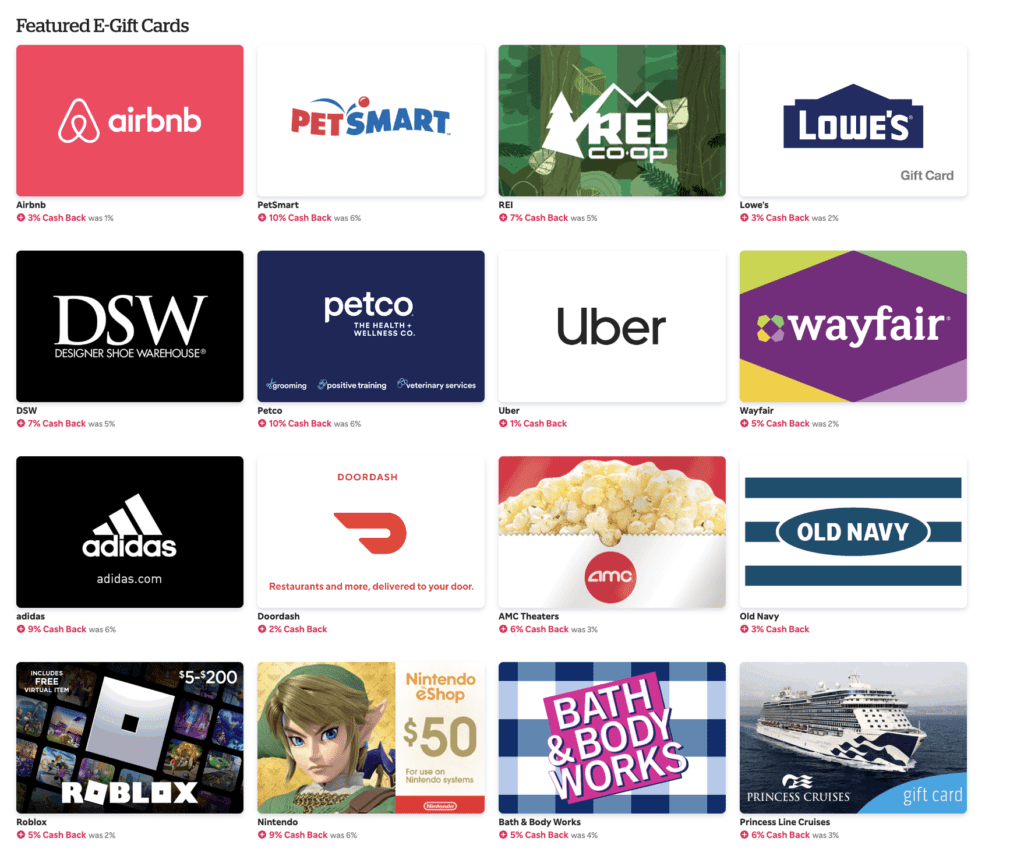

When you login to your portal you’ll see something like this below…

When you click on any of those offers, you’ll be directed to the site you wish to buy from. If that were Finish Line, you’d arrive at the very same Finish Line that you’d see if you didn’t first go to Rakuten. The only thing the portal does is code your purchase as being routed via Rakuten, and as a result you earn the cashback advertised in the Rakuten portal.

This cashback, or Amex Points, is then paid to you every 3 months on the 15th.

- Feb

- May

- August

- November

You should choose to earn Bilt or Amex Points.

Both of these currencies are worth well over a penny a point. Meaning, that whichever you choose you’ll ultimately be earning way more value back than if you’d just choose the cashback.

Why should you select Bilt Points instead of Cashback

One…you don’t need a credit card vs Amex where you do. Anyone can sign up for Bilt Rewards. In order to earn Amex points via Rakuten you need to have a Membership Rewards earning credit card.

I value Bilt points at over 2 cents. You can directly transfer them to Hyatt and Alaska as well as over 20 other partners shown below, but those two are the best hotel and airline points around.

This means instead of earning 8% cashback on every dollar I spend via the portal, I’d be earning 8x Bilt Points. If I spend a $100 and earn 800 Bilt Points, I’m earning points worth $16+ or more than double the cashback rate.

Not everyone values points like I do, but I almost always redeem my points for a higher than 2 cent valuation. On the low side, I can redeem my points in Bilt Travel in Amex Travel for 1.25 cents – so regardless, I feel comfortable I will extract value in excess of a penny.

.

Here’s a step by step guide

First create an account – you can get $50 back on a $50 purchase when you use my referral

Link your Bilt account to Rakuten here

Why should you select Amex Points instead of Cashback

The main reason I do it is because I love travel, and value Amex points at roughly 2 cents. This means instead of earning 8% cashback on every dollar I spend via the portal, I’d be earning 8x Amex Points. If I spend a $100 and earn 800 Amex Points, I’m earning points worth $16 or double the cashback rate.

Not everyone values points like I do, but I almost always redeem my points for a higher than 2 cent valuation. On the low side, I can redeem my points for flights in Amex Travel for 1.55 cents ( I have an Amex Biz Plat ) – so regardless, I feel comfortable I will extract value in excess of a penny.

I use Amex points to fly in Lufthansa First Class. This was an easy, and instantaneous, transfer of 70k Amex points to Aeroplan. Took all of 15 mins to execute and will ultimately be less than 50% of the points I earn from Rakuten this year.

Go to account settings where you’ll find this:

If you don’t have a Rakuten account, you’ll need to select either PayPal or Big Fat Check to get going. You may need to sign out and back in for the Amex or Bilt account to actually populate. If you’re choosing Amex, you’ll need to load an Amex into your wallet for it to trigger.

If it doesn’t go here for Help which has a chat function

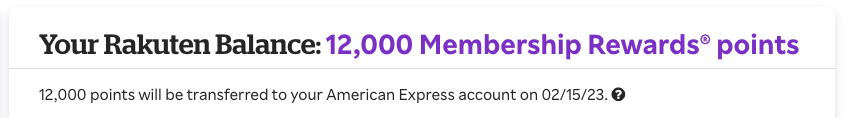

Once you start earning Membership Rewards or Bilt, how quickly do they populate?

Long and short of it….you accumulate points over a 3 month period, and then 6 weeks after the close of that period, on the 15th of month, you’ll be credited. My period from January to March closed, and I was due to be credited May 15th, roughly 6 weeks later, and as you can see below….it hit same day. That is fantastic.

Don’t have a Rakuten account? You can use our referral to get $50 cashback or 5000 Amex Points after you spend $50

A quick way to take advantage of Rakuten – must earn cashback though.

The Rakuten Gift Card shop is a great way to quickly get your points: buy a gift card for $40+ and get your bonus immediately. The big caveat is that the gift cards must earn cashback, and recently, many cards won’t earn them. If it says no cashback you won’t get your bonus

Rakuten Dining + In Store –

Add your existing credit cards to Rakuten to earn another 5x points on all of their partners and earn while you shop In Store at a ton of different spots too. This is actually richer than a lot of Bilt Dining partners, and you can still choose Bilt points.

Rakuten compared to other shopping portals

This is a big consideration. I have almost exclusively used Rakuten because I factor in the underlying value of Amex Points into the equation. However…if you’re looking for cashback I’d recommend that you check out cashbackmonitor which gives you the best rates across all of the shopping portals.

Overall

Rakuten has captured my business and will continue to do so as long as it offers Amex points as an earn option. Rarely do I see another portal offering double the cashback which is about the only circumstance I’d consider another portal based on value.

Hope this helps and as always, please ask any questions you may have.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.