This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

You can now earn 100k off Amex Referrals

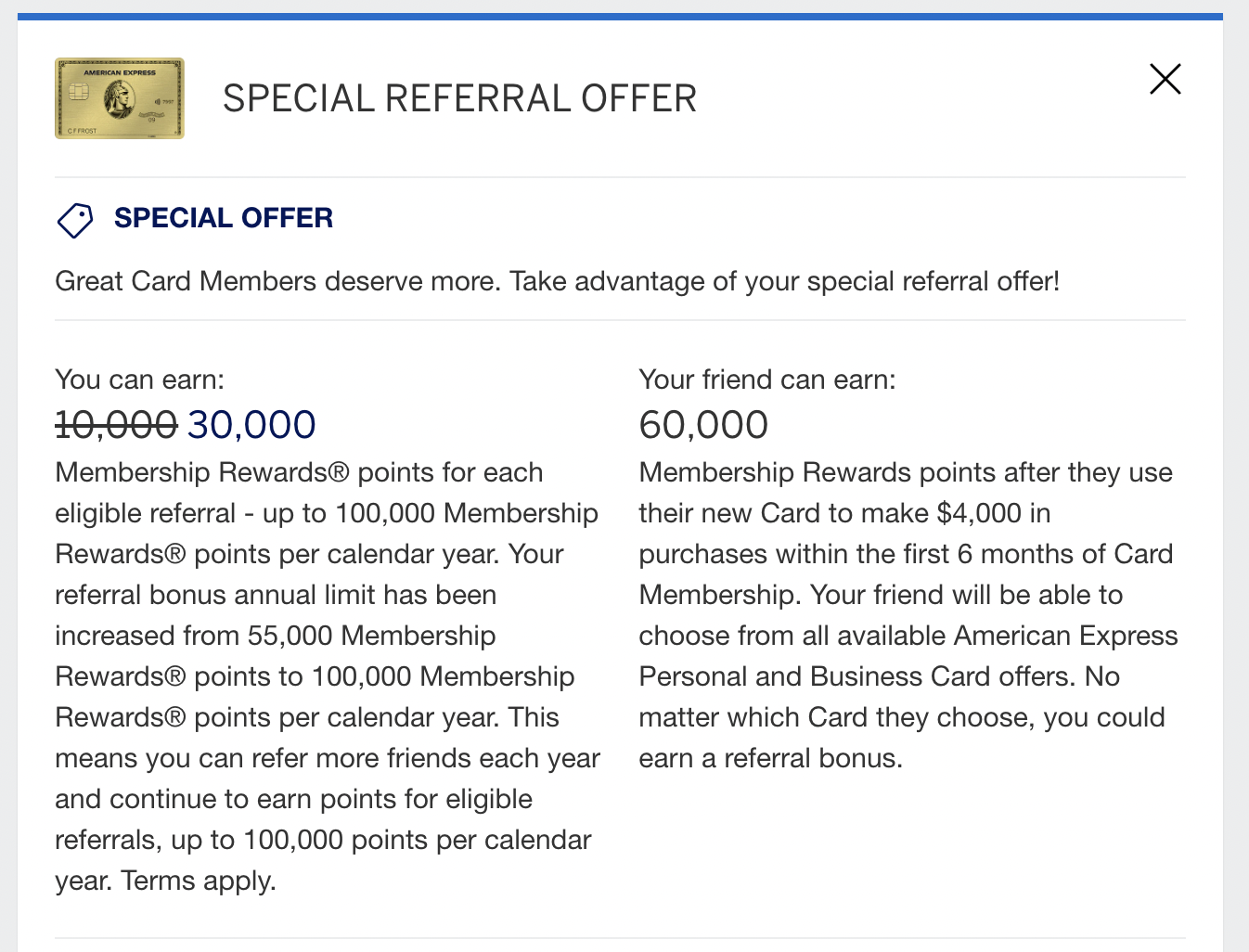

This is a really big deal for those of you who leave your Amex Referrals on my site. Instead of the old cap of 55k points per referrer, it seems that Amex has increased the amount to 100k.

I logged into my Amex account this morning and noticed a 100k point jump in my American Express Membership Rewards balance. Upon some investigation, I saw that 4 people had used my Amex referrals at 25k per referral. I couldn’t find any explanation on my Amex Biz Plat which populated the referral.

I then logged into a family account that I manage and saw that the language on the Amex Gold had changed and the cap had been raised to 100k

Upon further investigation, I found that DOC is also seeing this Increased cap on the amount of points that you can earn. If you’re unfamiliar, American Express allows you to take the Amex card in your wallet and generate a referral code for not only that card, but basically any other card that they offer. The biggest caveat is that this seems to work most effectively for cards that start out earning Amex Membership Rewards vs cards that earn Marriott, Delta or Hilton points. I go into much more detail in this post, but it’s a wonderful way to earn a ton of points every.

I publish the best deal on credit cards listed and keep a spreadsheet updated at all times. In the past couple of years, quite often, the referrals generated by Amex cardholders themselves have been populating the best offers. As a result, I’ve compiled a list of Amex referral pages that you can leave your links on.

I add my family and friends into the body of the posts first. Then, once they are used up, which normally occurs by mid Feb, I will start putting your links into the body of my posts. You’ll max out quickly.

You can also leave referrals for

- Amex Green

- Amex Aspire

- Amex Platinum

- Amex Biz Platinum

- Amex Everyday Preferred

- Amex Blue Business Plus

- Amex Biz Gold

Recap

It nows appears that Amex has raised the total amount of points you can earn by referring Amex cards to 100k from 55k points. This is awesome and hopefully you can earn a ton of points off my traffic by leaving your links up above.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.