This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’m a huge fan of Amex Referrals. In fact, I have dedicated posts to Amex referrals ( which you can leave your links on ), but things just got a lot better. From today, until October 28th, if you refer someone to an Amex card, you’ll not only get the referral bonus ( which can be up to 30k points ), but you’ll get a 7500 point bonus on top of it, and the card from which the referral was generated will earn a bonus 3x points for the next 3 months.

Here is the release that was sent to me earlier in the day via an Amex PR rep:

Beginning today, if a consumer Card Member refers a friend for any consumer or business Card product between October 1 – October 28, and their friend gets approved, Card Members will earn 3x more points (or 3% more cash back) per dollar they spend for the next three months, while their friend receives one of the most rewarding welcome offers available.

Additionally, Card Members who refer a friend who is approved will also earn another 7,500 Membership Rewards points for each approved referral, up to 55,000 points.

Let’s use Amex Gold as an example

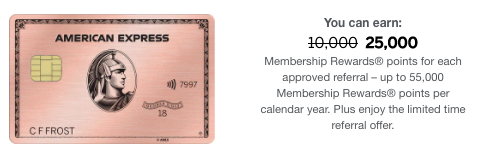

If you generate a referral for Amex Gold ( which is currently 60k ) and someone is approved, you’ll earn your referral bonus which right now for me is 25k + 3x on all categories + 7500 bonus. Note that the most you can earn is 55k so I would max after 2. I maxed out early in the year and currently reader links are embedded in my posts.

So, if you referred from an Amex gold you’d get 7x on dining and 7x on groceries ( with a $25k cap ) for the next 3 months. That is freaking awesome.

Note that referrals per card vary – this was just my targeted referral, and the maximum you can earn is 55k in a year per card. The 7500 bonus is included in that maximum

Leave your referrals but also check out our referrals pages. GET THOSE POINTS!

Remember, you can refer to a different card than the card that generates the referral as long as it earns the same currency.

- Amex Green

- Amex Aspire

- Amex Platinum

- Amex Biz Platinum

- Amex Everyday Preferred

- Amex Blue Business Plus

- Amex Biz Gold

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.