This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Who can apply for Small Business Credit Cards?

More than likely…YOU CAN.

Yes, that’s right. The odds are in your favor that you qualify for a small business credit card, and you probably had no idea. I’d guess you’re probably thinking, why on earth do I even care?

Well…small business credit cards are a great way to earn a lot of points, improve your credit score, segregate expenses, and enjoy additional benefits…which means you can fly like this a whole lot easier.

Table of Contents

What are your favorite Small Business Credit Cards?

Right now, I would focus my energy on these three if you don’t have them and I would prioritize them like this

- Chase Ink Business Preferred® Credit Card

- Chase Ink Business Unlimited® Credit Card

- Chase Ink Business Cash® Credit Card

- Chase Sapphire Reserve for Business℠

- Capital One Venture X Business

- 150k after $30k spend in 3 months

They all work in the same Chase Ultimate Rewards ecosystem, and the points earned from the Unlimited and Cash can be transferred into a Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Chase Ink Business Preferred® Ultimate Rewards account and become fully transferrable.

Capital One:

| Capital One Venture X Business | $395 | 150k after $30k spend in 3 months |

| Capital One Spark Miles | $95 | 50k after $4500 in 3 months |

| Capital One Spark Cash Plus | $150 | $2000 cash after $30k spend in 3 month |

Bank of America

|

ATMOS™ REWARDS VISA BUSINESS CARD |

$50 | 65k after $4k in 3 months + $122 BOGO |

Chase:

| Chase Sapphire Reserve for Business | $795 | 200k after $30k in 6 months |

| Chase Ink Business Preferred | $95 | 90k after $8k spend in 3 months |

| Chase Ink Business Cash | $0 | 75k tiered offer: 35k after $3k in 90 days and 40k after $6k in 6 months |

| Chase Ink Business Unlimited | $0 | 75k ( $750 ) after $6k in 3 months |

| Chase® Ink Business Premier® | $195 | $1000 after $10k spend in 3 months |

| World of Hyatt Business | $199 | 60k after $5k spend in 3 months |

| Chase IHG® Rewards Premier Business Credit Card | $99 | 140k after $3k spend in 3 months |

| Southwest® Rapid Rewards® Performance Business Credit Card | $199 | 80k: after $5k spend in 3 months |

Amex:

|

American Express® Business Gold Card |

$375 | 150k after $15k spend in 3 months |

|

The Business Platinum Card® from American Express |

$695 | 200k after $20k spend in 3 months |

|

The Blue Business® Plus Credit Card from American Express |

$0 | Targeted 15k after $6k in 3 months |

|

The American Express Blue Business Cash™ Card |

$0 | $250 after $5k/6mos |

|

The Hilton Honors American Express Business Card |

$195 | 175k after $8k spend in 3 months |

| Marriott Bonvoy Business® American Express® Card | $125 | 3 free night award certs after $6k in 6 months – up to 50k per night |

|

Delta SkyMiles® Gold Business American Express Card |

$150 | 80k after $4k/6 months |

|

Delta SkyMiles® Platinum Business American Express Card |

$350 | 90k after $6k spend in 6 months |

|

Delta SkyMiles® Reserve Business American Express Card |

$650 | 110k after $10k in 6 months |

Small Business Credit Cards make it much easier go to dream destinations like the Maldives and stay at the St Regis Maldives

First off…why do I think you could qualify for a small business credit card?

If you have a side hustle, earn money from the gig economy, or even now what people are referring to as the creator economy…the odds are strongly in your favor that you qualify for a small business credit card. So many people earn money that isn’t W2 income, but they haven’t established formal LLCs or S-corps that have EIN ( Employer Identification Number), and they aren’t taking advantage of what that income opens the door to….but they can still apply and get approved for small business credit cards.

If you’re earning income on a 1099, you’re good to go. Some examples of those are…

- Online Coaches, tutors, etc

- Uber and Lyft drivers (assuming they still get 1099s whenever you’re reading this).

- DoorDash, GrubHub and Postmates

- Social Media income ( TikTok, Instagram, YouTube )

- Cater Waiters

- Personal Trainers

- Dog Walkers

- Freelance graphic designers and web designers

- Singers, artists, dancers, models, etc

- Virtual Assistants

- Ebay, Amazon and Facebook resellers

Have you done this, Zach?

Yes… in fact, I not only have multiple EINs, I have had multiple Sole Proprietorships over the years. When I first started Monkey Miles I got a credit card as a sole proprietor to segregate the expenses. Then, when I started doing award bookings, I got another one for that specific business. I’ve applied for, and held, a dozen or two small business credit cards over the past several years.

In fact, I currently carry the following small business credit cards – you can find their current best offers here:

- Chase Sapphire Reserve for BusinessSM

- 2 Chase Ink Business Preferred®

- 2 Chase Ink Business Unlimited®

- 2 Chase Ink Business Cash®

- 3 The Business Platinum Card® from American Express

- 3 The American Express® Business Gold Card

- 2 The Blue Business® Plus Credit Card from American Express

- Barclay Aviator Red Business

Ok, but what are the benefits of a small business credit card?

- More opportunities for welcome offers and sign up bonuses

- Improve your credit score since utilization drops

- Segregate expenses to help come tax season

- Get multiple versions of the same card

Small business credit cards have incredible welcome offers. Let’s say you’re an Uber driver. You spend money on insurance, gas, new phones, cleaning, repairs, wear and tear, etc, etc. All of those expenses could be put toward a sign up bonus, but they also needed to be accounted to help with write offs. A small business credit card helps keep those expenses separate. If you’re an uber driver and an aspiring content creator, you could have two small business credit cards.

But have you considered all of those expenses are adding to your credit utilization as well?

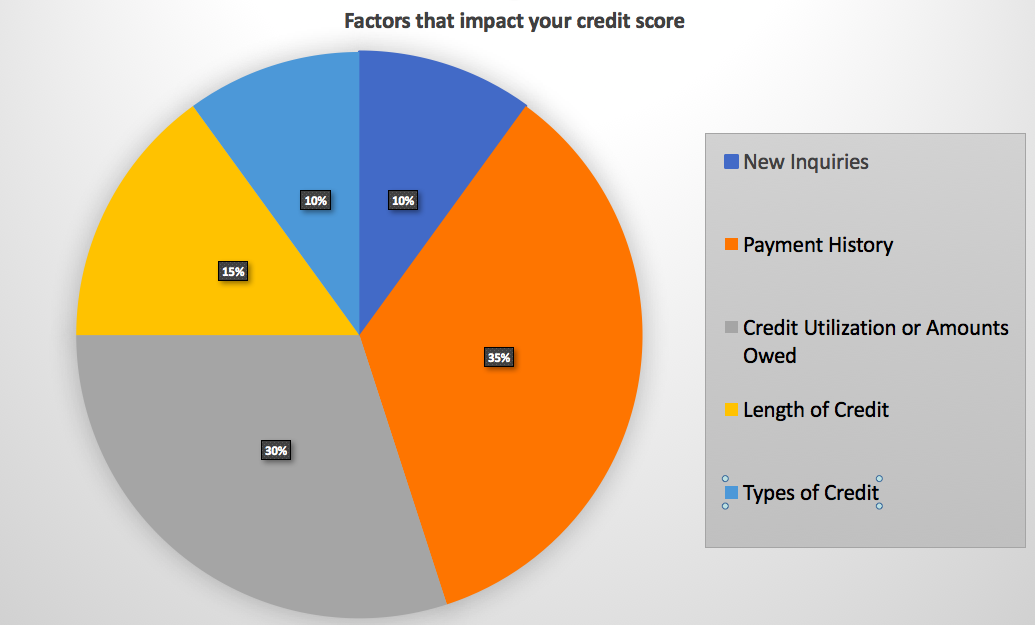

30% of your score is how much of your debt is used every month. For the most part, small business credit card purchases aren’t reported to your personal credit report ( I list the exceptions below ).

By using a small business credit card to pay for your side hustle expenses, advertising for your foodie blog, or the monthly fee for your blog’s email list, you’re reducing that utilization rate. Let’s say you spend $1500 a month on your side hustle, and you’re putting that on a card with a $10000 limit. If you don’t have any other cards, you’re adding 15% utilization and lowering your score. Adding a small business credit card could quickly boost your score by lowering this percentage.

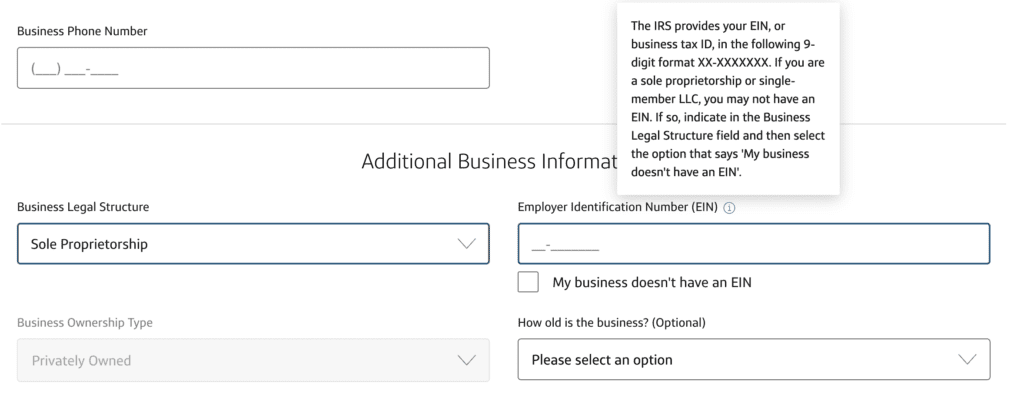

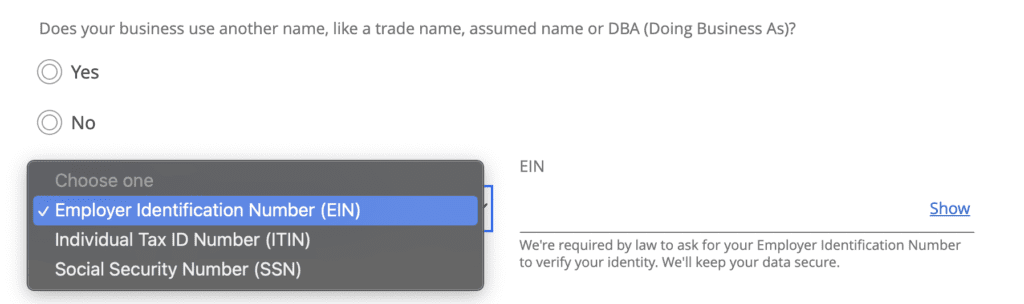

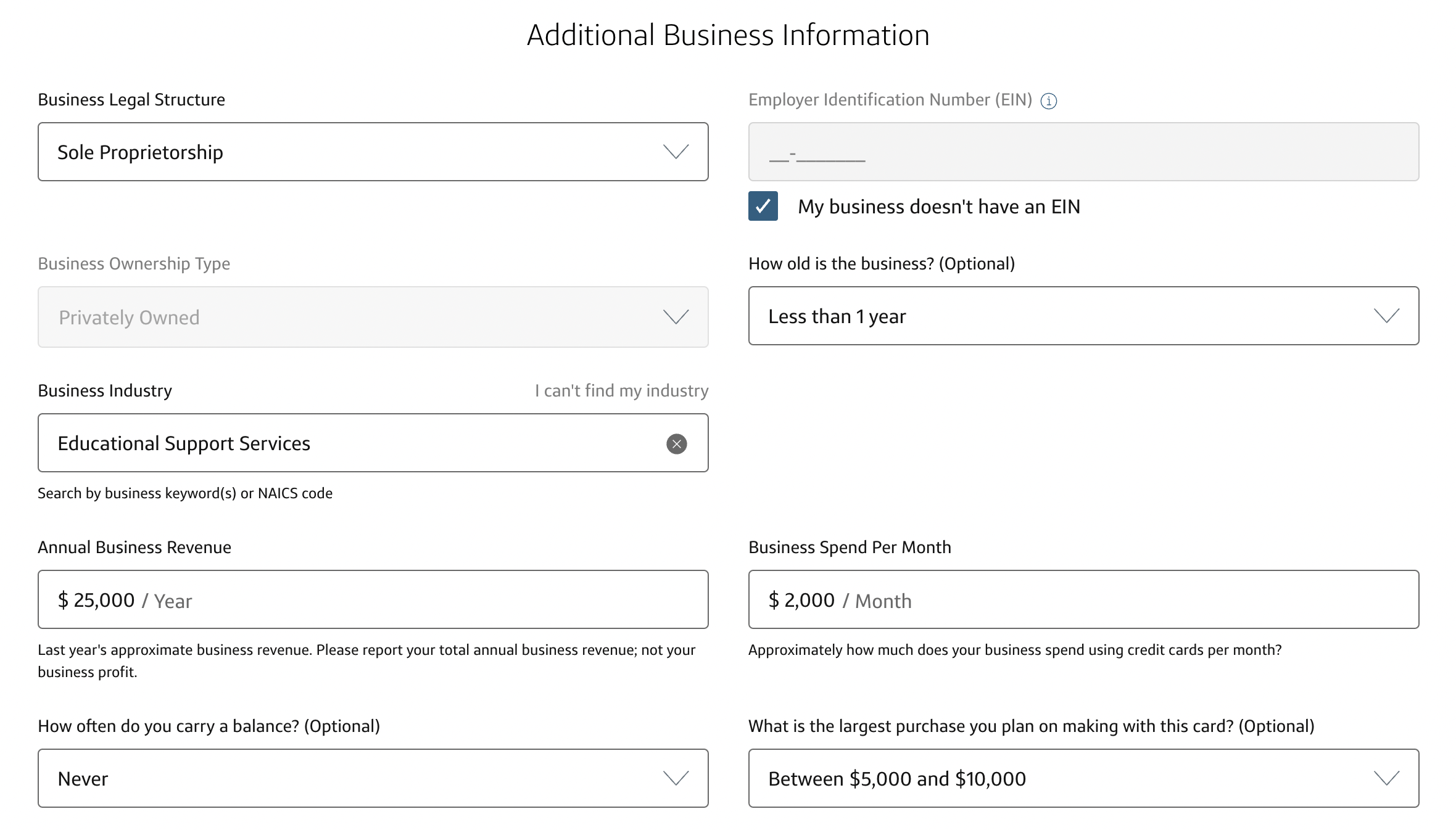

How do I go about applying for a small business credit card without an EIN?

That’s super easy. You apply as a Sole Proprietor and, depending on the bank, in the section on the application that asks for your EIN ( Employment Indentification Number ) you either enter your social security number, or leave it blank.

What credit do they pull for small business credit cards?

Your credit.

Who is liable for the debt on a small business credit card?

You are.

These aren’t corporate credit cards and if you hold any balance or unpaid debt, you are personally liable for that balance. This is why it’s possible to acquire small business credit cards as a sole proprietor because you’re on the hook for the debt.

Does a small business credit card show up on my credit report?

For the most part, the answer is no which is one of the greatest attributes of a small business credit card. You can not only get a welcome offer or sign up bonus, but the spend your put on the card doesn’t affect your credit utiliziation.

Banks that do not report the account or balance to your personal credit report

- Amex

- Chase

- Citi

- Barclay

- Bank of America

Banks that do report the card to your personal credit report and the expenses that are put on it.

- Capital One does report to your personal with the exception of the following cards

- Spark Cash Plus ( if you open now…prior to 2020 these did report )

- Spark Miles Elite

- Discover does report the new card and the balance to personal report

- Wells Fargo has been known to report on occasion

Do small business credit cards affect my Chase 5/24 number?

If you’re unfamiliar with 5/24, Chase has a rule that they will not approve you for any new accounts if you have opened 5 or more cards in the past 24 months. Specifically they count the number of new accounts added to your personal credit report.

The answer is Yes and no. If the account is added to your personal credit report, then yes, it would affect that number. Otherwise, no, this is an effective strategy of adding another card to your wallet, enjoying the welcome offer, added benefits, etc all the while keeping your 5/24 number the same.

As you can see… I have 10 American Express cards, but only 2 of them show up on my credit report. The other 8 are small business credit cards whose monthly spend stays off my personal report helping to keep my utilization lower, and don’t count against my 5/24 number.

How do I fill out the income section on a small business credit card?

There are two sections for income: Personal and Business. Answer both truthfully.

Let’s say you just started selling a course on Teachable or Kajabi and you’re going to spend money marketing it and want to segregate those expenses. You aren’t really sure if it’ll be successful so you haven’t incorporated it just quite yet. You think you’ll earn a couple grand a month and also spend that trying to push sales. I’d probably fill out the application like this.

Jump to Our Current Favorite Business Cards

Recap

Small Business Credit Cards are a great way to lower your utilization to get your score higher, enjoy more benefits and bonuses, and they help segregate expenses to help you come tax time.

Any questions? Feel free to drop one in the comment section!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.