This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express Application Rules

Are you looking to add an Amex to your wallet? Make sure you take a close look at all of American Express Application Rules so you have the best shot at getting approved and strategizing which Amex cards to add to your wallet.

Amex issues both “Pay Over Time” cards, which are initially charge cards, and credit cards. Remember, charge cards need to be paid off in full every month whereas credit cards have a credit line attached to it and permits fractional payment over time with an interest rate assessed.

- The Platinum Card® from American Express

- American Express® Gold Card

- The Business Platinum Card® from American Express

- American Express® Green Card

- American Express® Business Gold Card

- Hilton Honors American Express Aspire Card

- Blue Business® Plus Credit Card

- The American Express Blue Business Cash™ Card

- Amex EveryDay® Preferred

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Business® American Express® Card

- Marriott Bonvoy Bevy™ American Express® Card

- Marriott Bonvoy Brilliant® American Express® Card

- Blue Cash Everyday® Card from American Express

- Amex EveryDay® Credit Card

Table of Contents

Amex has some of the best points available

You can read our favorite uses here.

Credit Cards vs “Pay over time” Cards

Amex issues both credit cards and what they refer to as “Pay over Time” Cards. Credit cards are issued a line of credit and you can either pay them in full at the end of the month ( which you should do ), or you can use part of that line of credit in which case the bank, American Express, is going to charge you interest. These are what most people think of when people use a credit card to pay.

The second is the “Pay Over Time” cards.

If you’ve ever traveled the world and noticed that some vendors refuse to accept Amex, it’s because of the “Pay over Time” cards. You see, these cards, are actually “charge” cards that you need to pay in full every month, unless you, “opt in” to “Pay Over Time.”

I know, a lot of “quotation marks.”

You see, these “Pay Over Time” cards aren’t initially given any line of credit and the bank requires those who hold them to pay in full at the end of the month. If the cardholder is paying in full, the bank isn’t collecting any interest, and they will charge the vendors higher fees to swipe them. Several years ago, Amex created an option for its cardholders to defer payment on qualifying charges ( usually over $100 ) and incur interest, by opting into a program called “Pay Over Time.” You’ll be issued a line of credit that you can use, but if you don’t opt into the program, you are holding a charge card.

Amex distinguishes between Credit Cards and “Pay Over Time” cards which I refer to down below.

Once in a Lifetime

American Express will only give a welcome offer once in a lifetime per card product. This is per card product, or in some instances per family of cards, and per cardmember. If you had an Amex Gold years 3 years ago, canceled the card, and you wanted to get it again…you would most likely be ineligible for the welcome offer again.

Zach, what exactly determines a “lifetime”

Anecdotally, a lifetime is 7 years of inactivity, meaning, if you closed a card more than 7 years ago, you’re likely past the “lifetime” restriction and eligible to get a welcome offer again.

This rule applies to both charge and credit cards.

Apply with Confidence – notification of denial, or denial of offer before credit pull

American Express has employed a new tool that effectively tells you if you’ll get approved or if you qualify for a welcome offer. Generally, this tool is pretty accurate, but it’s not a fail safe. Knowing the rules that I detail after this section will help you navigate the order in which you apply, and whether or not you may be eligible before you take the time to apply

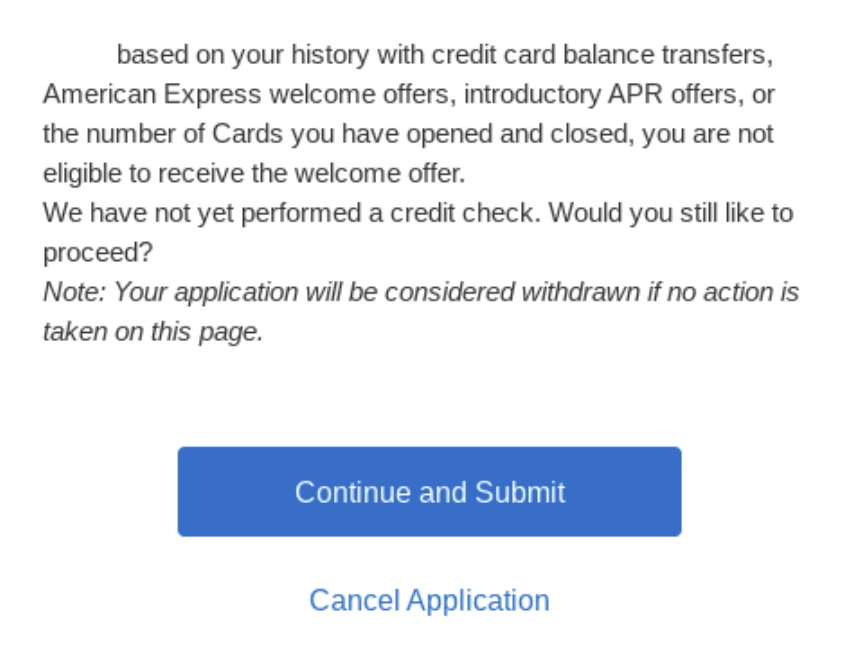

If you’re ineligible for an offer, you’ll see something like this pop up during the application process.

If you’re ineligible for an offer, you’ll see something like this pop up during the application process.

Amex Family Rules – you may get approved, but not get a welcome offer

The gist of the Amex Family rules is that you can go up the premium ladder and still be eligible for welcome offers; however, you can not work your way down it.

I’ve listed the cards below, but you should also be aware that Marriott has more stringent rules since Chase also issues cobranded Marriott cards and there are intrabank rules to be aware of ( it’s complicated ). Additionally, the cobranded Hilton cards aren’t currently enforcing family rules.

Now… it seems pretty obvious you need to add Amex cards to your wallet in this order

- Green

- Gold

- Platinum

Amex Platinum

As you can see below – American Express likely will not extend a welcome offer to you if you’ve alternative versions of the Amex Platinum like those listed below. As far as I know, this language is on all version of the Amex Platinum. Prior to these exclusions, it was possible to have each Platinum version and qualify for the welcome offer, but now, you need to choose one.

You may not be eligible to receive a welcome offer if you have or have had this Card, the Platinum Card® from American Express Exclusively for Charles Schwab, the Platinum Card® from American Express Exclusively for Morgan Stanley or previous versions of these Cards

Amex Gold

The American Express Gold Card in October of 2023 implemented new eligibility rules which have made it harder to qualify for a welcome offer.

You are now ineligible if you’ve had:

- Premier Rewards Gold Card,

- the Platinum Card®,

- the Platinum Card® from American Express Exclusively for Charles Schwab,

- the Platinum Card® from American Express Exclusively for Morgan Stanley

- or previous versions of these Cards

This means if you ever want to get an Amex Gold card, you should get it before getting a Platinum card, then should you want a Platinum card, get it after getting a Gold card. Wow…this is getting more and more restrictive and harder to keep track of.

Here’s a look at the new rules

You may not be eligible to receive a welcome offer if you have or have had this Card, the Premier Rewards Gold Card, the Platinum Card®, the Platinum Card® from American Express Exclusively for Charles Schwab, the Platinum Card® from American Express Exclusively for Morgan Stanley or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

American Express® Green Card

Amex Green recently changed their terms and now you’ll be ineligible to receive an Amex Green welcome offer if you’ve had the Amex Gold or Amex Platinum or the other iterations of the Amex Platinum from Schwab or Morgan Stanley.

Amex EveryDay® Credit Card

Following the same trend, if you’ve had a more premium version of this card, you’re now ineligible to get this one…namely the Amex EveryDay® Preferred or previous versions. I

You may not be eligible to receive the welcome offer, intro APRs, and intro plan fees if you have or have had this Card, the Amex EveryDay® Preferred Credit Card or previous versions of these Cards. You also may not be eligible to receive the welcome offer, intro APRs, and intro plan fees based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for the welcome offer, intro APRs, and intro plan fees we will notify you prior to processing your application so you have the option to withdraw your application.

Blue Cash Everyday® Card from American Express

Same idea here, but expanded to even include the Morgan Stanley iterations.

- Cash Magnet® Card,

- The Blue Cash Preferred® Card,

- The Morgan Stanley Blue Cash Preferred® American Express Card

You may not be eligible to receive the welcome offer, intro APRs, and intro plan fees if you have or have had this Card, the Cash Magnet® Card, the Blue Cash Preferred® Card, the Morgan Stanley Blue Cash Preferred® American Express Card or previous versions of these Cards. You also may not be eligible to receive the welcome offer, intro APRs, and intro plan fees based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for the welcome offer, intro APRs, and intro plan fees we will notify you prior to processing your application so you have the option to withdraw your application

Marriott Cards

Because you can get Marriott cards from both Amex and Chase, there are quite complicated rules. If you’d like to hold two cards concurrently, you should add the business card first, and then add a personal card. This would allow you to get two Amex Marriott bonuses within a short period of time and earn a bunch of elite nights as well.

One thing to note, Marriott is a part of the family rules now, meaning that you can go up the premium ladder, but not down it. In other words, if you get the Bevy, you can still get the Brilliant at some point in the future; however, if you’ve had the Brilliant you are ineligible for the Bevy.

Personal Cards:

- If you’ve received a cardmember bonus in the past 24 months from either another Amex personal card, or a Chase card you’re ineligible

- If you’ve have or have had a Chase card in the past 30 days, you’re ineligible

- If you added the Chase Bountiful, Bold, or Boundless in the past 90 days

- If you’ve had the Brilliant in the past, you are ineligible to the get Bevy, but not vice versa

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton® Credit Card from J.P. Morgan, the J.P. Morgan Ritz-Carlton Rewards® Credit Card, the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy® Premier Credit Card from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy® Credit Card from Chase, the Marriott Rewards® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, the Marriott Bonvoy® Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business® Credit Card from Chase, or the Marriott Rewards Business® Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase in the last 24 months

Business Cards

These are a sweet spot for Marriott Amex cards because you can actually get a welcome offer on both the business and personal versions of Amex Marriott cards within 24 months. You’re just limited when it comes adding Chase version alongside it.

- If you held the Starwood Preferred Guest® Business Credit Card from American Express or previous versions of these Cards

- This was the old Starwood business card

- If you’ve have or have had a Chase card listed below in the past 30 days, you’re ineligible

- These are basically the older versions of the Chase Marriott cards

- If you added the Chase Bountiful, Bold, or Boundless in the past 90 days

- These are the new versions

- If you got a bonus in the past 24 months on the Marriott Bonvoy Bountiful™ Credit Card from Chase, Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase

Welcome offer not available to applicants who (i) have or have had the Marriott Bonvoy® Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business® Credit Card from Chase, or the Marriott Rewards® Business Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, in the last 90 days, or (iii) received a new Card Member bonus offer in the last 24 months on the Marriott Bonvoy Bountiful™ Credit Card from Chase, Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase.

Delta Personal Cards

Delta has made elite status more difficult and have implemented a new policy shown below. If you want to get more than one personal Delta welcome offer, you’ll need to start at the lowest tier and work your way up. If you’ve already had a premium card, you’re out of luck. Welcome offers are no longer available to you. Note that as of 9/22/23 this hasn’t affected the business cards.

- Vertical: Card you Have/Have had

- Horizontal: Card you want

| Delta SkyMiles® Blue American Express Card | Delta SkyMiles® Gold American Express Card | Delta SkyMiles® Platinum American Express Card | Delta SkyMiles® Reserve American Express Card | |

| Delta SkyMiles® Blue American Express Card | no | yes | yes | yes |

| Delta SkyMiles® Gold American Express Card | no | no | yes | yes |

| Delta SkyMiles® Platinum American Express Card | no | no | no | yes |

| Delta SkyMiles® Reserve American Express Card | no | no | no | no |

5 credit card limit

Unlike Chase which will theoretically permit you holding infinite credit cards, Amex caps you at 5.

10 “Pay Over Time” Card Limit? – May be just 5 now

This used to be without cap, but recently the rules have changed a bit and we’re seeing a 10 card cap implemented. While this hasn’t been confirmed, in late Oct of 2025 reports indicate that this may have been lowered to 5.

2 in 90

Amex will approve you for a maximum of 2 credit cards in a 90 day period. This rule applies only to credit cards, not charge cards

1 in 5

Amex will only approve you for 1 credit card every 5 days.

- Get a card on Dec 15th

- You’d need to wait until Dec 21st to get the 2nd.

- Then you’d need to wait 91 days from Dec 15th to add a 3rd card

Referrals

American Express has one of the most generous referral programs whereby you can use one card to not only refer another person to that card, but you can also refer them to nearly any other American Express. For instance, if you have an Amex Gold and you want to refer your friend to the Amex Platinum you can do so via the Amex Gold that you carry. If you want to read how to go about doing this, read this guide on how to generate Amex Referrals

Can I refer myself to a different Amex card?

Absolutely not, I’ll get into this more in the next section, but this could create all sorts of problems including a clawback of the points you earned to account shut down.

Do you have anywhere I can leave Amex referral links?

I sure do! Some of the best possible deals are via referral and readers earns millions of points from my site. I keep a spreadsheet with all of the best credit card deals here, but these posts specifically offer up a place where you can drop you referrals.

- The Platinum Card® from American Express

- American Express® Gold Card

- The Business Platinum Card® from American Express

- American Express® Green Card

- American Express® Business Gold Card

- Hilton Honors American Express Aspire Card

- Blue Business® Plus Credit Card

- The American Express Blue Business Cash™ Card

- Amex EveryDay® Preferred

Clawbacks, Pop Ups, Exceptions, Targeted offers

The rules listed above have been collected via multiple sources and widely held to be true. However, these rules aren’t written in stone and Amex has been known to enforce rules on a case by case basis as well as carve out offers that bypass or circumvent these rules.

Clawbacks + Popups

Amex doesn’t like people who game the system. So if they think you’ve manipulated or abused their rules, they reserve the right to clawback your bonus. Let’s say you got an Amex Business Gold, and you uncovered a new link with a high offer, and you were approved, then received the bonus a second time. Amex could take a look at your account and if they believe that you were gaming the system to get your second bonus, they can clawback the points you earned and even shutdown the account.

I’ve known a lot of people to get their bonuses clawed back without much explanation, and even some who have been shutdown completely. Yes, they have been blacklisted by Amex.

As a result of these clawbacks, Amex created a pop-up feature that will warn you if you’re ineligible for a welcome offer. Most people that avoid seeing the pop-up are good to go, but there are always examples where that hasn’t been the case and points are removed months later after an audit is conducted. This has been fewer and far between recently, and I haven’t heard of many people who receive new targeted emails for a card they have or have had being shutdown. But, it’s a risk to be aware of.

Exceptions to the Rule – targeted Offers

What rule doesn’t have an exception? The biggest exception with Amex applies to the “Once in a lifetime rule.”

When you receive a Targeted Offer, meaning your account specifically receives an offer, you can bypass this Once in a LifeTime rule. I have received a ton of them since 2020 and have had no problems with clawbacks, etc. They are almost always pre-approved offers with what we call NLL ( No Lifetime Language” ) included. This is very important since they offer itself has eliminated the restrcitions found in public offers. You always want to screencap this and save it just in case.

Usually these are either mailed physically or emailed to you.

If you’re wondering how I have 10 Amex cards…this is how.

Overall

American Express is a rich ecosystem of points that offer up some of the very best points you can earn.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.