This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express Green Card Referral Offer

Information about this card has been collected independently by Monkey Miles. Card issuer is not responsible for the information or accuracy.

One of the best ways to amp up your Amex point balance is to refer friends and family members and get referral bonuses ( 100k per card, per year ). Since we’re all friends here, I keep this page so you can get referral offers that may not be available elsewhere as well as leave your own referrals links in the comment section.

Amex Green Referral Link

Card Benefits

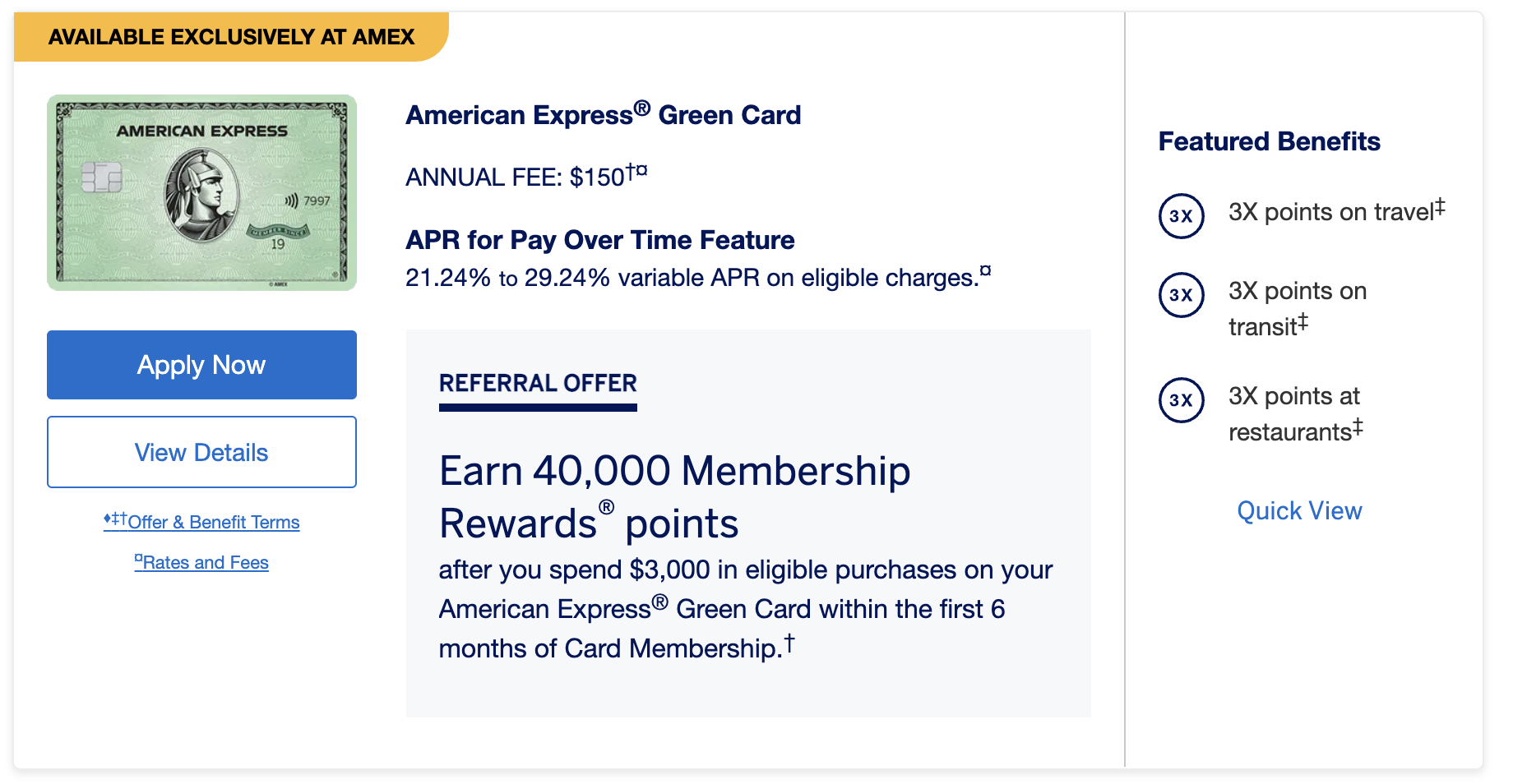

- Earn 40,000 Membership Rewards(R) Points after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership.

- Earn 3X Membership Rewards(R)

- points on travel including airfare, hotels, cruises, tours, car rentals, campgrounds, and vacation rentals.

- transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways.

- eligible purchases at restaurants worldwide, including takeout and delivery in the US.

- $209 CLEAR Plus Credit:

- Receive up to $189 per calendar year in statement credits when you pay for your CLEAR Plus membership (subject to auto-renewal) with the American Express(R) Green Card.

- $100 LoungeBuddy

- Purchase lounge access through the LoungeBuddy app using the American Express(R) Green Card and receive up to $100 in statement credits annually.

- No Foreign Transaction Fees: No matter where you’re traveling, when you use your American Express(R) Green Card there are no foreign transaction fees.

- $150 annual fee.

- *Rates and Fees; terms apply

Here’s how it works with our site and referrals: do not spam post or I’ll block your referral

First off, this is meant to help everyone. So, if you’re posting your referral a dozen times a day, week, month, and trying to manipulate the comment section, I’m going block your referral for abuse. No ifs ands or buts – if I see you’re doing it, or you’re flagged by another use, I’ll just block you from ever posting. Let’s not ruin a good thing.

We earn commission when you use our links via our partner CreditCards.com and are really grateful when you do, but we also publish other deals that may be attractive to you. Referrals, are one of those other deals, and is a way we can give back to you for supporting us since you earn a referral bonus when someone uses your link.

We want to give you an opportunity to earn some valuable points as well, and so this is how we go about doing it.

- We add our own referrals first

- Because we use a ton of points every year and publish reviews of the flight and hotels we take, but we quickly max out

- We add those of friends and family to load up their accounts

- Once those are maxed out

- We then import your links from the comments section below to help you out.

- We usually leave those up for a few weeks and cycle through them, or when we get an email notifying us that someone’s account has maxes out

You can also leave referrals for

- The Platinum Card® from American Express

- American Express® Gold Card

- The Business Platinum Card® from American Express

- American Express® Green Card

- American Express® Business Gold Card

- Hilton Honors American Express Aspire Card

- Blue Business® Plus Credit Card

*I would note that you get more action when the referral is correlated to the article.

The Referral 40k welcome offer – Use this link if you want to help us, our friends, and commenters

Here’s a full video explanation of why we picked up the card, and how each offer is populating + a quick tour a cool Curio Collection Hotel in London.

American Express Green Card Bullet Point Benefits

- 3x on Travel, transit, and dining

- $189 annual Clear credit ( enrollment required )

- $100 annual Loungebuddy credit ( enrollment required )

- $150 annual fee

3x on travel and dining – no nonsense categories as well.

The Amex Green card has a much more open and liberal interpretation of travel than does other Amex cards. Amex Green will earn you 3x points on every dollar you spend at the following:

- Flights

- Hotels

- Rideshares like uber and lyft

- Busses

- Taxi

- Subways and Metros

- Tolls

- AND ALL Dining worldwide.

240k points your 12 months if you max out referrals

That is a staggering amount of points that opens the door to an amazing list of premium cabins accessible via their transfer partners. How am I figuring that?

40k with this offer and then if you max out your 100k referrals for 2023 – that’s 140k. THEN you’ll be earning another 100k in referrals again in 2024. That is just ridiculous.

You could fly roundtrip in Lufthansa First Class if you transfer them to Aeroplan and redeem, like we did, for 70k points.

You could even transfer to Aeroplan and fly for more than 24 hours in Etihad Apartments to Australia

Overall – leave your links

Amex has really come to compete. After this Amex Green card, I’ll have 6 American Express cards in my wallet, and while I’ll certainly reassess each card come 2020, right now, they all fill a position in my wallet with good reason, and create an earning structure that keeps me flying flat, and reporting all that good good for your ( and my ) pleasure 🙂

If you want more information on how I make over 500k points a year, plus leave your links on the video too, check out this step by step walk through we published on YouTube.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.